Whats the Best Portfolio Management Software for Venture Capital Why

In the fast-paced world of venture capital, managing investments efficiently is crucial for success. With a myriad of portfolio companies, diverse asset classes, and complex data to track, venture capitalists rely on robust portfolio management software to streamline operations and make informed decisions. These tools not only provide real-time insights into portfolio performance but also enhance collaboration, risk assessment, and reporting capabilities. However, with numerous options available, choosing the best software can be daunting. This article explores the key features to look for in portfolio management software tailored for venture capital and highlights why selecting the right solution is essential for maximizing returns and driving growth.

-

What is the Best Portfolio Management Software for Venture Capital and Why?

- 1. Why is Real-Time Data Tracking Essential for Venture Capital Firms?

- 2. How Does Customizable Reporting Benefit Venture Capital Portfolio Management?

- 3. What Role Does Deal Flow Management Play in Venture Capital Software?

- 4. Why are Investor Communication Tools Important in Portfolio Management Software?

- 5. What Makes Scalability a Key Factor in Choosing Portfolio Management Software?

- What is the best software for portfolio management?

- What is VC portfolio management?

- How do VC companies monitor their investment?

- What is a good Moic for venture capital?

-

Frequently Asked Questions (FAQs)

- What features should I look for in the best portfolio management software for venture capital?

- Why is scalability important in venture capital portfolio management software?

- How does portfolio management software improve decision-making in venture capital?

- What are the security considerations when choosing portfolio management software for venture capital?

What is the Best Portfolio Management Software for Venture Capital and Why?

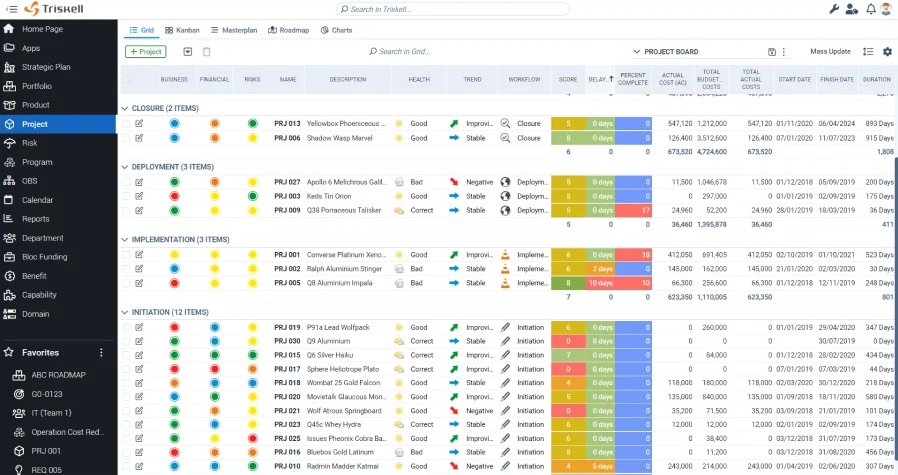

When it comes to managing venture capital portfolios, having the right software is crucial for efficiency, accuracy, and scalability. The best portfolio management software for venture capital should offer robust features such as real-time data tracking, customizable reporting, deal flow management, and investor communication tools. These features help venture capital firms streamline their operations, make informed decisions, and maintain strong relationships with their investors. Below, we explore the key aspects that make certain software solutions stand out in this competitive space.

See Also What is the Best Software for Vc Fund Management?

What is the Best Software for Vc Fund Management?1. Why is Real-Time Data Tracking Essential for Venture Capital Firms?

Real-time data tracking is a critical feature for venture capital firms because it allows them to monitor their investments and portfolio performance continuously. This capability ensures that firms can react quickly to market changes, identify trends, and make data-driven decisions. Without real-time tracking, firms risk relying on outdated information, which can lead to missed opportunities or poor investment choices.

