What is the Difference Between Fundraising Venture Capital and Private Investments

Fundraising through venture capital and private investments are two prominent methods for securing financial backing, yet they differ significantly in structure, purpose, and audience. Venture capital typically involves institutional investors funding high-growth startups in exchange for equity, often targeting innovative or tech-driven companies. In contrast, private investments encompass a broader range of funding sources, including individual investors or family offices, and may involve equity, debt, or hybrid instruments. While venture capital is often associated with early-stage companies seeking rapid scaling, private investments can cater to established businesses or niche markets. Understanding these distinctions is crucial for entrepreneurs and investors navigating the complex landscape of funding options.

- What is the Difference Between Fundraising, Venture Capital, and Private Investments?

- What is the difference between venture capital and private investors?

- What is the difference between venture capital funds and private equity funds?

- How does venture capital differ from a private placement?

- What is the difference between investment and venture capital?

-

Frequently Asked Questions (FAQs)

- What is the main difference between fundraising venture capital and private investments?

- How do venture capital and private investments differ in terms of involvement?

- What are the typical stages of companies that attract venture capital versus private investments?

- How do the risk and return profiles compare between venture capital and private investments?

What is the Difference Between Fundraising, Venture Capital, and Private Investments?

Fundraising, venture capital, and private investments are often used interchangeably, but they represent distinct concepts in the financial world. Fundraising refers to the process of gathering capital from various sources, which can include individuals, institutions, or groups. Venture capital, on the other hand, is a subset of private equity that focuses on investing in early-stage or high-growth companies with significant potential. Private investments encompass a broader range of financial activities, including private equity, real estate, and other non-publicly traded assets. Understanding the differences between these terms is crucial for entrepreneurs, investors, and anyone involved in the financial ecosystem.

See Also What Are the Key Differences Between Private Equity and Venture Capital

What Are the Key Differences Between Private Equity and Venture Capital1. What is Fundraising in the Context of Business?

Fundraising is the process of securing financial resources to support a business, project, or initiative. It can involve various methods, such as equity financing, debt financing, or crowdfunding. Fundraising is not limited to startups; established companies also engage in fundraising to expand operations, launch new products, or enter new markets. The key aspect of fundraising is that it is a general term that can apply to any effort to raise capital, regardless of the source or structure.

2. How Does Venture Capital Work?

Venture capital (VC) is a form of private equity financing provided to early-stage, high-potential companies. VC firms invest in startups with the expectation of high returns, often in exchange for equity or ownership stakes. These investments are typically high-risk but can yield substantial rewards if the company succeeds. Venture capitalists also provide mentorship, industry connections, and strategic guidance to help the company grow. Unlike traditional fundraising, venture capital is highly specialized and focuses on innovative businesses with scalable models.

See Also Whats the Difference Between Growth Equity and Venture Capital

Whats the Difference Between Growth Equity and Venture Capital3. What Are Private Investments?

Private investments refer to capital allocated to non-publicly traded assets, such as private equity, real estate, hedge funds, or infrastructure projects. These investments are often made by high-net-worth individuals, institutional investors, or private equity firms. Unlike venture capital, private investments are not limited to startups and can include mature companies or tangible assets. The primary goal of private investments is to generate long-term returns, often through buyouts, restructuring, or asset appreciation.

4. Key Differences Between Venture Capital and Private Investments

While both venture capital and private investments fall under the umbrella of private equity, they differ in focus, risk profile, and investment stages. Venture capital targets early-stage companies with high growth potential, whereas private investments often involve established businesses or tangible assets. Additionally, venture capital is typically more hands-on, with investors actively participating in the company's development. In contrast, private investments may involve passive ownership or long-term holding strategies.

See Also How long does it take from finalists to actual notification of acceptance at the TechStars incubator?

How long does it take from finalists to actual notification of acceptance at the TechStars incubator?5. Which Option is Right for Your Business?

Choosing between fundraising, venture capital, and private investments depends on your business's stage, goals, and financial needs. Startups with innovative ideas and high growth potential may benefit from venture capital, while established companies seeking expansion or restructuring might opt for private investments. Fundraising, being a broader term, can be tailored to suit various needs, from small-scale crowdfunding to large institutional investments. Understanding your business's unique requirements will help you determine the most suitable financing option.

| Aspect | Fundraising | Venture Capital | Private Investments |

|---|---|---|---|

| Focus | General capital raising | Early-stage, high-growth companies | Non-publicly traded assets |

| Risk Level | Varies | High | Moderate to High |

| Investment Stage | Any stage | Seed to Growth | Mature companies or assets |

| Investor Involvement | Varies | Active | Passive or Active |

| Return Expectations | Varies | High | Long-term |

What is the difference between venture capital and private investors?

