Who Are the Top Active Vcs in the Education Technology Space

The education technology (EdTech) sector has experienced exponential growth in recent years, driven by the increasing demand for innovative learning solutions and digital transformation in education. Behind this surge are visionary venture capitalists (VCs) who identify and support groundbreaking startups shaping the future of learning. These investors not only provide crucial funding but also offer strategic guidance, industry connections, and mentorship to help EdTech companies scale. In this article, we explore the top active VCs in the EdTech space, highlighting their investment philosophies, notable portfolio companies, and the impact they are making in revolutionizing education through technology.

Who Are the Top Active VCs in the Education Technology Space?

The education technology (EdTech) sector has seen significant growth in recent years, driven by the increasing demand for innovative learning solutions. Venture capitalists (VCs) have played a crucial role in fueling this growth by investing in promising startups. Below, we explore the top active VCs in the EdTech space, their investment strategies, and the impact they have had on the industry.

See Also Are There Any Venture Capital Funds in the Nutrition Natural Product and or Health Wellness Industry

Are There Any Venture Capital Funds in the Nutrition Natural Product and or Health Wellness Industry1. What Defines a Top VC in the EdTech Space?

A top VC in the EdTech space is characterized by their ability to identify and invest in startups that have the potential to revolutionize education. These VCs typically have a strong track record of successful investments, deep industry knowledge, and a network of experts who can provide valuable guidance to portfolio companies. They also tend to focus on startups that leverage cutting-edge technologies such as artificial intelligence, machine learning, and data analytics to enhance learning outcomes.

2. Which VCs Have Made the Most Impactful Investments in EdTech?

Several VCs have made significant contributions to the EdTech sector. Among them are Andreessen Horowitz, Sequoia Capital, and GSV Ventures. These firms have backed some of the most successful EdTech companies, including Coursera, Duolingo, and Udemy. Their investments have not only provided these companies with the capital needed to scale but also helped them navigate the complexities of the education market.

See Also Which Venture Capital Firms Invest in Online Marketplaces?

Which Venture Capital Firms Invest in Online Marketplaces?3. What Are the Key Investment Trends in EdTech?

The EdTech sector is evolving rapidly, and VCs are keen to capitalize on emerging trends. Some of the key investment trends include personalized learning, gamification, and remote learning solutions. VCs are also increasingly interested in startups that focus on lifelong learning and upskilling, as these areas are expected to grow in importance as the job market continues to change.

4. How Do VCs Evaluate EdTech Startups?

VCs use a variety of criteria to evaluate EdTech startups. These include the team's expertise, the scalability of the product, and the market potential. VCs also look for startups that have a clear value proposition and a sustainable business model. Additionally, they consider the regulatory environment and the competitive landscape when making investment decisions.

See Also What Are the Top Vc Firms in Israel?

What Are the Top Vc Firms in Israel?5. What Are the Challenges Faced by VCs in the EdTech Space?

Despite the opportunities, VCs face several challenges in the EdTech space. These include the long sales cycles typical in the education sector, the complexity of the market, and the need for continuous innovation. Additionally, VCs must navigate the regulatory hurdles that can impact the growth of EdTech companies. Despite these challenges, the potential for high returns continues to attract VCs to the sector.

| VC Firm | Notable Investments | Focus Areas |

|---|---|---|

| Andreessen Horowitz | Coursera, Duolingo | AI, Personalized Learning |

| Sequoia Capital | Udemy, Byju's | Scalability, Market Potential |

| GSV Ventures | ClassDojo, Coursera | Remote Learning, Lifelong Learning |

| Reach Capital | Outschool, Newsela | K-12 Education, Gamification |

| Owl Ventures | Dreambox, Quizlet | Data Analytics, Upskilling |

What is the largest EdTech venture capital company?