2. How Does Customizable Reporting Benefit Venture Capital Portfolio Management?

Customizable reporting enables venture capital firms to tailor their reports to meet specific needs, whether for internal analysis or investor updates. This flexibility ensures that stakeholders receive relevant and actionable insights. For example, firms can generate reports on portfolio performance, cash flow, or individual investment metrics, all of which are essential for strategic planning and maintaining investor confidence.

See Also I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make Sense

I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make Sense3. What Role Does Deal Flow Management Play in Venture Capital Software?

Deal flow management is a core functionality of venture capital software, as it helps firms organize, track, and evaluate potential investment opportunities. A robust deal flow management system allows firms to prioritize deals, collaborate with team members, and maintain a pipeline of opportunities. This ensures that no potential investment slips through the cracks and that the firm can act swiftly when a promising opportunity arises.

4. Why are Investor Communication Tools Important in Portfolio Management Software?

Investor communication tools are vital for maintaining transparency and trust with stakeholders. These tools enable venture capital firms to share updates, reports, and performance metrics with investors in a timely and professional manner. Effective communication fosters stronger relationships and ensures that investors remain informed and engaged with the firm's activities.

See Also How Will Venture Capital Change in the Next Decade?

How Will Venture Capital Change in the Next Decade?5. What Makes Scalability a Key Factor in Choosing Portfolio Management Software?

Scalability is essential for venture capital firms, especially those looking to grow their portfolios or expand their operations. The best portfolio management software should be able to handle an increasing number of investments, users, and data without compromising performance. Scalable software ensures that firms can adapt to growth and continue to operate efficiently as their needs evolve.

| Feature | Importance |

|---|---|

| Real-Time Data Tracking | Enables quick decision-making and trend identification. |

| Customizable Reporting | Provides tailored insights for stakeholders. |

| Deal Flow Management | Organizes and prioritizes investment opportunities. |

| Investor Communication Tools | Maintains transparency and trust with investors. |

| Scalability | Supports growth and operational efficiency. |

What is the best software for portfolio management?

What is the Difference Between Fundraising Venture Capital and Private Investments

What is the Difference Between Fundraising Venture Capital and Private InvestmentsWhat is Portfolio Management Software?

Portfolio management software is a tool designed to help individuals and organizations manage their investments, assets, and financial portfolios efficiently. It provides features such as performance tracking, risk analysis, and asset allocation to ensure optimal decision-making. These tools are essential for investors looking to streamline their financial strategies and achieve long-term goals.

- Performance Tracking: Monitors the performance of investments over time.

- Risk Analysis: Evaluates potential risks associated with investments.

- Asset Allocation: Helps in distributing investments across various asset classes.

Key Features to Look for in Portfolio Management Software

When selecting the best portfolio management software, it is crucial to consider specific features that align with your financial goals. Look for tools that offer real-time data updates, customizable dashboards, and integration with financial institutions. These features ensure that you have access to accurate information and can make informed decisions.

See Also What is the Typical Structure of a Vc Fund?

What is the Typical Structure of a Vc Fund?- Real-Time Data Updates: Provides up-to-date information on market trends and portfolio performance.

- Customizable Dashboards: Allows users to tailor the interface to their preferences.

- Integration with Financial Institutions: Enables seamless data import from banks and brokers.

Top Portfolio Management Software Options

Several portfolio management software options stand out due to their advanced features and user-friendly interfaces. Some of the top choices include Morningstar, Personal Capital, and eMoney. These platforms offer comprehensive tools for managing investments, analyzing risks, and planning for the future.

- Morningstar: Known for its robust research tools and investment analysis.

- Personal Capital: Offers a combination of financial planning and investment management.

- eMoney: Provides advanced financial planning features and client collaboration tools.

Benefits of Using Portfolio Management Software

Using portfolio management software offers numerous benefits, including improved decision-making, time savings, and better risk management. These tools help investors stay organized and focused on their financial objectives, reducing the likelihood of costly mistakes.

- Improved Decision-Making: Access to accurate data and analytics enhances investment choices.