Definition and Structure

Venture capital (VC) refers to funds provided by professional investment firms to startups and early-stage companies with high growth potential. These firms pool money from institutional investors and high-net-worth individuals. On the other hand, private investors, also known as angel investors, are individuals who invest their personal wealth directly into businesses, often at an earlier stage than venture capitalists.

- Venture capital is institutional and involves pooled funds.

- Private investors use personal wealth and invest individually.

- VCs typically invest larger amounts compared to private investors.

Investment Stage

Venture capitalists usually invest in companies that have already demonstrated some level of traction, such as a working prototype or initial revenue. In contrast, private investors often fund businesses at the seed stage, sometimes even at the idea phase, when the risk is highest.

See Also What is the Difference Between a Private Equity Firm and a Venture Capital Firm

What is the Difference Between a Private Equity Firm and a Venture Capital Firm- VCs target companies with proven potential.

- Private investors are more likely to invest in early-stage startups.

- The investment stage determines the level of risk and involvement.

Level of Involvement

Venture capital firms often take an active role in the management of the companies they invest in, providing strategic guidance, industry connections, and operational support. Private investors, while they may offer advice, generally have a more hands-off approach unless they have specific expertise in the industry.

- VCs are highly involved in business operations.

- Private investors may offer mentorship but are less hands-on.

- The level of involvement depends on the investor's expertise and interest.

Funding Amounts

Venture capital investments are typically larger, ranging from millions to tens of millions of dollars, depending on the stage of the company. Private investors, however, usually provide smaller amounts, often between $25,000 and $500,000, though this can vary based on the investor's capacity.

- VCs invest significantly larger sums.

- Private investors provide smaller, more flexible funding.

- The funding amount influences the equity stake and control.

Risk and Return Expectations

Venture capitalists expect high returns on their investments, often aiming for 10x or more, given the high risk associated with startups. Private investors also seek substantial returns but may be more patient and willing to accept lower returns due to their personal connection to the business or founder.

- VCs prioritize high-risk, high-reward opportunities.

- Private investors may have more flexible return expectations.

- The risk tolerance varies based on the investor's goals.