Which Venture Capital Firms Invest Heavily in Bio Med and Healthcare Companies

Which Venture Capital Firms Invest Heavily in Bio Med and Healthcare CompaniesThe largest EdTech venture capital company is GSV Ventures. GSV Ventures is a leading investment firm focused on the global education and workforce technology sector. It has a significant portfolio of innovative companies in the EdTech space, including Coursera, ClassDojo, and Degreed. The firm is known for its annual ASU+GSV Summit, which brings together leaders in education and technology to discuss the future of learning.

What makes GSV Ventures stand out in the EdTech sector?

GSV Ventures stands out in the EdTech sector due to its:

- Specialization: It focuses exclusively on education and workforce technology, allowing it to deeply understand and support its portfolio companies.

- Global reach: The firm invests in companies worldwide, fostering innovation across diverse educational systems.

- Industry influence: Through the ASU+GSV Summit, it has established itself as a thought leader in the EdTech space.

What are the key investments of GSV Ventures?

GSV Ventures has made several key investments in the EdTech sector, including:

- Coursera: A leading online learning platform offering courses from top universities.

- ClassDojo: A communication app connecting teachers, students, and parents.

- Degreed: A platform for upskilling and lifelong learning in the workforce.

How does GSV Ventures support its portfolio companies?

GSV Ventures supports its portfolio companies through:

- Strategic guidance: Providing expertise in scaling and navigating the EdTech market.

- Networking opportunities: Connecting companies with industry leaders and potential partners.

- Access to capital: Facilitating follow-on funding rounds to ensure growth and sustainability.

What is the ASU+GSV Summit, and why is it important?

The ASU+GSV Summit is an annual event co-hosted by GSV Ventures and Arizona State University. It is important because:

- Global platform: It brings together over 5,000 attendees, including investors, entrepreneurs, and educators.

- Innovation showcase: Highlights cutting-edge technologies and trends in education.

- Collaboration opportunities: Fosters partnerships that drive progress in the EdTech sector.

What is the future outlook for GSV Ventures in EdTech?

The future outlook for GSV Ventures in EdTech is promising due to:

- Growing demand: Increasing global demand for online and personalized learning solutions.

- Technological advancements: Continued innovation in AI, VR, and other technologies enhancing education.

- Expansion opportunities: Potential to invest in emerging markets and underserved communities.

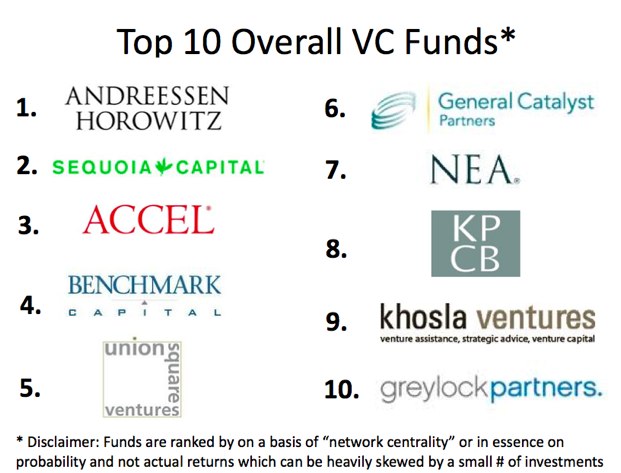

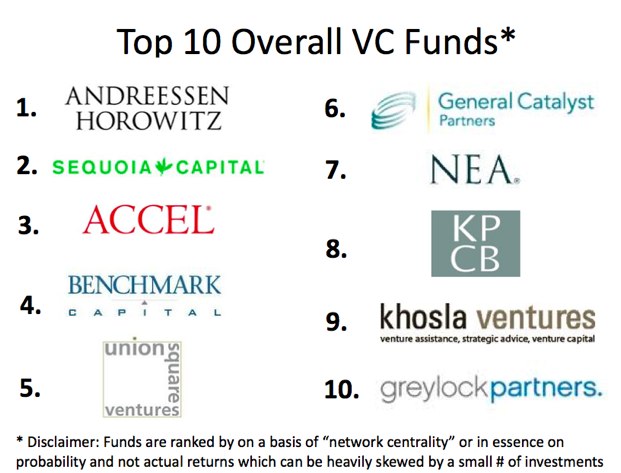

Who are the Tier 1 VCs?