- Time Savings: Automates routine tasks, freeing up time for strategic planning.

- Better Risk Management: Identifies and mitigates potential risks effectively.

How to Choose the Right Portfolio Management Software

Choosing the right portfolio management software depends on your specific needs and investment goals. Consider factors such as ease of use, cost, and customer support when making your decision. It is also important to test the software through free trials or demos to ensure it meets your expectations.

- Ease of Use: The software should have an intuitive interface and be easy to navigate.

- Cost: Evaluate the pricing structure to ensure it fits within your budget.

- Customer Support: Look for providers that offer reliable and responsive support services.

What is VC portfolio management?

What is VC Portfolio Management?

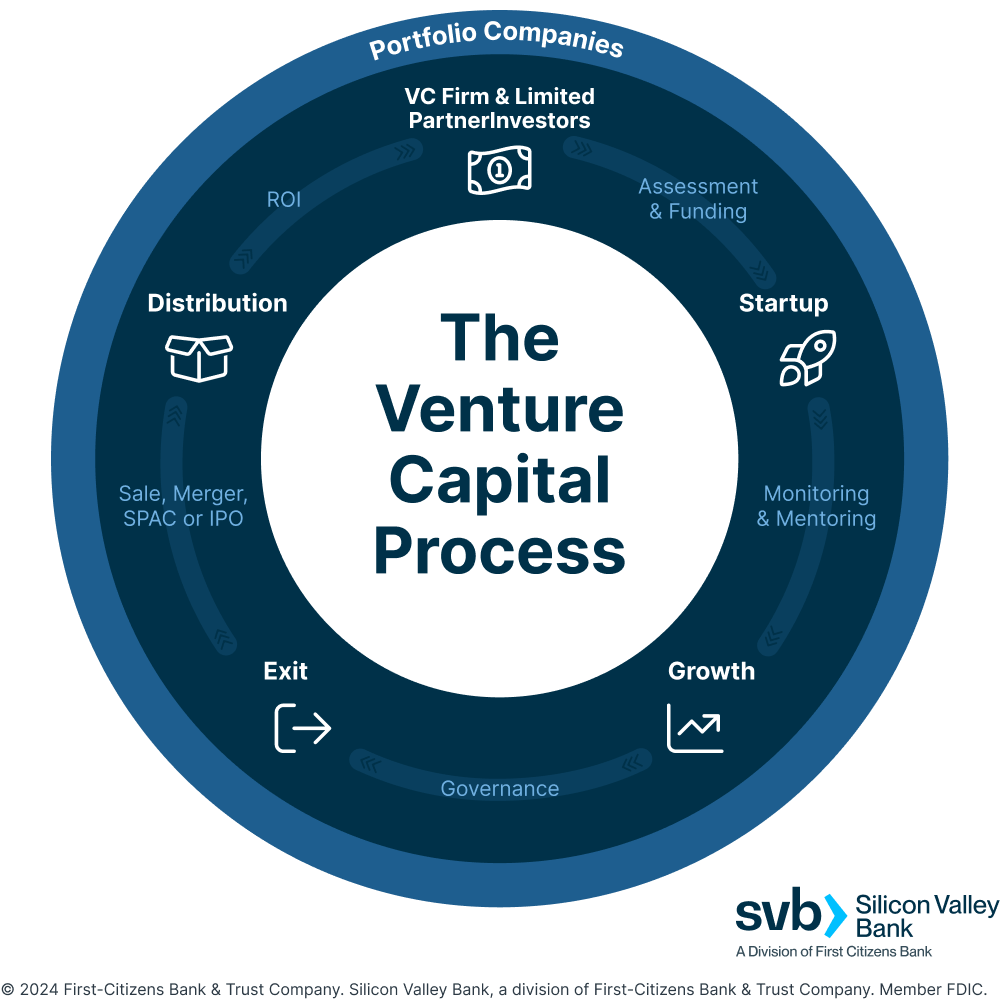

VC portfolio management refers to the strategic oversight and optimization of a venture capital firm's investments in startups and early-stage companies. It involves monitoring, supporting, and managing the performance of portfolio companies to maximize returns and mitigate risks. This process includes activities such as tracking financial performance, providing mentorship, facilitating connections, and making decisions about follow-on investments or exits.

