Where Can I Find a Pre Seed and Seed Venture Capital List in the United States

Finding the right pre-seed and seed venture capital funding is a critical step for startups aiming to turn innovative ideas into successful businesses. In the United States, numerous resources and platforms provide comprehensive lists of venture capital firms specializing in early-stage investments. These lists often include detailed information about investment criteria, focus industries, and contact details, helping entrepreneurs identify the best matches for their ventures. Whether through online databases, industry networks, or startup-focused organizations, accessing these resources can significantly streamline the fundraising process. This article explores where to find reliable pre-seed and seed venture capital lists to support your entrepreneurial journey.

- Where Can I Find a Pre Seed and Seed Venture Capital List in the United States

- How to find investors for pre-seed?

- How do I get pre-seed funding?

- Who are the Tier 1 VCs?

-

Frequently Asked Questions (FAQs)

- Where can I find a reliable pre-seed and seed venture capital list in the United States?

- Are there free resources to access pre-seed and seed venture capital lists?

- How can I verify the credibility of a pre-seed or seed venture capital firm?

- What criteria should I consider when selecting a pre-seed or seed venture capital firm?

Where Can I Find a Pre Seed and Seed Venture Capital List in the United States

Finding a reliable list of pre-seed and seed venture capital firms in the United States can be a game-changer for startups looking to secure early-stage funding. Below, we explore various resources and strategies to help you locate these lists and make informed decisions.

See Also How Do You Get in Touch With Venture Capitalists?

How Do You Get in Touch With Venture Capitalists?1. Online Venture Capital Databases

Online platforms like Crunchbase, AngelList, and PitchBook are excellent resources for finding pre-seed and seed venture capital lists. These platforms provide detailed information about investors, including their investment focus, portfolio companies, and contact details.

| Platform | Features |

|---|---|

| Crunchbase | Comprehensive database of investors, funding rounds, and company profiles. |

| AngelList | Focuses on startups and early-stage investors, with a strong emphasis on seed funding. |

| PitchBook | Offers in-depth analytics and data on venture capital firms and their investments. |

2. Networking Events and Startup Conferences

Attending networking events and startup conferences can provide direct access to venture capitalists who specialize in pre-seed and seed funding. Events like TechCrunch Disrupt, SXSW, and Startup Grind often feature panels and meetups with investors.

See AlsoWhat is Considered a Good Roi in Vc?| Event | Focus |

|---|---|

| TechCrunch Disrupt | Showcases startups and connects them with investors. |

| SXSW | Combines technology, film, and music, with a strong startup presence. |

| Startup Grind | Global community of startups and investors, with regular events and conferences. |

3. Accelerators and Incubators

Accelerators and incubators often have close ties with venture capital firms that focus on pre-seed and seed funding. Programs like Y Combinator, 500 Startups, and Techstars can provide not only funding but also valuable connections to investors.

| Program | Benefits |

|---|---|

| Y Combinator | Provides seed funding, mentorship, and access to a vast network of investors. |

| 500 Startups | Offers seed funding and a global network of mentors and investors. |

| Techstars | Connects startups with mentors and investors, with a focus on early-stage funding. |

4. Industry-Specific Publications and Blogs

Industry-specific publications and blogs often publish lists of venture capital firms that focus on pre-seed and seed funding. Websites like VentureBeat, TechCrunch, and The Information frequently feature articles and reports on early-stage investors.

See Also Is There a Broker for Venture Capitalist?

Is There a Broker for Venture Capitalist?| Publication | Focus |

|---|---|

| VentureBeat | Covers technology and startup news, including funding rounds and investor lists. |

| TechCrunch | Provides in-depth coverage of startups and venture capital trends. |

| The Information | Offers premium content on technology and business, including investor insights. |

Social media platforms like LinkedIn and Twitter, as well as online communities such as Reddit and Quora, can be valuable resources for finding pre-seed and seed venture capital lists. Many investors actively share their insights and investment criteria on these platforms.

| Platform | Benefits |

|---|---|

| Professional networking platform where investors and startups connect. | |

| Investors often share funding opportunities and industry insights. | |

| Communities like r/startups and r/venturecapital provide discussions and resources. | |

| Quora | Q&A platform where investors and entrepreneurs share knowledge and advice. |

How to find investors for pre-seed?

Is It Possible to Intern at a Venture Capital Firm?

Is It Possible to Intern at a Venture Capital Firm?1. Build a Strong Network

Finding investors for pre-seed funding often starts with building a strong network. Investors are more likely to trust founders who come recommended by someone they know. Here’s how to build your network effectively:

- Attend startup events, pitch competitions, and industry conferences to meet potential investors.

- Leverage LinkedIn to connect with angel investors, venture capitalists, and other founders.

- Join startup incubators or accelerators, as they often provide access to investor networks.

2. Create a Compelling Pitch Deck

A pitch deck is essential for attracting pre-seed investors. It should clearly communicate your vision, market opportunity, and team. Here’s what to include:

See Also What Are the Major Advantages of Being a Venture Capitalist?

