Which Venture Capital Firms Have Major Offices in Chicago?

Chicago, a bustling hub of innovation and entrepreneurship, has become a key player in the venture capital landscape. With its strategic location, diverse talent pool, and thriving startup ecosystem, the city attracts top-tier venture capital firms seeking to invest in groundbreaking ideas. This article explores the prominent venture capital firms with major offices in Chicago, highlighting their investment focus, notable portfolio companies, and contributions to the local tech and business communities. Whether you're an entrepreneur seeking funding or an investor looking to understand the city's VC scene, this guide provides valuable insights into the firms shaping Chicago's entrepreneurial future.

-

Which Venture Capital Firms Have Major Offices in Chicago?

- 1. Lightbank: A Pioneer in Chicago's Venture Capital Scene

- 2. Pritzker Group Venture Capital: Investing in High-Growth Companies

- 3. Chicago Ventures: Supporting Early-Stage Innovation

- 4. MATH Venture Partners: Focused on Scalable Businesses

- 5. Hyde Park Venture Partners: Bridging the Midwest and Beyond

- Who are tier 1 VCs?

- What is the most prestigious VC firm?

- What is the best city for venture capital?

- Is VC a high paying job?

- Frequently Asked Questions (FAQs)

Which Venture Capital Firms Have Major Offices in Chicago?

Chicago has emerged as a significant hub for venture capital activity in the Midwest, attracting a variety of firms that invest in startups and innovative businesses. Below, we explore some of the most prominent venture capital firms with major offices in Chicago, their investment focus, and their impact on the local ecosystem.

See AlsoWhat is the Best Vc Firm to Join as an Eir?1. Lightbank: A Pioneer in Chicago's Venture Capital Scene

Lightbank is one of the most well-known venture capital firms in Chicago, founded by Groupon co-founders Eric Lefkofsky and Brad Keywell. The firm primarily focuses on early-stage investments in technology-driven companies. Lightbank has played a pivotal role in nurturing Chicago's startup ecosystem by providing not only capital but also mentorship and strategic guidance to entrepreneurs.

| Firm Name | Focus Area | Notable Investments |

|---|---|---|

| Lightbank | Early-stage tech startups | Groupon, Sprout Social |

2. Pritzker Group Venture Capital: Investing in High-Growth Companies

Pritzker Group Venture Capital, part of the Pritzker family's investment portfolio, focuses on high-growth technology and services companies. With a strong presence in Chicago, the firm has been instrumental in supporting startups that aim to scale nationally and globally. Their investments often target sectors like SaaS, e-commerce, and digital health.

See Also What is the Difference Between an Angel Series a and B Round of Funding

What is the Difference Between an Angel Series a and B Round of Funding| Firm Name | Focus Area | Notable Investments |

|---|---|---|

| Pritzker Group Venture Capital | High-growth tech and services | Uptake, Tempus |

3. Chicago Ventures: Supporting Early-Stage Innovation

Chicago Ventures is a venture capital firm that specializes in early-stage investments, particularly in software and technology-enabled services. The firm is known for its hands-on approach, working closely with founders to help them navigate the challenges of building a successful business. Chicago Ventures has been a key player in fostering innovation within the city.

| Firm Name | Focus Area | Notable Investments |

|---|---|---|

| Chicago Ventures | Early-stage software and tech services | ShipBob, FourKites |

4. MATH Venture Partners: Focused on Scalable Businesses

MATH Venture Partners is another prominent venture capital firm in Chicago, with a focus on scalable businesses in the technology sector. The firm invests in companies that demonstrate strong growth potential and a clear path to profitability. MATH Venture Partners has a reputation for backing innovative startups that disrupt traditional industries.

See Also What is the Difference Between Angel Investors Venture Capitalists and Silent Partner Investors

What is the Difference Between Angel Investors Venture Capitalists and Silent Partner Investors| Firm Name | Focus Area | Notable Investments |

|---|---|---|

| MATH Venture Partners | Scalable tech businesses | SpotHero, Tock |

5. Hyde Park Venture Partners: Bridging the Midwest and Beyond

Hyde Park Venture Partners is a venture capital firm that invests in early-stage technology companies, with a particular emphasis on the Midwest. The firm has a strong presence in Chicago and actively seeks to bridge the gap between Midwest startups and larger markets. Hyde Park Venture Partners is known for its collaborative approach and deep industry expertise.

| Firm Name | Focus Area | Notable Investments |

|---|---|---|

| Hyde Park Venture Partners | Early-stage tech companies | G2 Crowd, FourKites |

Who are tier 1 VCs?