Key Responsibilities in VC Portfolio Management

VC portfolio managers have several critical responsibilities to ensure the success of their investments. These include:

- Monitoring financial performance: Regularly reviewing financial metrics such as revenue growth, burn rate, and profitability to assess the health of portfolio companies.

- Providing strategic guidance: Offering mentorship and advice to founders on business strategy, scaling, and operational efficiency.

- Facilitating networking opportunities: Connecting portfolio companies with potential partners, customers, and investors to drive growth.

Importance of Diversification in VC Portfolios

Diversification is a cornerstone of effective VC portfolio management. By spreading investments across various industries, stages, and geographies, venture capitalists can reduce risk and increase the likelihood of high returns. Key aspects include:

- Sector diversification: Investing in multiple industries to avoid overexposure to a single market.

- Stage diversification: Balancing investments between early-stage startups and more mature companies to manage risk and reward.

- Geographic diversification: Expanding investments across different regions to tap into diverse markets and opportunities.

Tools and Metrics for VC Portfolio Management

Effective VC portfolio management relies on the use of specialized tools and metrics to track and analyze performance. These include:

- Key Performance Indicators (KPIs): Metrics such as customer acquisition cost (CAC), lifetime value (LTV), and monthly recurring revenue (MRR) to evaluate company performance.

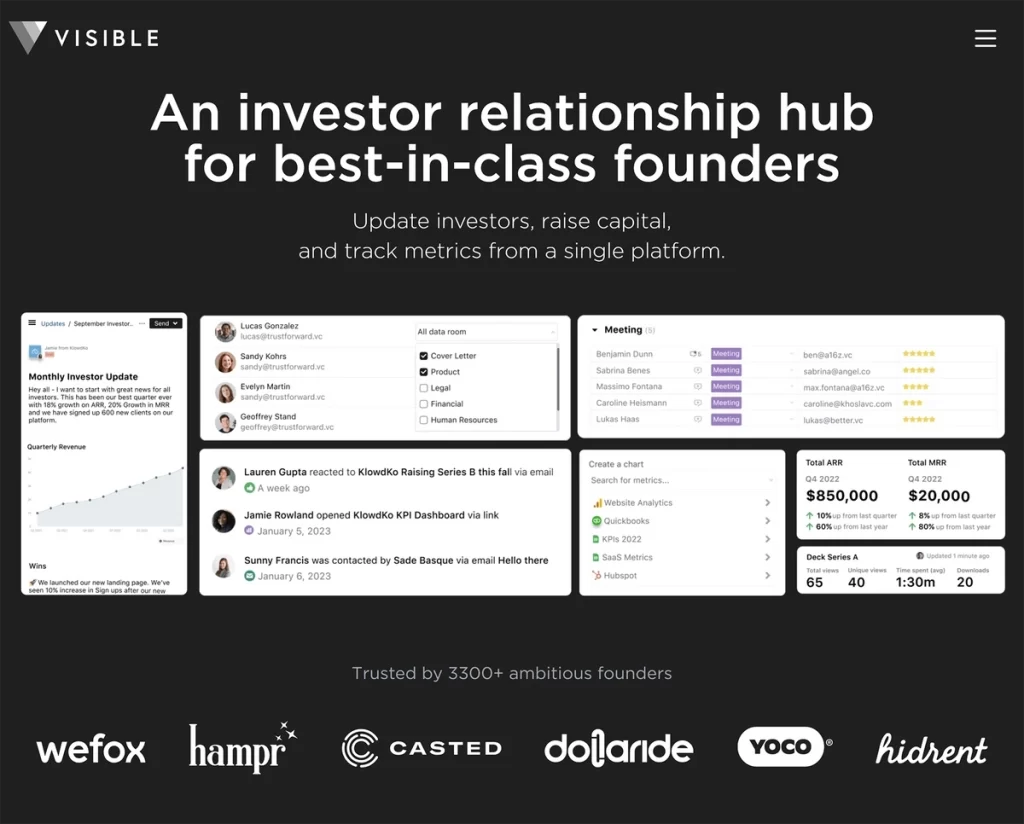

- Portfolio management software: Platforms like Carta or Visible.vc to track investments, valuations, and equity distributions.

