What is It Like to Be an Analyst at a Venture Capital Firm?

Being an analyst at a venture capital (VC) firm is a dynamic and intellectually stimulating role that sits at the intersection of finance, technology, and entrepreneurship. Analysts are tasked with identifying promising startups, conducting in-depth market research, and evaluating investment opportunities. The role demands a blend of analytical rigor, strategic thinking, and a keen understanding of emerging trends. While the work can be fast-paced and demanding, it offers unparalleled exposure to innovative ideas and the chance to shape the future of industries. For those passionate about startups and venture ecosystems, this position provides a unique vantage point into the world of high-stakes investing.

What is It Like to Be an Analyst at a Venture Capital Firm?

Being an analyst at a venture capital (VC) firm is a dynamic and challenging role that requires a mix of analytical skills, financial acumen, and a deep understanding of startups and emerging markets. Analysts are often the backbone of a VC firm, conducting research, evaluating investment opportunities, and supporting senior team members in making informed decisions. This role is ideal for individuals who thrive in fast-paced environments and have a passion for innovation and entrepreneurship.

See Also How Does a Product Manager Get Into Venture Capital?

How Does a Product Manager Get Into Venture Capital?1. What Are the Key Responsibilities of a VC Analyst?

A VC analyst is responsible for a wide range of tasks, including market research, financial modeling, and due diligence on potential investments. They often prepare investment memos that summarize their findings and present them to senior partners. Additionally, analysts may assist in portfolio management, tracking the performance of existing investments, and identifying opportunities for follow-on funding.

| Responsibility | Description |

|---|---|

| Market Research | Analyzing industry trends and identifying high-growth sectors. |

| Financial Modeling | Creating projections and valuations for potential investments. |

| Due Diligence | Investigating the viability and risks of startups. |

| Investment Memos | Summarizing findings and recommendations for senior partners. |

| Portfolio Management | Monitoring and supporting existing investments. |

2. What Skills Are Required to Succeed as a VC Analyst?

To excel as a VC analyst, one needs a combination of technical skills and soft skills. Strong financial analysis and data interpretation abilities are crucial, as is proficiency in tools like Excel and financial modeling software. Equally important are communication skills, as analysts must present complex information clearly and persuasively. A keen interest in startups and emerging technologies is also essential.

See Also What is the Worst Part of Being a Vc?

What is the Worst Part of Being a Vc?| Skill | Importance |

|---|---|

| Financial Analysis | Critical for evaluating investment opportunities. |

| Data Interpretation | Helps in making informed decisions based on market data. |

| Communication | Necessary for presenting findings to stakeholders. |

| Interest in Startups | Drives passion and understanding of the ecosystem. |

| Technical Proficiency | Enables efficient analysis and reporting. |

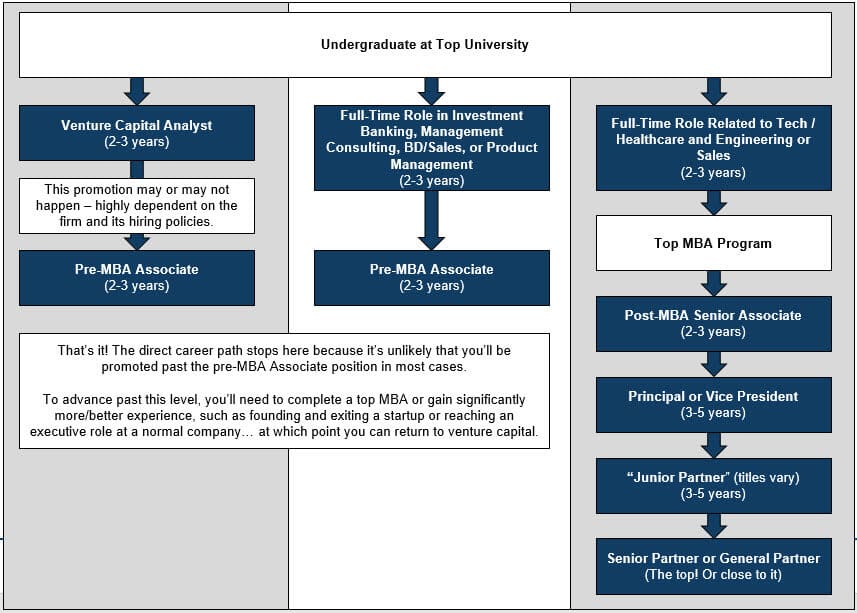

3. What is the Career Path for a VC Analyst?

The career path for a VC analyst typically starts with an entry-level position, often after completing a degree in finance, business, or a related field. With experience, analysts can advance to roles such as associate, senior associate, and eventually partner. Many analysts also transition into roles within startups or corporate venture arms, leveraging their experience to drive innovation.

