What Vc Firms Invest in the Aviation and Aerospace Industry?

The aviation and aerospace industry represents a dynamic and high-growth sector, attracting significant interest from venture capital (VC) firms seeking innovative opportunities. As technological advancements and sustainability goals reshape the industry, VCs are increasingly investing in startups and companies that push the boundaries of air travel, space exploration, and defense technologies. From electric aircraft and autonomous drones to satellite constellations and advanced materials, the focus is on cutting-edge solutions that address efficiency, safety, and environmental concerns. This article explores the key areas within aviation and aerospace that are drawing VC attention, highlighting the trends and innovations shaping the future of this transformative industry.

- What Do VC Firms Invest in the Aviation and Aerospace Industry?

- Who are the Tier 1 VCs?

- What industries have the most VC funding?

- What kind of companies do VCs invest in?

- What is the most prestigious VC firm?

-

Frequently Asked Questions (FAQs)

- What types of companies in the aviation and aerospace industry do VC firms typically invest in?

- How do VC firms evaluate investment opportunities in the aviation and aerospace sector?

- What are the risks associated with investing in the aviation and aerospace industry?

- What trends are driving VC investment in the aviation and aerospace industry?

What Do VC Firms Invest in the Aviation and Aerospace Industry?

The aviation and aerospace industry is a dynamic and rapidly evolving sector that attracts significant interest from venture capital (VC) firms. These firms invest in innovative technologies, startups, and companies that are shaping the future of air travel, space exploration, and defense systems. Below, we explore the key areas where VC firms are directing their investments.

See Also Venture Capital: Who Are the Recent New Vc Firms in Fintech?

Venture Capital: Who Are the Recent New Vc Firms in Fintech?1. Sustainable Aviation Technologies

VC firms are increasingly investing in sustainable aviation technologies to address environmental concerns and reduce the carbon footprint of the aviation industry. This includes funding for electric and hybrid-electric aircraft, sustainable aviation fuels (SAF), and energy-efficient propulsion systems. Startups working on these technologies are seen as pivotal in achieving the industry's goal of net-zero emissions by 2050.

2. Advanced Aerospace Manufacturing

The aerospace sector is witnessing a surge in investments in advanced manufacturing techniques such as 3D printing, composite materials, and automation. These technologies enable faster production, reduce costs, and improve the performance of aircraft and spacecraft. VC firms are particularly interested in companies that integrate artificial intelligence (AI) and machine learning into manufacturing processes.

See AlsoWhat is the Best Vc Firm to Join as an Eir?3. Space Exploration and Satellite Technology

With the rise of private space companies, VC firms are pouring funds into space exploration and satellite technology. Investments are directed toward companies developing reusable rockets, satellite constellations for global internet coverage, and lunar and Mars exploration missions. This sector is seen as a frontier for innovation and long-term growth.

4. Urban Air Mobility (UAM)

Urban Air Mobility (UAM) is a rapidly growing area of interest for VC firms. This includes investments in electric vertical takeoff and landing (eVTOL) aircraft, drone delivery services, and air taxi startups. These technologies aim to revolutionize urban transportation by reducing traffic congestion and providing faster, more efficient travel options.

See Also What Are the Most Active Health Care Focused Vc Firms?

What Are the Most Active Health Care Focused Vc Firms?5. Defense and Security Innovations

The defense and security segment of the aerospace industry continues to attract VC funding. Firms are investing in autonomous drones, cybersecurity solutions for aviation systems, and advanced surveillance technologies. These innovations are critical for national security and have significant commercial potential.

| Investment Area | Key Technologies | Examples |

|---|---|---|

| Sustainable Aviation | Electric aircraft, SAF, energy-efficient systems | ZeroAvia, Heart Aerospace |

| Advanced Manufacturing | 3D printing, composites, AI-driven automation | Relativity Space, Markforged |

| Space Exploration | Reusable rockets, satellite constellations | SpaceX, Planet Labs |

| Urban Air Mobility | eVTOL, drone delivery, air taxis | Joby Aviation, Lilium |

| Defense and Security | Autonomous drones, cybersecurity | Shield AI, Anduril Industries |

Who are the Tier 1 VCs?