- Data analytics: Leveraging data to identify trends, assess risks, and make informed investment decisions.

Challenges in VC Portfolio Management

Managing a venture capital portfolio comes with unique challenges that require careful navigation. Some of the most common challenges include:

- High failure rates: Startups often fail, requiring VCs to carefully select and support their investments.

- Illiquidity: Venture capital investments are typically long-term and illiquid, making it difficult to exit positions quickly.

- Market volatility: Economic downturns or shifts in industry trends can impact the performance of portfolio companies.

How do VC companies monitor their investment?

Regular Financial Reporting

Venture capital (VC) companies require regular financial reports from their portfolio companies to monitor performance. These reports typically include:

- Monthly or quarterly financial statements detailing revenue, expenses, and cash flow.

- Key performance indicators (KPIs) such as customer acquisition costs, lifetime value, and burn rate.

- Budget vs. actual comparisons to track deviations and ensure financial discipline.

Board Participation

VC firms often secure board seats in their portfolio companies to actively oversee operations. This involvement allows them to:

- Influence strategic decisions and provide guidance based on their expertise.

- Monitor compliance with agreed-upon milestones and business plans.

- Address risks and challenges proactively through direct communication with management.

Milestone Tracking

VC companies set specific milestones for their investments and track progress rigorously. This includes:

- Product development timelines to ensure timely launches.

- Revenue targets to measure growth and scalability.

- Market penetration goals to assess the company's competitive position.

Operational Audits

To ensure transparency and efficiency, VC firms may conduct operational audits of their portfolio companies. These audits focus on:

- Internal controls to prevent fraud and mismanagement.

- Operational processes to identify inefficiencies and areas for improvement.

- Compliance with legal and regulatory requirements to mitigate risks.

Regular Communication and Updates

VC companies maintain frequent communication with portfolio companies to stay informed. This involves:

- Scheduled meetings with founders and management teams to discuss progress and challenges.

- Ad-hoc updates on significant developments, such as new partnerships or funding rounds.

- Performance reviews to evaluate the company's trajectory and alignment with investment goals.

What is a good Moic for venture capital?

What is MOIC in Venture Capital?

MOIC (Multiple on Invested Capital) is a key performance metric used in venture capital to measure the return on investment relative to the initial amount invested. It is calculated by dividing the total value of the investment by the initial capital invested. A good MOIC indicates that the investment has generated significant returns, while a low MOIC suggests underperformance. For venture capital, a good MOIC typically ranges between 3x and 5x, depending on the stage of investment and the risk profile of the portfolio.

Why is MOIC Important in Venture Capital?

MOIC is crucial in venture capital because it provides a clear and straightforward measure of investment performance. Unlike other metrics, MOIC does not account for the time value of money, making it easier to compare returns across different investments. Here are three reasons why MOIC is important:

- Simplicity: It offers a quick snapshot of how much an investment has grown relative to the initial capital.

- Comparability: It allows investors to compare the performance of different investments within a portfolio or across funds.

- Decision-Making: It helps investors assess whether an investment aligns with their return expectations and risk tolerance.

What Factors Influence a Good MOIC?

Several factors can influence what constitutes a good MOIC in venture capital. These include the stage of investment, industry trends, and the overall market conditions. Below are three key factors:

- Investment Stage: Early-stage investments typically require a higher MOIC (e.g., 5x or more) to justify the higher risk, while later-stage investments may have lower MOIC expectations.