| Role | Description |

|---|---|

| Analyst | Entry-level position focused on research and analysis. |

| Associate | Mid-level role with more responsibility in deal execution. |

| Senior Associate | Involves leading deals and mentoring junior staff. |

| Partner | Senior role with decision-making authority and fund management. |

| Startup Roles | Transitioning to operational or strategic roles in startups. |

4. What Are the Challenges Faced by VC Analysts?

VC analysts face several challenges, including the high-pressure environment of making investment decisions with limited information. They must also navigate the uncertainty inherent in startups, where many ventures fail. Additionally, balancing multiple projects and meeting tight deadlines can be demanding. However, these challenges also provide valuable learning opportunities and growth.

See Also What Does an Mba Summer Intern Typically Do at a Venture Capital Firm

What Does an Mba Summer Intern Typically Do at a Venture Capital Firm| Challenge | Impact |

|---|---|

| High-Pressure Environment | Requires quick decision-making and resilience. |

| Uncertainty | Dealing with the high failure rate of startups. |

| Multiple Projects | Juggling various tasks and deadlines simultaneously. |

| Limited Information | Making decisions with incomplete data. |

| Learning Curve | Adapting to the fast-paced and ever-changing VC landscape. |

5. What Are the Rewards of Being a VC Analyst?

Despite the challenges, being a VC analyst offers numerous rewards. Analysts gain exposure to cutting-edge technologies and innovative business models. They also build a network of industry professionals and entrepreneurs. Additionally, the role provides a steep learning curve, equipping analysts with skills that are highly transferable across industries. For those passionate about innovation, the opportunity to shape the future of startups is immensely fulfilling.