Are There Vc Firms That Invest in Sport Related Startups?

Are There Vc Firms That Invest in Sport Related Startups?What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are distinguished by their reputation, track record, and influence in the startup ecosystem. These firms typically have a history of investing in highly successful companies, often referred to as unicorns, and have a significant impact on the growth and direction of the industries they invest in. Key characteristics include:

- High-profile investments: They back companies that often become market leaders or disruptors.

- Extensive networks: They provide startups with access to top-tier talent, advisors, and partners.

- Large fund sizes: They manage billions of dollars, enabling them to make substantial investments.

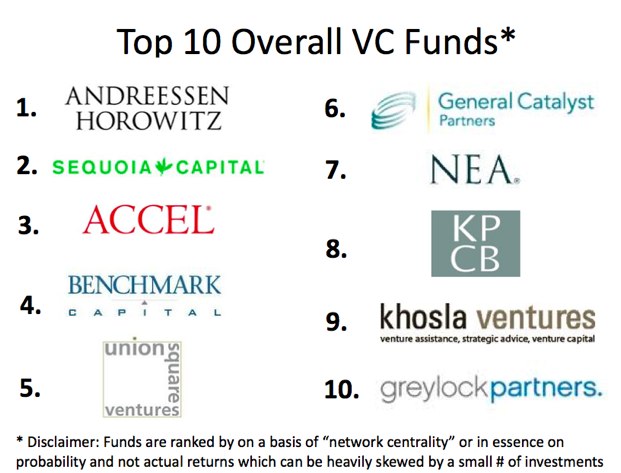

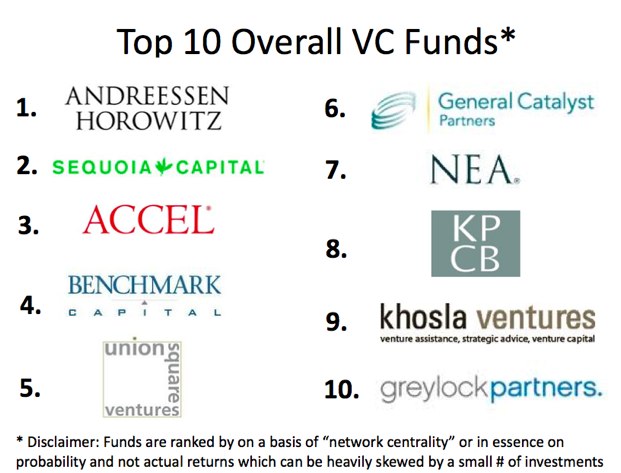

Top Tier 1 Venture Capital Firms Globally

Some of the most renowned Tier 1 venture capital firms include:

See Also Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy Themselves

Which Venture Capitalists Make Investments in Fashion Tech Ventures and Are Fashion Savvy Themselves- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): Famous for backing companies like Facebook, Twitter, and Coinbase.

- Accel: Notable for its investment in Facebook, Slack, and Dropbox.

- Kleiner Perkins: A pioneer in venture capital, with investments in Amazon and Google.

- Benchmark: Known for its early stake in Uber and Twitter.

Why Startups Seek Tier 1 VC Funding

Startups often prioritize securing funding from Tier 1 VCs due to the strategic advantages they offer. These include:

- Credibility: Association with a Tier 1 VC can enhance a startup's reputation.

- Mentorship: Access to experienced partners who provide guidance and mentorship.

- Follow-on funding: Tier 1 VCs often lead subsequent funding rounds, attracting other investors.

How Tier 1 VCs Evaluate Investment Opportunities

Tier 1 venture capital firms use a rigorous evaluation process to identify high-potential startups. Key factors they consider include:

- Market potential: The size and growth prospects of the target market.

- Team quality: The experience and capability of the founding team.

- Innovation: The uniqueness and defensibility of the product or technology.

The Impact of Tier 1 VCs on the Startup Ecosystem

Tier 1 venture capital firms play a pivotal role in shaping the startup ecosystem. Their influence extends beyond funding, as they:

- Set trends: Their investments often signal emerging industries or technologies.

- Drive innovation: By funding disruptive startups, they accelerate technological advancements.