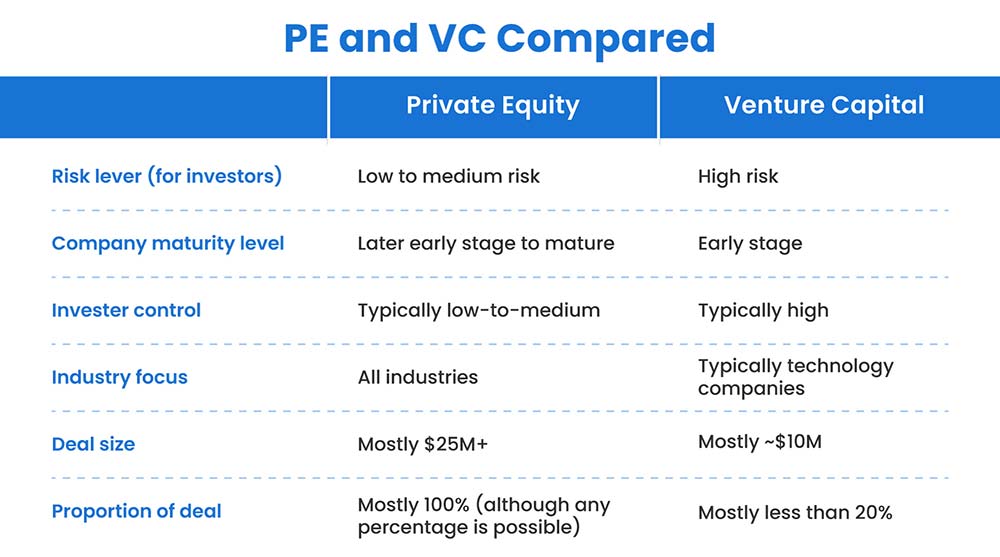

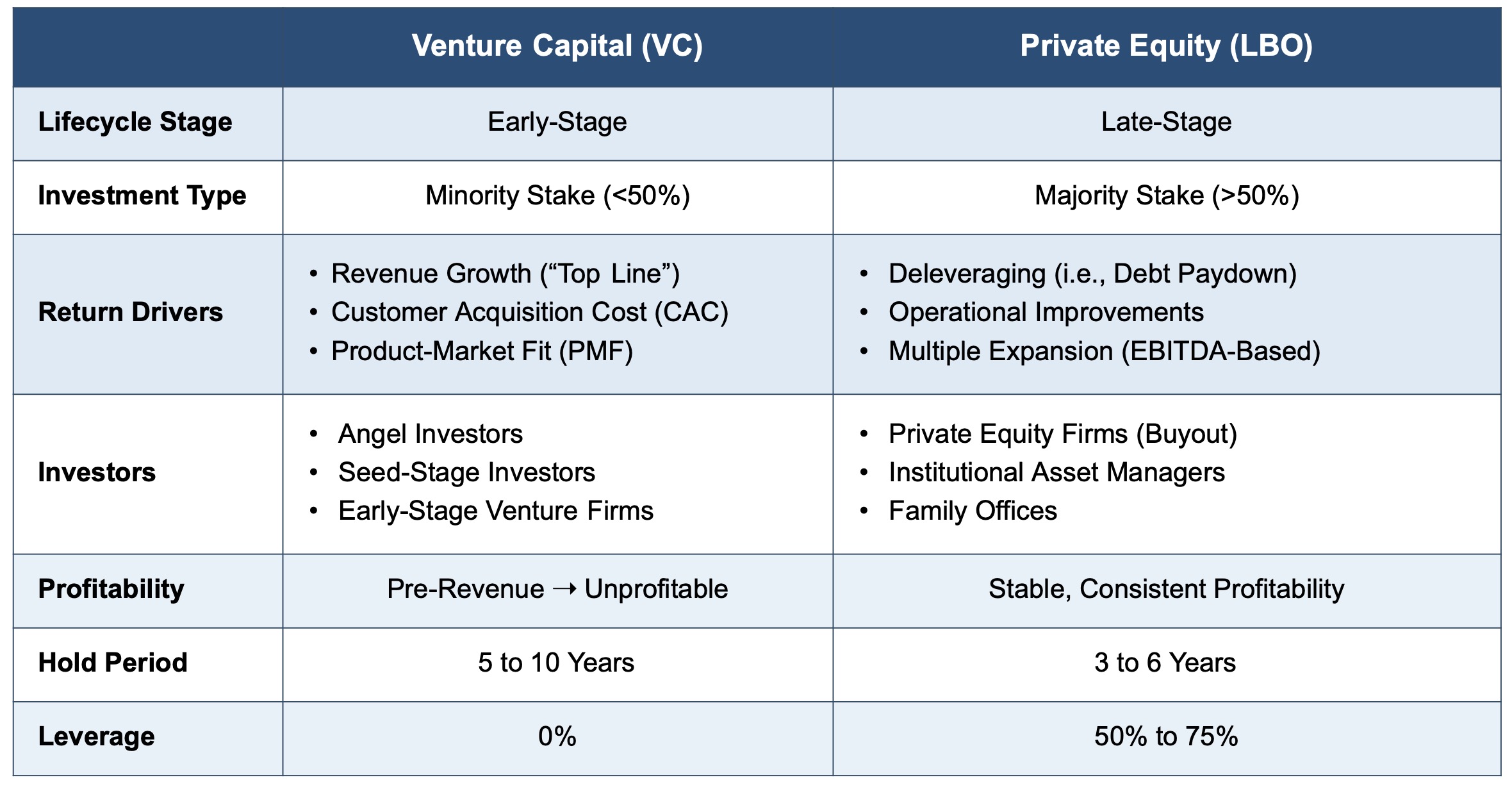

What is the difference between venture capital funds and private equity funds?

Investment Stage

Venture capital funds and private equity funds differ significantly in the stages of investment they target. Venture capital funds typically invest in early-stage companies or startups that are in the initial phases of development and often lack a proven track record. These investments are considered high-risk but offer the potential for high returns. On the other hand, private equity funds usually invest in mature companies that are already established and have a stable revenue stream. These investments are generally less risky compared to venture capital but still aim for substantial returns through operational improvements or strategic acquisitions.