| Reward | Benefit |

|---|---|

| Exposure to Innovation | Working with groundbreaking technologies and ideas. |

| Networking Opportunities | Building relationships with industry leaders

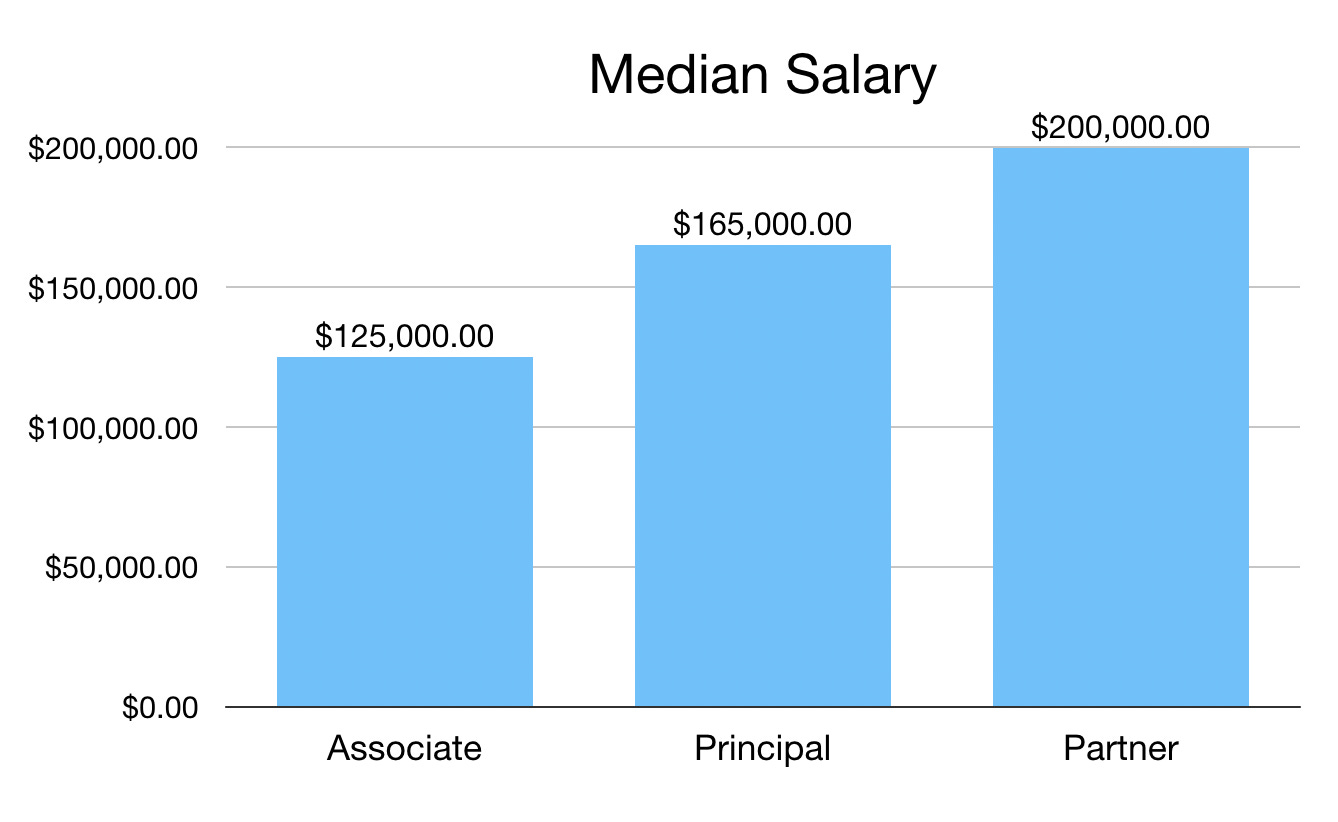

How much do VC firm analysts make?

What is the Average Salary of a VC Firm Analyst?The average salary for a VC firm analyst typically ranges between $80,000 and $120,000 per year, depending on factors such as location, firm size, and experience. Entry-level analysts often start at the lower end of this range, while those with more experience or working in major financial hubs like San Francisco or New York may earn higher salaries.

How Does Experience Affect VC Analyst Salaries?Experience plays a significant role in determining a VC analyst's salary. Entry-level analysts with less than two years of experience may earn closer to $80,000, while those with 2-4 years of experience can expect salaries in the range of $100,000 to $120,000. Analysts with specialized skills or advanced degrees may command even higher pay.

What Are the Additional Benefits for VC Analysts?Beyond base salaries, VC firm analysts often receive additional benefits such as bonuses, equity stakes, and health benefits. These perks can significantly enhance their total compensation package, making the role more attractive despite the demanding nature of the job.

How Do VC Analyst Salaries Compare to Other Finance Roles?VC analyst salaries are competitive but generally lower than those in investment banking or private equity. However, the potential for long-term gains through equity stakes and career growth in the venture capital industry can offset this difference.

What Factors Influence VC Analyst Salaries?Several factors influence the salary of a VC firm analyst, including the firm's size, geographic location, and the analyst's educational background. Analysts with degrees from top-tier universities or prior experience in finance may command higher salaries.

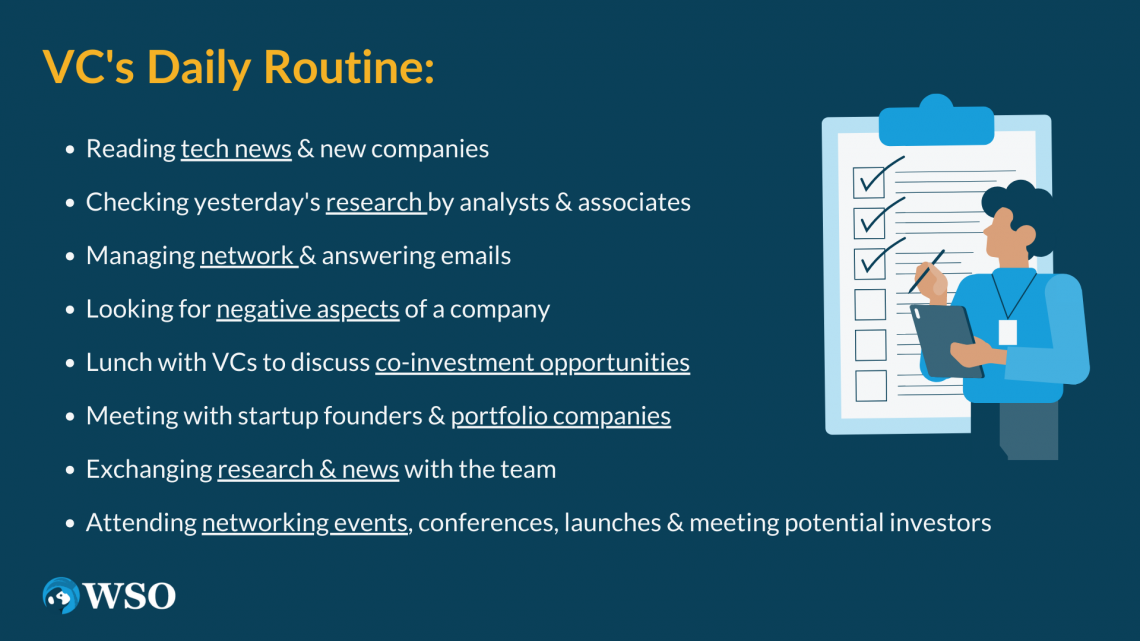

What is a day in the life of a VC analyst?