- Market Conditions: During bullish markets, higher MOICs are more achievable due to increased valuations and exits.

- Portfolio Diversification: A diversified portfolio can balance high and low MOIC investments, reducing overall risk.

How is MOIC Calculated?

Calculating MOIC is straightforward. The formula is:

MOIC = Total Value of Investment / Initial Capital Invested

For example, if an investor puts $1 million into a startup and later sells their stake for $4 million, the MOIC would be 4x. Here’s a breakdown of the calculation process:

- Determine Initial Investment: Identify the total amount of capital invested.

- Assess Exit Value: Calculate the total value returned from the investment, including proceeds from sales or IPOs.

- Divide: Divide the exit value by the initial investment to get the MOIC.

What Are the Limitations of MOIC?

While MOIC is a useful metric, it has limitations that investors should be aware of. These include:

- Ignores Time: MOIC does not account for the time it takes to achieve returns, which can be critical in venture capital.

- No Risk Adjustment: It does not factor in the risk associated with the investment, making it less useful for comparing high-risk and low-risk opportunities.

- Dependent on Exit Timing: MOIC can be skewed by the timing of exits, especially in volatile markets.

How Does MOIC Compare to Other Metrics?

MOIC is often compared to other performance metrics like IRR (Internal Rate of Return) and TVPI (Total Value to Paid-In Capital). Here’s how they differ:

- IRR: Measures the annualized return, accounting for the time value of money, whereas MOIC does not.

- TVPI: Combines MOIC with the distribution of returns, providing a more comprehensive view of performance.

- Use Case: MOIC is simpler and more intuitive, while IRR and TVPI offer deeper insights into the timing and distribution of returns.

Frequently Asked Questions (FAQs)

What features should I look for in the best portfolio management software for venture capital?

When selecting the best portfolio management software for venture capital, it's crucial to prioritize features that align with your firm's needs. Look for tools that offer comprehensive portfolio tracking, allowing you to monitor investments, valuations, and performance metrics in real-time. Additionally, deal flow management capabilities are essential for organizing and prioritizing potential investments. Advanced reporting and analytics features can help you make data-driven decisions, while integration with other tools (like CRMs or accounting software) ensures seamless workflows. Lastly, consider software with collaboration features to enhance communication among team members and stakeholders.

Why is scalability important in venture capital portfolio management software?

Scalability is a critical factor when choosing portfolio management software for venture capital. As your firm grows, the volume of data, number of investments, and complexity of operations will increase. A scalable solution ensures that the software can handle this growth without compromising performance. It should support multiple funds, diverse asset classes, and evolving regulatory requirements. Additionally, scalable software often provides customizable workflows and the ability to add new features or integrations as needed. This flexibility allows venture capital firms to adapt to changing market conditions and maintain efficiency over time.

How does portfolio management software improve decision-making in venture capital?

Portfolio management software enhances decision-making by providing real-time insights and data-driven analytics. It consolidates all relevant information, such as financial performance, market trends, and portfolio company updates, into a single platform. This enables venture capitalists to identify opportunities and mitigate risks more effectively. Advanced tools also offer predictive analytics, helping firms forecast outcomes and allocate resources strategically. By streamlining data collection and analysis, the software reduces manual effort and minimizes errors, allowing teams to focus on high-impact decisions that drive growth and returns.

What are the security considerations when choosing portfolio management software for venture capital?

Security is a top priority when selecting portfolio management software for venture capital, as these platforms handle sensitive financial and proprietary data. Ensure the software offers robust encryption for data storage and transmission, as well as multi-factor authentication to prevent unauthorized access. Look for solutions that comply with industry standards and regulations, such as GDPR or SOC 2. Additionally, consider software with role-based access controls to limit data exposure to only those who need it. Regular security audits and updates are also essential to protect against evolving cyber threats and ensure the integrity of your firm's data.

Leave a Reply

Our Recommended Articles