- Venture capital focuses on startups and early-stage companies.

- Private equity targets established, mature companies.

- Venture capital investments are higher risk with potential for high returns.

Investment Size

The size of investments made by venture capital funds and private equity funds also varies. Venture capital funds typically make smaller investments, often in the range of a few million dollars, as they are dealing with startups that may not require large amounts of capital initially. In contrast, private equity funds usually make much larger investments, often in the range of hundreds of millions or even billions of dollars, as they are dealing with established companies that may require significant capital for expansion, restructuring, or acquisitions.

- Venture capital investments are generally smaller, often in the millions.

- Private equity investments are larger, often in the hundreds of millions or billions.

- Venture capital deals with startups that need less capital.

Ownership Stake

Another key difference lies in the ownership stake that these funds typically acquire. Venture capital funds usually take a minority stake in the companies they invest in, as they are often dealing with multiple investors and the founders still retain significant control. Private equity funds, however, often seek a majority stake or even complete ownership of the companies they invest in, allowing them to have greater control over the company's operations and strategic direction.

- Venture capital usually takes a minority stake in companies.

- Private equity often seeks a majority or complete ownership.

- Private equity allows for greater control over operations.

Investment Horizon

The investment horizon for venture capital and private equity funds also differs. Venture capital funds typically have a longer investment horizon, often ranging from 5 to 10 years, as they are investing in startups that may take several years to mature and achieve significant growth. Private equity funds, on the other hand, usually have a shorter investment horizon, often around 3 to 7 years, as they aim to improve the performance of established companies and then exit through a sale or public offering.

- Venture capital has a longer investment horizon, often 5-10 years.

- Private equity has a shorter investment horizon, often 3-7 years.

- Venture capital investments require more time to mature.

Risk and Return Profile

The risk and return profile of venture capital and private equity funds is another area of distinction. Venture capital funds are associated with higher risk due to the nature of investing in unproven startups, but they also offer the potential for higher returns if the startups succeed. Private equity funds, while still risky, generally have a lower risk profile because they invest in established companies with proven business models. However, the returns, while substantial, are typically not as high as those from successful venture capital investments.

- Venture capital is higher risk with potential for higher returns.

- Private equity is lower risk with substantial but typically lower returns.

- Venture capital success can yield significant returns.

How does venture capital differ from a private placement?

Definition and Purpose

Venture capital and private placement are both methods of raising capital, but they serve different purposes and target different types of investors. Venture capital is typically used by startups and early-stage companies to secure funding in exchange for equity. Private placement, on the other hand, is a method used by more established companies to raise capital from a select group of investors without going public.

- Venture capital focuses on high-growth potential startups.

- Private placement is often used by mature companies seeking capital without the regulatory requirements of public offerings.

- Both methods involve equity or debt issuance but differ in target audience and regulatory scrutiny.

Investor Profile

The investor profile for venture capital and private placement differs significantly. Venture capital investors are typically institutional investors, such as venture capital firms, angel investors, or corporate venture arms, who are willing to take on high risk for potentially high returns. Private placement investors are usually accredited or institutional investors who prefer more stable, lower-risk investments.

- Venture capital investors seek high-risk, high-reward opportunities.

- Private placement investors are often more risk-averse and prefer established companies.

- Both types of investors require significant capital but differ in their risk tolerance.

Regulatory Requirements

Regulatory requirements for venture capital and private placement vary. Venture capital investments are subject to fewer regulations compared to private placements, which must comply with securities laws such as Regulation D in the United States. Private placements require detailed disclosures and are limited to accredited investors to ensure compliance.

- Venture capital deals are less regulated, focusing on equity stakes in startups.

- Private placement involves strict compliance with securities regulations.

- Both methods require transparency but differ in the level of regulatory oversight.

Investment Structure

The investment structure in venture capital and private placement differs in terms of equity and debt. Venture capital typically involves equity investments, where investors receive ownership stakes in the company. Private placement can involve both equity and debt instruments, such as bonds or convertible notes, depending on the company's needs.

- Venture capital is primarily equity-based, offering ownership shares.

- Private placement can include debt instruments like bonds or convertible notes.

- Both methods provide capital but differ in the financial instruments used.