Morning Routine and Market ResearchA typical day for a VC analyst often begins with catching up on the latest market trends and news. This involves:

Deal Sourcing and EvaluationOne of the core responsibilities of a VC analyst is to source and evaluate potential deals. This includes:

Meetings and CollaborationsThroughout the day, a VC analyst engages in various meetings and collaborative efforts, such as:

Portfolio Management and SupportSupporting existing portfolio companies is another critical aspect of the role. This involves:

End-of-Day Wrap-Up and PreparationAs the day winds down, a VC analyst focuses on wrapping up tasks and preparing for the next day. This includes:

How many hours do VC analysts work?

Typical Working Hours for VC AnalystsVenture Capital (VC) analysts typically work long hours, often ranging from 50 to 70 hours per week. The workload can vary depending on the firm, deal flow, and stage of investment. Analysts are expected to be highly responsive and proactive, especially during critical periods such as due diligence or fundraising.

Factors Influencing VC Analysts' Working HoursThe number of hours a VC analyst works can be influenced by several factors, including the size of the firm, the stage of investments, and the analyst's level of experience. Smaller firms or early-stage funds may require more hands-on involvement, leading to longer hours.

Work-Life Balance for VC AnalystsWork-life balance can be challenging for VC analysts due to the demanding nature of the job. However, some firms prioritize employee well-being by offering flexible schedules or remote work options.

Differences Between VC Analysts and Other Finance RolesCompared to other finance roles, such as investment banking or private equity, VC analysts may have slightly better hours but still face significant demands. The focus on early-stage companies and innovation adds unique pressures.

How VC Analysts Manage Their TimeEffective time management is crucial for VC analysts to handle their workload efficiently. Prioritizing tasks, leveraging technology, and collaborating with team members can help streamline processes.

Is VC a high paying job?

What is the Average Salary of a Venture Capitalist?The average salary of a venture capitalist varies significantly depending on factors such as experience, location, and the size of the firm. However, it is generally considered a high-paying job. Here are some key points:

How Does Compensation in VC Compare to Other Finance Jobs?Compensation in venture capital is competitive but differs from other finance roles. Here’s how it compares:

What Factors Influence VC Salaries?Several factors determine how much a venture capitalist earns. These include:

What Role Does Carried Interest Play in VC Compensation?Carried interest is a critical component of VC compensation. Here’s why:

Is VC a High-Paying Job for Entry-Level Professionals?While VC is a high-paying job overall, entry-level roles may not always reflect this. Consider the following:

Frequently Asked Questions by our CommunityWhat does a typical day look like for an analyst at a venture capital firm?Being an analyst at a venture capital firm involves a mix of research, deal sourcing, and due diligence. A typical day might start with reviewing industry news and identifying emerging trends. Analysts often spend time evaluating potential investment opportunities, which includes analyzing financial statements, market size, and competitive landscapes. They also attend meetings with startup founders, prepare investment memos, and collaborate with senior team members to make informed decisions. The role is fast-paced and requires strong analytical skills, as well as the ability to multitask effectively. What skills are essential for success as a venture capital analyst?To thrive as a venture capital analyst, you need a combination of technical and soft skills. Strong financial modeling and data analysis capabilities are crucial for evaluating startups and assessing their growth potential. Additionally, excellent communication skills are necessary for presenting findings to senior team members and building relationships with founders. A deep understanding of specific industries, curiosity, and the ability to think critically are also key. Being adaptable and having a proactive mindset can help you navigate the dynamic nature of the venture capital world. How does an analyst contribute to the investment decision-making process?An analyst plays a critical role in the investment decision-making process by conducting thorough research and providing actionable insights. They are responsible for sourcing potential deals, performing due diligence, and creating detailed reports that outline the risks and opportunities of each investment. Analysts also help senior team members by preparing investment memos, which summarize key findings and recommendations. While the final decision rests with the partners, the analyst's work significantly influences the direction and success of the firm's investments. What are the career growth opportunities for a venture capital analyst?Starting as a venture capital analyst can open doors to various career paths within the industry. Many analysts progress to roles such as associate or senior associate, where they take on more responsibility in deal sourcing and portfolio management. Over time, some move into principal or partner positions, where they lead investment decisions and shape the firm's strategy. Others leverage their experience to transition into roles at startups, private equity firms, or entrepreneurship. The skills and network gained as an analyst provide a strong foundation for long-term career growth in the venture capital ecosystem. Leave a Reply |

Our Recommended Articles