- Create ecosystems: They foster networks of entrepreneurs, investors, and industry experts.

What industries have the most VC funding?

Technology and Software Industry

The technology and software industry consistently receives the largest share of venture capital (VC) funding. This sector includes companies focused on software development, cloud computing, artificial intelligence, and other tech-driven innovations. Key areas attracting significant investments are:

- Artificial Intelligence (AI): Startups developing AI-driven solutions for automation, data analysis, and machine learning.

- SaaS (Software as a Service): Companies offering subscription-based software solutions for businesses and consumers.

- Cybersecurity: Firms providing advanced security solutions to protect data and systems.

Healthcare and Biotechnology

The healthcare and biotechnology industry is another major recipient of VC funding, driven by advancements in medical research and technology. Key areas include:

- Biotech Innovations: Startups working on gene editing, personalized medicine, and drug discovery.

- Digital Health: Companies developing telemedicine platforms, wearable health devices, and health monitoring apps.

- Medical Devices: Firms creating cutting-edge medical equipment and diagnostic tools.

Fintech (Financial Technology)

The fintech industry has seen a surge in VC funding as it disrupts traditional financial services. Key areas of investment include:

- Digital Payments: Companies offering mobile payment solutions and digital wallets.

- Blockchain and Cryptocurrency: Startups focused on decentralized finance (DeFi) and blockchain technology.

- Lending Platforms: Firms providing peer-to-peer lending and alternative credit scoring systems.

E-commerce and Retail

The e-commerce and retail industry continues to attract significant VC funding, especially with the rise of online shopping. Key areas include:

- Direct-to-Consumer (DTC) Brands: Companies selling products directly to consumers through online platforms.

- Marketplace Platforms: Startups creating platforms for buyers and sellers to connect.

- Logistics and Supply Chain Tech: Firms improving delivery and inventory management systems.

Clean Energy and Sustainability

The clean energy and sustainability sector is gaining traction in VC funding as the world shifts toward greener solutions. Key areas include:

- Renewable Energy: Startups focused on solar, wind, and other renewable energy sources.

- Energy Storage: Companies developing advanced battery technologies and energy storage systems.

- Sustainable Materials: Firms creating eco-friendly alternatives to traditional materials.

What kind of companies do VCs invest in?

What Industries Attract Venture Capital Investments?

Venture capitalists (VCs) typically invest in industries that show high growth potential and scalability. Some of the most common sectors include:

- Technology: This includes software, hardware, artificial intelligence, and fintech companies.

- Healthcare and Biotech: Startups focused on medical devices, pharmaceuticals, and health tech innovations.

- E-commerce and Retail: Companies that leverage online platforms to disrupt traditional retail models.

- Clean Energy and Sustainability: Businesses developing renewable energy solutions or sustainable products.

- Consumer Goods and Services: Brands that offer unique or innovative products to meet consumer demands.

What Stage of Companies Do VCs Target?

VCs often invest in companies at specific stages of their growth journey. These stages include:

- Seed Stage: Early-stage companies with a prototype or minimum viable product (MVP).

- Early Stage (Series A): Startups that have demonstrated market traction and need funding to scale.

- Growth Stage (Series B and C): Established companies looking to expand operations or enter new markets.

- Late Stage (Series D and beyond): Mature companies preparing for an IPO or acquisition.

What Characteristics Make a Company Attractive to VCs?

VCs look for specific traits in companies before investing. Key characteristics include:

- Scalability: The potential to grow rapidly and serve a large market.

- Strong Management Team: Experienced and capable leadership with a clear vision.

- Innovative Product or Service: A unique offering that solves a significant problem.

- Market Opportunity: A large and growing target market.

- Proven Traction: Evidence of customer demand and revenue growth.

What Are the Risks VCs Consider When Investing?

VCs evaluate several risks before committing funds to a company. These risks include:

- Market Risk: The possibility that the target market may not grow as expected.

- Execution Risk: The chance that the company may fail to deliver on its business plan.

- Competitive Risk: The threat of competitors outperforming the company.

- Regulatory Risk: Changes in laws or regulations that could impact the business.

- Financial Risk: The potential for the company to run out of funds before achieving profitability.

How Do VCs Evaluate a Company's Potential?