Exit Strategies

Exit strategies for venture capital and private placement investors vary. Venture capital investors typically exit through an initial public offering (IPO) or acquisition, aiming for significant returns. Private placement investors may exit through buybacks, secondary market sales, or debt repayment, depending on the investment structure.

- Venture capital exits often involve IPOs or acquisitions for high returns.

- Private placement exits may include buybacks or secondary market sales.

- Both methods offer exit opportunities but differ in the timing and potential returns.

What is the difference between investment and venture capital?

Definition of Investment and Venture Capital

Investment refers to the act of allocating resources, usually money, with the expectation of generating an income or profit. This can be done through various means such as stocks, bonds, real estate, or other financial instruments. On the other hand, venture capital is a subset of investment that specifically focuses on providing funding to early-stage, high-potential, and often high-risk startups in exchange for equity.

- Investment is a broad term encompassing various financial activities.

- Venture capital is a specialized form of investment targeting startups.

- Venture capital involves higher risk compared to traditional investments.

Risk and Return Profile

The risk and return profile of traditional investments and venture capital differs significantly. Traditional investments generally offer lower risk and more predictable returns, whereas venture capital is characterized by high risk and the potential for high returns.

- Traditional investments are typically safer with steady returns.

- Venture capital involves high risk but can yield substantial returns.

- Investors in venture capital must be prepared for the possibility of losing their entire investment.

Investment Horizon

The investment horizon for traditional investments and venture capital also varies. Traditional investments often have shorter to medium-term horizons, while venture capital investments usually require a long-term commitment.

- Traditional investments can be liquidated relatively quickly.

- Venture capital investments often take years to mature.

- Investors in venture capital need to be patient and committed for the long haul.

Types of Investors

The types of investors involved in traditional investments and venture capital differ as well. Traditional investments attract a wide range of investors, including individuals, institutions, and funds. Venture capital, however, is typically pursued by specialized firms or high-net-worth individuals.

- Traditional investments are accessible to a broad audience.

- Venture capital is usually limited to accredited investors and firms.

- Venture capital investors often have significant expertise in specific industries.

Impact on Companies

The impact on companies receiving traditional investments versus venture capital can be quite different. Traditional investments provide capital without necessarily influencing company operations, whereas venture capital investors often take an active role in guiding the company.

- Traditional investments offer financial support without operational involvement.

- Venture capital investors may provide mentorship and strategic guidance.

- Companies backed by venture capital often benefit from the investor's network and expertise.

Frequently Asked Questions (FAQs)

What is the main difference between fundraising venture capital and private investments?

Fundraising venture capital and private investments differ primarily in their structure and target audience. Venture capital is typically provided by professional investors or firms to early-stage or high-growth companies with significant potential. These investments are often made in exchange for equity and involve a high level of risk. On the other hand, private investments can include a broader range of funding sources, such as angel investors, family offices, or private equity firms, and may target more established businesses. Private investments are often less risky compared to venture capital, as they focus on companies with proven track records.

How do venture capital and private investments differ in terms of involvement?

Venture capital investors often take an active role in the companies they fund, providing mentorship, strategic guidance, and networking opportunities to help the business grow. This involvement is due to the high-risk nature of their investments and the need to ensure a return. In contrast, private investors may adopt a more hands-off approach, especially if they are investing in mature companies. Their focus is typically on financial returns rather than operational involvement, unless they are private equity firms that specialize in restructuring or scaling businesses.

What are the typical stages of companies that attract venture capital versus private investments?

Venture capital is usually directed toward startups or companies in their early stages of development, often before they have generated significant revenue or profits. These companies are in high-growth sectors like technology, biotech, or clean energy. In contrast, private investments are more commonly associated with established companies that have a stable revenue stream and are looking to expand, acquire other businesses, or improve operations. Private equity firms, for example, often invest in companies that are already profitable but require capital for further growth.

How do the risk and return profiles compare between venture capital and private investments?

Venture capital is considered high-risk, high-reward due to the uncertainty surrounding early-stage companies. While the potential for significant returns exists, many venture-backed startups fail, leading to a loss of investment. On the other hand, private investments generally carry lower risk because they target more established businesses with proven business models. However, the returns may also be more modest compared to successful venture capital investments. Private equity, for instance, often aims for steady, long-term growth rather than explosive returns.

Leave a Reply

Our Recommended Articles