What Are the Major Advantages of Being a Venture Capitalist?- Define the problem your startup solves and your unique solution.

- Highlight the market size and growth potential.

- Showcase your traction, even if it’s early-stage, such as prototypes or customer feedback.

3. Leverage Online Platforms

Online platforms can help you connect with pre-seed investors globally. Here are some effective platforms to consider:

- Use AngelList to create a profile and connect with angel investors.

- Explore Gust or SeedInvest to showcase your startup to a broader audience.

- Consider crowdfunding platforms like Kickstarter or Indiegogo for early validation and funding.

4. Approach Angel Investors

Angel investors are often the best fit for pre-seed funding. They typically invest smaller amounts and are more willing to take risks. Here’s how to approach them:

- Research angel investor groups in your industry or region.

- Prepare a concise elevator pitch to grab their attention quickly.

- Be transparent about your risks and challenges, as angels appreciate honesty.

5. Demonstrate Traction and Vision

Even at the pre-seed stage, showing traction and a clear vision can attract investors. Here’s how to demonstrate your potential:

- Present early prototypes or minimum viable products (MVPs) to show progress.

- Share customer testimonials or feedback to validate your idea.

- Outline your long-term vision and how you plan to scale the business.

How do I get pre-seed funding?

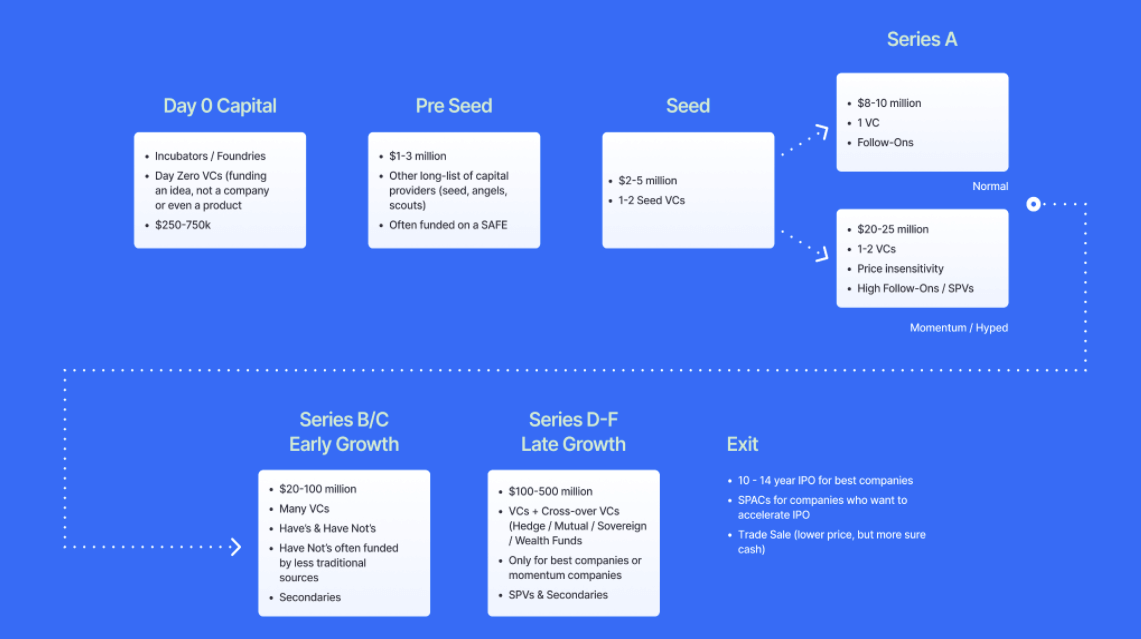

What is Pre-Seed Funding?

Pre-seed funding is the earliest stage of financing for startups, typically used to validate an idea, build a prototype, or conduct market research. It often comes from personal savings, friends, family, or angel investors. This stage is crucial for laying the foundation of your business before seeking larger investments.

- Validate your idea: Ensure there is a market need for your product or service.

- Build a prototype: Create a basic version of your product to demonstrate its potential.

- Conduct market research: Gather data to understand your target audience and competition.

How to Prepare for Pre-Seed Funding?

Preparation is key to securing pre-seed funding. Start by refining your business idea and creating a compelling pitch deck. Investors need to see a clear vision and potential for growth.

- Refine your business idea: Clearly define your value proposition and target market.

- Create a pitch deck: Include key elements like problem statement, solution, market size, and financial projections.

- Build a strong team: Assemble a team with complementary skills and a shared vision.

Where to Find Pre-Seed Investors?

Finding the right investors for pre-seed funding can be challenging. Look for angel investors, startup accelerators, and crowdfunding platforms that specialize in early-stage investments.

- Angel investors: Individuals who invest their own money in early-stage startups.

- Startup accelerators: Programs that provide funding, mentorship, and resources in exchange for equity.

- Crowdfunding platforms: Online platforms where you can raise small amounts of money from a large number of people.

What Do Investors Look for in Pre-Seed Startups?