What is the Best Software for Vc Fund Management?

What is the Best Software for Vc Fund Management?What Defines Tier 1 Venture Capital Firms?

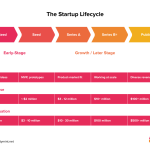

Tier 1 venture capital (VC) firms are the most prestigious and influential investors in the startup ecosystem. They are characterized by their ability to consistently identify and fund high-potential startups, often leading to significant returns. These firms typically have:

- Extensive track records of successful investments in unicorn companies.

- Large funds under management, often exceeding billions of dollars.

- Global reach, with investments spanning multiple continents and industries.

Top Tier 1 Venture Capital Firms in the World

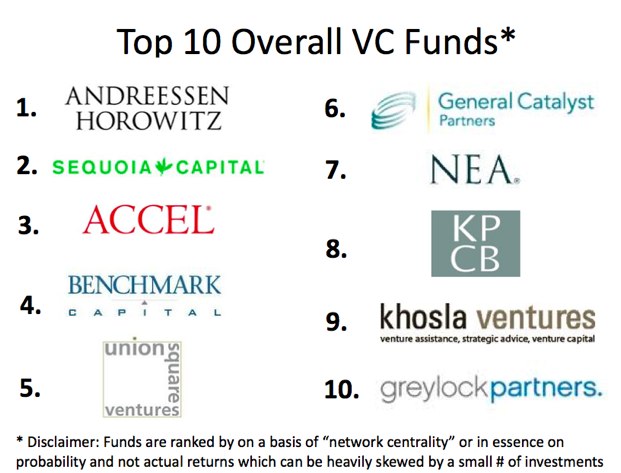

Some of the most renowned Tier 1 VC firms include:

See Also What's the Reputation of Dcm Venture Capital?

What's the Reputation of Dcm Venture Capital?- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz (a16z): A leader in tech investments, including Facebook and GitHub.

- Accel: Famous for backing companies like Slack and Dropbox.

How Tier 1 VCs Differ from Other Investors

Tier 1 VCs stand out due to their unique approach and resources. Key differences include:

- Access to top-tier networks, including founders, executives, and industry experts.

- Deep expertise in scaling startups from seed stage to IPO.

- Brand recognition, which helps portfolio companies attract talent and additional funding.

The Investment Strategy of Tier 1 VCs

Tier 1 VCs employ a highly selective and strategic investment process. Their approach involves:

- Focusing on disruptive technologies and innovative business models.

- Leading funding rounds to establish dominance in deals.

- Providing hands-on support to help startups scale rapidly.

Why Startups Seek Tier 1 VC Funding

Startups often prioritize Tier 1 VC funding due to the following advantages:

- Credibility and validation in the market.

- Access to mentorship from experienced investors.

- Increased chances of success through strategic guidance and resources.

What is the most prestigious VC firm?

What Defines a Prestigious VC Firm?

A prestigious VC firm is typically defined by its track record of successful investments, the caliber of its portfolio companies, and its influence in the startup ecosystem. These firms often have a history of backing high-profile startups that have gone on to become industry leaders. Key factors include:

- Reputation: Built over years of successful exits and high returns.

- Network: Access to top-tier entrepreneurs, investors, and industry experts.

- Capital: Ability to raise large funds and deploy them effectively.

Top Contenders for the Most Prestigious VC Firm

Several firms are often cited as the most prestigious in the venture capital world. These include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz: Renowned for its investments in Facebook, Twitter, and GitHub.

- Kleiner Perkins: Famous for backing Amazon, Google, and Genentech.

Sequoia Capital: A Case Study in Prestige

Sequoia Capital is often regarded as the most prestigious VC firm due to its unparalleled track record. Key highlights include:

- Global Presence: Offices in the U.S., China, India, and Israel.

- Diverse Portfolio: Investments in tech, healthcare, and consumer sectors.

- High-Profile Exits: Successful IPOs and acquisitions of portfolio companies.

