What's the Reputation of Dcm Venture Capital?

DCM Venture Capital has established itself as a prominent player in the global venture capital landscape, known for its strategic investments in high-growth technology companies. With a focus on early-stage and growth-stage startups, DCM has built a reputation for identifying innovative businesses with transformative potential. The firm’s portfolio spans diverse sectors, including enterprise software, fintech, and consumer technology, with notable successes in both the U.S. and Asian markets. DCM’s collaborative approach, deep industry expertise, and long-term vision have earned it respect among entrepreneurs and investors alike. This article explores DCM Venture Capital’s reputation, its investment philosophy, and its impact on the tech ecosystem.

What's the Reputation of DCM Venture Capital?

DCM Venture Capital, often referred to simply as DCM, is a prominent venture capital firm with a strong reputation in the tech investment space. Founded in 1996, DCM has established itself as a key player in early-stage and growth-stage investments, particularly in the United States, Japan, and China. The firm is known for its strategic approach to investing, focusing on sectors like consumer internet, enterprise software, fintech, and deep tech. DCM's reputation is built on its ability to identify and nurture high-potential startups, as well as its extensive network and expertise in cross-border investments.

See Also Who Are the Top Venture Capital Firms in the Biotech Industry?

Who Are the Top Venture Capital Firms in the Biotech Industry?1. DCM's Global Investment Strategy

DCM Venture Capital is renowned for its global investment strategy, which leverages its presence in major tech hubs like Silicon Valley, Tokyo, and Beijing. The firm has a unique ability to bridge markets, helping portfolio companies scale internationally. This approach has earned DCM a reputation as a cross-border investment leader, particularly in connecting U.S. startups with Asian markets and vice versa.

2. Track Record of Successful Exits

DCM has a strong track record of successful exits, including IPOs and acquisitions. Some notable exits include Fortinet, 58.com, and Bill.com. These successes highlight DCM's ability to identify and support companies with high growth potential, further solidifying its reputation as a top-tier venture capital firm.

See Also Which Vc Firms Are the Best to Work With?

Which Vc Firms Are the Best to Work With?3. Focus on Early-Stage Investments

DCM is particularly respected for its focus on early-stage investments. The firm often invests in startups during their seed or Series A rounds, providing not only capital but also strategic guidance. This early involvement has helped DCM build long-term relationships with founders and establish itself as a trusted partner in the startup ecosystem.

4. Commitment to Diversity and Inclusion

DCM has also gained recognition for its commitment to diversity and inclusion within its portfolio and team. The firm actively supports startups led by underrepresented founders and promotes a culture of inclusivity. This focus has enhanced DCM's reputation as a forward-thinking and socially responsible investor.

See Also Which Are the Tier 1 Vc Firms in the Us?

Which Are the Tier 1 Vc Firms in the Us?5. Strong Network and Mentorship

One of DCM's standout features is its strong network of industry experts and mentors. The firm provides portfolio companies with access to a vast network of advisors, executives, and entrepreneurs. This mentorship is a key factor in DCM's ability to help startups navigate challenges and achieve success, further boosting its reputation.

| Aspect | Details |

|---|---|

| Global Reach | Investments in U.S., Japan, and China |

| Key Sectors | Consumer internet, enterprise software, fintech, deep tech |

| Notable Exits | Fortinet, 58.com, Bill.com |

| Investment Stage | Early-stage (Seed, Series A) |

| Diversity Focus | Supports underrepresented founders |

How big is DCM Ventures Fund?

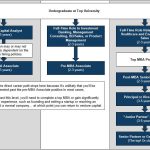

Which Venture Capitalist Firms Offer Analyst Internship Positions for Undergraduates

Which Venture Capitalist Firms Offer Analyst Internship Positions for UndergraduatesOverview of DCM Ventures Fund Size

DCM Ventures is a global venture capital firm with a significant presence in the United States, China, and Japan. The firm manages multiple funds, and its total assets under management (AUM) are estimated to be in the range of $4 billion to $5 billion. This includes investments across various stages, from early-stage startups to growth-stage companies.

- Total AUM: Approximately $4 billion to $5 billion.

- Geographic Focus: Investments span across the U.S., China, and Japan.

- Investment Stages: Early-stage to growth-stage companies.

DCM Ventures Fund Allocation

DCM Ventures allocates its funds across a diverse portfolio of companies, primarily focusing on technology-driven sectors. The firm has a strong emphasis on consumer internet, enterprise software, and fintech. The allocation strategy is designed to balance risk and reward, ensuring a diversified investment approach.

See AlsoHow Much Money Did Facebook Raise From Venture Capitalists- Primary Sectors: Consumer internet, enterprise software, and fintech.