What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are the most prestigious and influential players in the venture capital ecosystem. They are characterized by their ability to consistently identify and invest in high-growth startups, often leading funding rounds and providing significant value beyond capital. These firms typically have:

- Proven track records of successful exits, including IPOs and acquisitions.

- Access to top-tier deal flow, allowing them to invest in the most promising startups early.

- Strong networks of industry experts, mentors, and advisors to support portfolio companies.

Top Tier 1 Venture Capital Firms in the Industry

Some of the most renowned Tier 1 VCs include firms like Sequoia Capital, Andreessen Horowitz, and Accel. These firms are known for:

- Investing in unicorn companies such as Airbnb, Facebook, and Google.

- Having a global presence with offices in key tech hubs like Silicon Valley, New York, and London.

- Providing strategic guidance and operational support to their portfolio companies.

How Tier 1 VCs Differ from Other Venture Capital Firms

Tier 1 VCs stand out due to their ability to secure exclusive deals and their reputation for delivering exceptional returns. Key differences include:

- Access to larger funds, enabling them to write bigger checks and lead rounds.

- A focus on early-stage investments in high-potential startups.

- Strong brand recognition that attracts top-tier entrepreneurs seeking funding.

The Role of Tier 1 VCs in Startup Ecosystems

Tier 1 venture capital firms play a critical role in shaping the startup landscape by:

- Providing capital and resources to fuel innovation and growth.

- Acting as gatekeepers for follow-on funding from other investors.

- Building ecosystems that support entrepreneurship and technological advancement.

Why Startups Seek Funding from Tier 1 VCs

Startups often prioritize securing investments from Tier 1 VCs because:

- They offer validation and credibility, which can attract other investors and customers.

- Their extensive networks provide access to talent, partnerships, and markets.

- They bring strategic expertise to help startups scale and succeed.

Which EdTech company is best?

What Defines the Best EdTech Company?

Determining the best EdTech company depends on several factors, including the quality of their offerings, user experience, and adaptability to modern educational needs. Here are some key aspects to consider:

- Innovative Solutions: Companies that provide cutting-edge tools and technologies to enhance learning.

- User-Friendly Platforms: Platforms that are easy to navigate and accessible to users of all ages.

- Comprehensive Content: A wide range of subjects and courses that cater to diverse learning needs.

Top EdTech Companies in the Market

Several EdTech companies stand out due to their exceptional services and impact on education. Here are some of the leading names:

- Coursera: Offers a vast array of courses from top universities and institutions.

- Khan Academy: Provides free, high-quality educational resources for students worldwide.

- Duolingo: Specializes in language learning with a gamified approach.

Key Features of Leading EdTech Companies

The best EdTech companies share common features that set them apart from the competition. These include:

- Personalized Learning: Tailored educational experiences to meet individual student needs.

- Interactive Content: Engaging materials that make learning more enjoyable and effective.

- Scalability: Ability to serve a large number of users without compromising quality.

How to Choose the Right EdTech Company for You

Selecting the right EdTech company involves evaluating your specific needs and preferences. Consider the following steps:

- Identify Your Goals: Determine what you aim to achieve through the platform.

- Research Options: Look into various companies and compare their offerings.

- Read Reviews: Check user feedback to gauge the effectiveness and reliability of the platform.

Future Trends in EdTech

The EdTech industry is continuously evolving, with new trends shaping the future of education. Key trends to watch include:

- Artificial Intelligence: AI-driven tools for personalized learning and assessment.

- Virtual Reality: Immersive learning experiences through VR technology.