Andreessen Horowitz: Innovation and Influence

Andreessen Horowitz has carved out a reputation for being at the forefront of innovation. Notable aspects include:

- Thought Leadership: Regular publications and insights on emerging technologies.

- Strategic Investments: Focus on disruptive technologies and platforms.

- Mentorship: Strong support system for portfolio companies.

Kleiner Perkins: A Legacy of Success

Kleiner Perkins has a long-standing legacy of success in the venture capital industry. Key points include:

- Early-Stage Focus: Specializes in seed and early-stage investments.

- Diverse Expertise: Investments across tech, life sciences, and green tech.

- Influential Partners: Includes prominent figures like John Doerr and Mary Meeker.

What is the best city for venture capital?

What Makes a City Ideal for Venture Capital?

An ideal city for venture capital typically has a strong ecosystem that supports startups and innovation. Key factors include:

- Access to Funding: A city with a high concentration of investors, angel networks, and venture capital firms.

- Talent Pool: Proximity to top universities and a skilled workforce to fuel innovation.

- Infrastructure: Robust tech hubs, co-working spaces, and accelerators to nurture startups.

- Regulatory Environment: Business-friendly policies and tax incentives for startups and investors.

- Networking Opportunities: A thriving community of entrepreneurs, mentors, and industry leaders.

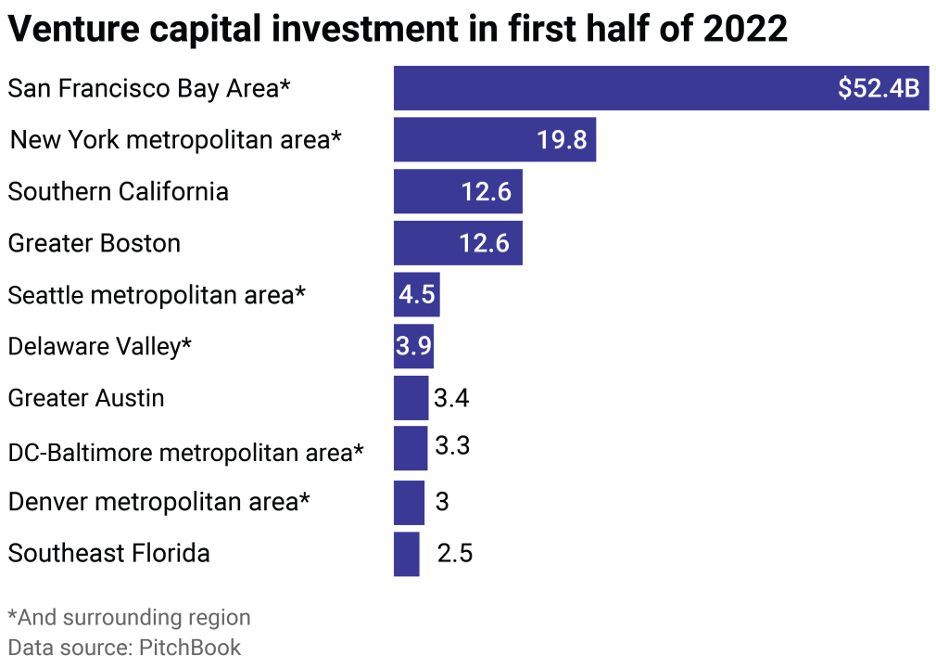

Why is Silicon Valley the Epicenter of Venture Capital?

Silicon Valley remains the global leader in venture capital due to its unparalleled ecosystem. Key reasons include:

- Historical Precedence: Home to tech giants like Apple, Google, and Facebook, creating a legacy of innovation.

- Investor Density: A high concentration of venture capital firms and angel investors.

- World-Class Talent: Proximity to Stanford University and UC Berkeley, attracting top-tier talent.

- Infrastructure: Advanced tech hubs, accelerators, and incubators.

- Cultural Mindset: A culture that embraces risk-taking and entrepreneurship.

How Does New York City Compete in Venture Capital?

New York City is a major contender in the venture capital landscape due to its diverse economy and resources. Key factors include:

- Financial Hub: Proximity to Wall Street and access to capital from global financial institutions.

- Industry Diversity: Strong presence in fintech, media, fashion, and healthcare startups.

- Talent Pool: Access to Ivy League universities like Columbia and NYU.