- Diversification: Balanced portfolio to mitigate risks.

- Global Reach: Investments in multiple geographic regions.

DCM Ventures Fund Performance

The performance of DCM Ventures funds has been robust, with several high-profile exits and successful IPOs. The firm has a track record of identifying and nurturing high-growth companies, which has contributed to its strong performance metrics. Notable exits include companies like 58.com, KakaoTalk, and Bill.com.

- High-Profile Exits: 58.com, KakaoTalk, and Bill.com.

- Successful IPOs: Multiple portfolio companies have gone public.

- Track Record: Consistent identification of high-growth companies.

DCM Ventures Fund Investment Strategy

DCM Ventures employs a hands-on investment strategy, providing not only capital but also strategic guidance to its portfolio companies. The firm leverages its global network and industry expertise to help startups scale and succeed. This approach has been a key factor in the firm's ability to generate strong returns.

- Hands-On Approach: Strategic guidance alongside capital investment.

- Global Network: Extensive connections across the U.S., China, and Japan.

- Industry Expertise: Deep knowledge in technology-driven sectors.

DCM Ventures Fund Future Outlook

Looking ahead, DCM Ventures is poised to continue its strong performance by focusing on emerging technologies and markets. The firm is particularly interested in artificial intelligence, blockchain, and healthcare technology. With its established track record and strategic focus, DCM Ventures is well-positioned to capitalize on future opportunities.

- Emerging Technologies: AI, blockchain, and healthcare tech.

- Market Focus: Continued emphasis on high-growth sectors.

- Strategic Positioning: Ready to capitalize on future opportunities.

Who are tier 1 VCs?

What Defines Tier 1 Venture Capital Firms?

Tier 1 venture capital (VC) firms are the most prestigious and influential investors in the startup ecosystem. They are characterized by their ability to consistently identify and fund high-potential startups, often leading to significant returns. These firms typically have:

- Proven track records of successful investments in unicorn companies.

- Extensive networks of industry experts, mentors, and follow-on investors.

- Large fund sizes, often managing billions of dollars in assets.

Top Tier 1 Venture Capital Firms in the World

Some of the most renowned Tier 1 VCs globally include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): A leader in tech investments, including Facebook and Slack.

- Accel: Early backers of companies like Facebook, Dropbox, and Slack.

How Tier 1 VCs Differ from Other Venture Capital Firms

Tier 1 VCs stand out due to their:

- Access to top-tier deal flow, often getting first dibs on promising startups.

- Reputation and brand recognition, which attract the best entrepreneurs.

- Operational support, providing startups with strategic guidance and resources.

Why Startups Seek Funding from Tier 1 VCs

Startups aim to secure funding from Tier 1 VCs because:

- Validation: Association with a Tier 1 VC signals credibility to other investors.

- Network access: Startups gain entry into a vast ecosystem of industry leaders.

- Follow-on funding: Tier 1 VCs often lead subsequent funding rounds.

Challenges of Working with Tier 1 VCs

While Tier 1 VCs offer immense benefits, there are challenges, such as:

- High competition: Securing funding from these firms is extremely competitive.

- Stringent terms: They often demand significant equity and control.

- Pressure to perform: Startups face high expectations to deliver rapid growth.

What is the dark side of venture capital?

1. High Pressure and Burnout

Venture capital often comes with intense pressure to deliver rapid growth and high returns. This can lead to significant stress and burnout for founders and their teams. The constant need to meet milestones and justify valuations can create a toxic work environment.

- Long working hours are common as startups strive to meet investor expectations.

- Mental health issues can arise due to the relentless pressure and fear of failure.

- High turnover rates are often seen as employees struggle to cope with the demanding culture.

2. Loss of Control and Autonomy

Accepting venture capital often means giving up a significant portion of equity and control. Investors may push for changes in strategy, leadership, or even the company's vision, which can lead to conflicts and a loss of the founder's original mission.

- Board seats are typically given to investors, who then have a say in major decisions.

- Strategic pivots may be forced upon the company, sometimes against the founder's wishes.

- Equity dilution reduces the founder's stake and influence over the company's future.

3. Short-Term Focus Over Long-Term Vision

Venture capitalists are often focused on achieving a quick exit, such as an IPO or acquisition, to realize their returns. This short-term focus can undermine the long-term vision and sustainability of the company.

- Pressure to scale quickly can lead to unsustainable growth and operational challenges.

- Neglect of core values as the company prioritizes growth over its original mission.

- Risk of premature exit strategies that may not align with the founder's long-term goals.

4. Inequitable Distribution of Wealth

While venture capital can create significant wealth, it is often concentrated among a small group of investors and founders. Employees and early contributors may receive a disproportionately small share of the financial rewards.