- Blockchain: Secure and transparent credentialing systems for online education.

What is the most prestigious VC firm?

What Defines a Prestigious VC Firm?

A prestigious venture capital (VC) firm is typically characterized by its track record of successful investments, influential portfolio companies, and a strong reputation within the industry. Key factors include:

- High-profile exits: Firms with multiple IPOs or acquisitions in their portfolio.

- Industry influence: Recognized for shaping trends and supporting groundbreaking startups.

- Network and resources: Access to top-tier entrepreneurs, advisors, and follow-on funding.

Top Contenders for the Most Prestigious VC Firm

Several VC firms are often cited as the most prestigious due to their history and impact. These include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): A leader in tech investments, including Facebook and Slack.

- Accel: Early backer of Facebook, Dropbox, and Slack.

- Kleiner Perkins: Pioneered investments in Amazon and Google.

- Benchmark: Notable for its early stake in Uber and Twitter.

Why Sequoia Capital Stands Out

Sequoia Capital is often regarded as the most prestigious VC firm due to its unparalleled track record. Key reasons include:

- Global presence: Operates in the U.S., China, India, and Southeast Asia.

- Iconic investments: Backed companies like Apple, Google, and WhatsApp.

- Longevity and consistency: Over 50 years of successful venture investing.

The Role of Andreessen Horowitz in Shaping Tech

Andreessen Horowitz has redefined venture capital with its focus on technology and innovation. Highlights include:

- Early-stage focus: Invests in startups like Coinbase and GitHub.

- Operational support: Provides extensive resources to portfolio companies.

- Thought leadership: Publishes influential content on tech trends.

How Accel Built Its Reputation

Accel has earned its prestige through strategic investments and global reach. Key achievements include:

- Early bets on unicorns: Backed Facebook, Slack, and Spotify.

- Global expansion: Strong presence in Europe and Asia.

- Focus on growth-stage companies: Helps startups scale effectively.

Frequently Asked Questions (FAQs)

Who are the most active venture capitalists in the education technology sector?

Venture capitalists play a crucial role in the growth of the education technology (EdTech) sector. Some of the most active VCs in this space include Reach Capital, GSV Ventures, Owl Ventures, and Learn Capital. These firms have consistently invested in innovative EdTech startups, focusing on areas such as online learning platforms, adaptive learning technologies, and workforce upskilling solutions. Their portfolios often include companies that are transforming how education is delivered and accessed globally.

What criteria do top VCs use to invest in EdTech startups?

Top venture capitalists in the EdTech space typically evaluate startups based on several key criteria. These include the scalability of the solution, the strength of the founding team, the size of the addressable market, and the potential for impact on education outcomes. Additionally, VCs look for startups with a clear revenue model, a strong product-market fit, and evidence of user engagement. Companies that demonstrate innovation in addressing pressing educational challenges, such as accessibility or personalized learning, are often prioritized.

How do top EdTech VCs support their portfolio companies beyond funding?

Beyond providing capital, leading EdTech VCs offer extensive support to their portfolio companies. This includes mentorship from experienced investors and industry experts, access to a network of partners and potential customers, and guidance on scaling operations and entering new markets. Many VCs also assist with talent acquisition, helping startups attract top talent in areas like product development and marketing. Additionally, they often facilitate connections with other investors for follow-on funding rounds.

What trends are top VCs in EdTech currently focusing on?

Top venture capitalists in the EdTech space are currently focusing on several emerging trends. These include the rise of artificial intelligence (AI) in education, the growth of micro-credentialing and lifelong learning platforms, and the increasing demand for remote and hybrid learning solutions. VCs are also investing in startups that address equity and inclusion in education, as well as those leveraging gamification and immersive technologies like virtual reality (VR) to enhance learning experiences. These trends reflect the evolving needs of learners and educators in a rapidly changing world.

Leave a Reply

Our Recommended Articles