VCs use a variety of methods to assess a company's potential for success. These methods include:

- Due Diligence: A thorough analysis of the company's financials, operations, and market position.

- Market Analysis: Evaluating the size and growth potential of the target market.

- Team Assessment: Reviewing the experience and capabilities of the founding team.

- Product Validation: Testing the product or service to ensure it meets customer needs.

- Financial Projections: Analyzing the company's revenue and profitability forecasts.

What is the most prestigious VC firm?

What Defines a Prestigious VC Firm?

A prestigious venture capital (VC) firm is typically characterized by its track record of successful investments, influential portfolio companies, and a strong reputation within the industry. These firms often have:

- High-profile exits: Successful IPOs or acquisitions of their portfolio companies.

- Top-tier investors: Limited partners (LPs) include institutional investors, endowments, and wealthy individuals.

- Global recognition: A strong presence in major tech hubs like Silicon Valley, New York, and London.

Top Contenders for the Most Prestigious VC Firm

Several VC firms are often cited as the most prestigious due to their history and impact. These include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): Renowned for backing companies like Facebook, Twitter, and Coinbase.

- Kleiner Perkins: A pioneer in venture capital with investments in Amazon and Google.

Why Sequoia Capital Stands Out

Sequoia Capital is often regarded as the most prestigious VC firm due to its:

- Decades of success: Founded in 1972, it has consistently identified and supported groundbreaking companies.

- Global influence: With offices in the U.S., China, India, and Southeast Asia, it has a truly international reach.

- Diverse portfolio: Investments span industries like technology, healthcare, and consumer goods.

The Role of Andreessen Horowitz in Shaping Tech

Andreessen Horowitz has earned its prestige by:

- Focusing on innovation: It invests heavily in cutting-edge technologies like AI, blockchain, and biotech.

- Building ecosystems: The firm actively supports its portfolio companies with operational expertise and networking opportunities.

- Cultural impact: Its founders, Marc Andreessen and Ben Horowitz, are influential figures in the tech world.

Kleiner Perkins: A Legacy of Innovation

Kleiner Perkins has maintained its prestige through:

- Early-stage investments: It has a history of identifying startups with transformative potential.

- Strong mentorship: The firm provides hands-on guidance to entrepreneurs.

- Adaptability: It has evolved its focus from hardware and software to green tech and life sciences.

Frequently Asked Questions (FAQs)

What types of companies in the aviation and aerospace industry do VC firms typically invest in?

Venture capital (VC) firms often invest in companies that are innovative and have the potential to disrupt the aviation and aerospace industry. This includes startups focused on electric aircraft, autonomous drones, satellite technology, and advanced materials. Additionally, firms may target companies developing sustainable aviation solutions, such as alternative fuels or energy-efficient propulsion systems. The goal is to support businesses that can scale quickly and address critical challenges in the industry.

How do VC firms evaluate investment opportunities in the aviation and aerospace sector?

VC firms evaluate opportunities based on several key factors, including the market potential, technological innovation, and the team's expertise. They look for companies with a clear competitive advantage, such as proprietary technology or strategic partnerships. Additionally, firms assess the regulatory environment and potential risks, as the aviation and aerospace industry is highly regulated. A strong business model and a clear path to profitability are also critical considerations.

What are the risks associated with investing in the aviation and aerospace industry?

Investing in the aviation and aerospace industry carries several risks, including high capital requirements, long development cycles, and regulatory hurdles. The industry is also sensitive to economic fluctuations, which can impact demand for air travel and related technologies. Additionally, technological advancements can render existing solutions obsolete, creating uncertainty for investors. Despite these challenges, successful investments can yield significant returns due to the industry's high growth potential and global impact.

What trends are driving VC investment in the aviation and aerospace industry?

Several trends are driving VC investment in this sector, including the rise of urban air mobility, the increasing demand for satellite-based services, and the push for sustainable aviation. The development of electric and hybrid-electric aircraft is also attracting significant attention, as it aligns with global efforts to reduce carbon emissions. Furthermore, advancements in artificial intelligence and autonomous systems are opening new opportunities for innovation in areas like drone delivery and air traffic management.

Leave a Reply

Our Recommended Articles