- Equity distribution is often skewed in favor of investors and top executives.

- Limited financial upside for early employees who may have taken significant risks.

- Widening wealth gap within the company as only a few benefit from the success.

The pursuit of high returns can sometimes lead to ethical compromises and negative social impacts. Companies may prioritize profit over social responsibility, leading to practices that harm communities or the environment.

- Exploitative practices such as poor labor conditions or environmental degradation.

- Data privacy issues as companies may prioritize growth over user security.

- Negative societal impact from products or services that may not align with public good.

Who is the founder of DCM Ventures?

The founder of DCM Ventures is David Chao. He co-founded the venture capital firm in 1996, which has since become a prominent player in the technology investment space, particularly in the U.S. and Asia.

Who is David Chao?

David Chao is a co-founder and General Partner of DCM Ventures. He is a seasoned venture capitalist with a strong focus on early-stage technology investments. Chao has been instrumental in shaping DCM's investment strategy and has played a key role in the firm's success.

- He has over 25 years of experience in venture capital.

- Chao has been involved in funding successful startups like 58.com, Fortinet, and Bill.com.

- He is known for his expertise in cross-border investments between the U.S. and Asia.

What is DCM Ventures?

DCM Ventures is a global venture capital firm that invests in early-stage technology companies. The firm has a strong presence in both the U.S. and Asia, making it a unique player in the venture capital landscape.

- Founded in 1996, DCM has funded over 400 companies.

- The firm manages over $4 billion in assets.

- DCM focuses on sectors like artificial intelligence, fintech, and e-commerce.

What are David Chao's key contributions to DCM Ventures?

David Chao has been a driving force behind DCM Ventures' growth and success. His leadership and strategic vision have helped the firm achieve significant milestones.

- He has led investments in high-growth companies such as About.com and Clearwire.

- Chao has been a mentor to many entrepreneurs, helping them scale their businesses.

- He has been a key advocate for fostering innovation and collaboration between the U.S. and Asian markets.

What industries does DCM Ventures focus on?

DCM Ventures primarily invests in technology-driven industries, with a focus on emerging trends and disruptive innovations.

- The firm has a strong interest in software-as-a-service (SaaS) companies.

- It also invests in consumer internet and mobile technology startups.

- DCM is actively involved in healthtech and enterprise software sectors.

What is the global reach of DCM Ventures?

DCM Ventures has a global footprint, with offices in Silicon Valley, Beijing, and Tokyo. This allows the firm to leverage opportunities across different markets.

- The firm has a strong network in both the U.S. and Asia.

- DCM has funded companies in China, Japan, and Southeast Asia.

- Its cross-border approach has led to successful exits and high returns for investors.

Frequently Asked Questions (FAQs)

What is DCM Venture Capital known for in the investment industry?

DCM Venture Capital is widely recognized for its global investment strategy, particularly in early-stage and growth-stage technology companies. With a strong presence in both the United States and Asia, DCM has built a reputation for identifying and nurturing innovative startups in sectors like software, fintech, e-commerce, and artificial intelligence. The firm is also known for its hands-on approach, providing portfolio companies with strategic guidance, operational support, and access to a vast network of industry experts.

How does DCM Venture Capital support its portfolio companies?

DCM Venture Capital is highly regarded for its active involvement in the growth and success of its portfolio companies. Beyond providing capital, DCM offers mentorship, strategic advice, and operational expertise to help startups scale effectively. The firm leverages its global network to connect companies with potential partners, customers, and talent. Additionally, DCM’s team often assists with market entry strategies, particularly for companies looking to expand into Asian markets, where the firm has deep roots and extensive experience.

What industries does DCM Venture Capital focus on?

DCM Venture Capital primarily focuses on technology-driven industries, including software-as-a-service (SaaS), fintech, e-commerce, artificial intelligence, and consumer internet. The firm has a strong track record of investing in companies that leverage cutting-edge technologies to disrupt traditional markets. DCM’s portfolio includes a diverse range of startups, from enterprise software providers to consumer-facing platforms, reflecting its ability to identify high-growth opportunities across multiple sectors.

What is DCM Venture Capital’s track record of successful investments?

DCM Venture Capital has a proven track record of successful investments, with numerous portfolio companies achieving significant exits through IPOs or acquisitions. Some notable examples include Fortinet, a cybersecurity leader, and 58.com, a leading Chinese online marketplace. The firm’s ability to identify and support high-potential startups has earned it a strong reputation among entrepreneurs and investors alike. DCM’s success is attributed to its deep industry expertise, global perspective, and commitment to fostering long-term growth in its portfolio companies.

Leave a Reply

Our Recommended Articles