Investors evaluate pre-seed startups based on several factors, including the strength of the team, market potential, and the uniqueness of the idea.

- Strong team: A dedicated and skilled team with a clear vision.

- Market potential: A large and growing market with a clear need for your product.

- Unique idea: A innovative solution that stands out from competitors.

How to Pitch for Pre-Seed Funding?

Pitching for pre-seed funding requires a clear and concise presentation of your business idea. Focus on the problem you're solving, your solution, and the potential for growth.

- Problem statement: Clearly define the problem your product or service solves.

- Solution: Explain how your product or service addresses the problem.

- Growth potential: Highlight the market size and scalability of your business.

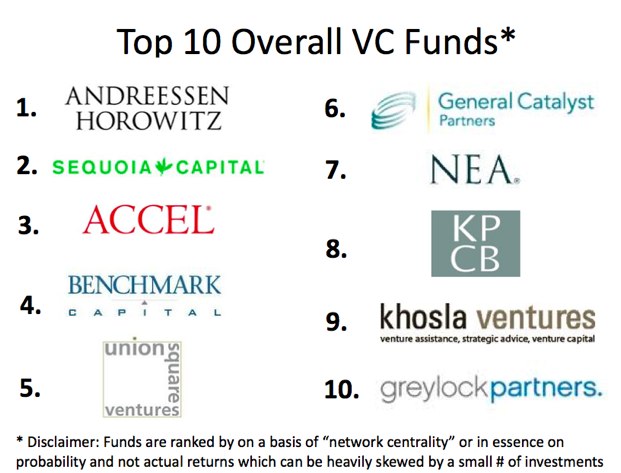

Who are the Tier 1 VCs?

What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are distinguished by their exceptional track record, significant influence in the startup ecosystem, and ability to consistently generate high returns for their investors. These firms typically have:

- Proven success in funding and scaling unicorn startups.

- Extensive networks of industry experts, entrepreneurs, and co-investors.

- Large fund sizes, often exceeding billions of dollars.

Top Tier 1 Venture Capital Firms in the World

Some of the most renowned Tier 1 VCs globally include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): A leader in tech investments, including Facebook and Slack.

- Accel: Famous for backing Facebook, Dropbox, and Slack.

Key Characteristics of Tier 1 VC Investments

Tier 1 VCs focus on specific traits when selecting startups to invest in:

- High-growth potential: Startups with scalable business models.

- Strong founding teams: Experienced and visionary entrepreneurs.

- Market leadership: Startups with a competitive edge in their industry.

How Tier 1 VCs Impact the Startup Ecosystem

Tier 1 venture capital firms play a pivotal role in shaping the startup landscape by:

- Providing mentorship and strategic guidance to founders.

- Facilitating partnerships with other investors and corporations.

- Driving innovation by funding cutting-edge technologies.

Challenges Faced by Tier 1 VCs

Despite their success, Tier 1 VCs encounter several challenges, such as:

- Intense competition for high-quality deals.

- Market volatility affecting investment returns.

- Regulatory hurdles in different regions.

Frequently Asked Questions (FAQs)

Where can I find a reliable pre-seed and seed venture capital list in the United States?

Finding a reliable pre-seed and seed venture capital list in the United States can be challenging, but there are several trusted resources available. Websites like Crunchbase, AngelList, and PitchBook offer comprehensive databases of venture capital firms and investors. These platforms allow you to filter by funding stage, location, and industry, making it easier to identify firms that specialize in pre-seed and seed funding. Additionally, industry-specific blogs and forums often share curated lists of active investors in the startup ecosystem.

Are there free resources to access pre-seed and seed venture capital lists?

Yes, there are free resources available to access pre-seed and seed venture capital lists. Platforms like Crunchbase and AngelList offer free tiers that provide access to basic information about venture capital firms and investors. Additionally, many startup accelerators and incubators publish lists of their partner investors, which often include those focused on early-stage funding. Blogs, newsletters, and LinkedIn groups dedicated to startups and venture capital are also valuable free sources for curated lists.

How can I verify the credibility of a pre-seed or seed venture capital firm?

To verify the credibility of a pre-seed or seed venture capital firm, start by researching their track record. Look for information about their past investments, successful exits, and portfolio companies on platforms like Crunchbase or PitchBook. Reading reviews or testimonials from founders who have worked with the firm can also provide insights into their reputation. Additionally, check if the firm is affiliated with reputable organizations or has been featured in trusted publications. Networking with other entrepreneurs and attending industry events can further help you gauge their credibility.

What criteria should I consider when selecting a pre-seed or seed venture capital firm?

When selecting a pre-seed or seed venture capital firm, consider factors such as their investment focus, industry expertise, and geographic location. Ensure the firm has experience in your sector and aligns with your startup's vision and goals. Evaluate their investment terms, including equity stakes and valuation expectations, to ensure they are fair and reasonable. Additionally, assess the firm's network and resources, as a strong support system can significantly benefit your startup's growth. Finally, consider the firm's reputation and the quality of their mentorship and guidance.

Leave a Reply

Our Recommended Articles