- Networking: A vibrant startup community with events like Techstars and WeWork Labs.

- Government Support: Initiatives like NYCEDC fostering innovation and entrepreneurship.

What Role Does Boston Play in Venture Capital?

Boston is a significant player in venture capital, particularly in biotech and education technology. Key reasons include:

- Academic Influence: Home to MIT and Harvard, driving cutting-edge research and innovation.

- Biotech Hub: A leading center for life sciences and healthcare startups.

- Investor Networks: Strong presence of venture capital firms like General Catalyst and Battery Ventures.

- Infrastructure: World-class research facilities and innovation labs.

- Collaborative Ecosystem: Partnerships between academia, industry, and government.

Why is London a Growing Hub for Venture Capital?

London has emerged as a leading venture capital hub in Europe due to its global connectivity and innovation. Key factors include:

- Global Financial Center: Access to international investors and financial markets.

- Tech Ecosystem: A thriving tech scene with startups in fintech, AI, and e-commerce.

- Talent Pool: Proximity to top universities like Imperial College London and UCL.

- Government Support: Initiatives like Tech Nation and favorable tax policies.

- Cultural Diversity: A multicultural environment fostering creativity and innovation.

Is VC a high paying job?

What is the Average Salary of a Venture Capitalist?

The average salary of a venture capitalist can vary significantly depending on factors such as experience, location, and the size of the firm. However, it is generally considered a high-paying job. Here are some key points:

- Entry-level positions in venture capital, such as analysts or associates, typically earn between $80,000 and $150,000 annually.

- Mid-level professionals, like principals or vice presidents, can earn between $150,000 and $300,000 per year.

- Senior-level venture capitalists, such as partners or managing directors, often earn $300,000 to $1,000,000 or more, including bonuses and carried interest.

How Does Compensation in Venture Capital Compare to Other Finance Jobs?

Venture capital compensation is often competitive with other high-paying roles in finance, such as investment banking or private equity. Here’s how it compares:

- Base salaries in venture capital are generally lower than in investment banking but are supplemented by bonuses and carried interest.

- Carried interest, a share of the profits from successful investments, can significantly boost earnings, especially for senior roles.

- Job stability in venture capital may be less predictable compared to traditional finance roles, but the potential for high rewards is substantial.

What Factors Influence a Venture Capitalist's Earnings?

Several factors can influence how much a venture capitalist earns. These include:

- Firm size and reputation: Larger, well-established firms tend to offer higher compensation packages.

- Geographic location: Venture capitalists in major financial hubs like Silicon Valley or New York often earn more due to higher living costs and greater deal flow.

- Performance and track record: Successful investments and a strong portfolio can lead to higher bonuses and carried interest.

What Are the Additional Benefits of Working in Venture Capital?

Beyond salary, venture capitalists often enjoy additional benefits that contribute to the overall appeal of the job. These include:

- Networking opportunities: Working closely with entrepreneurs, investors, and industry leaders can open doors to future opportunities.

- Equity stakes: Many venture capitalists receive equity in the startups they invest in, which can lead to significant financial gains if the company succeeds.

- Professional growth: The role offers exposure to cutting-edge technologies and innovative business models, enhancing career development.

Is Venture Capital a Lucrative Career in the Long Term?

Venture capital can be highly lucrative in the long term, especially for those who build a strong track record. Consider the following:

- Carried interest can result in substantial payouts over time, particularly if the firm’s investments perform well.

- Career progression to senior roles like partner or managing director can lead to exponential increases in earnings.

- Portfolio success: A single successful exit from an investment can generate significant returns, making the career financially rewarding.

Frequently Asked Questions (FAQs)

Which venture capital firms have major offices in Chicago?

Chicago is home to several prominent venture capital firms that play a significant role in the startup ecosystem. Some of the most notable firms include Lightbank, known for its early-stage investments in tech startups, and Hyde Park Venture Partners, which focuses on high-growth companies in the Midwest. Additionally, MATH Venture Partners and OCA Ventures are also headquartered in Chicago, offering funding and support to innovative businesses across various industries.

What industries do Chicago-based venture capital firms typically invest in?

Chicago-based venture capital firms are known for their diverse investment portfolios. Many firms, such as Lightbank and Hyde Park Venture Partners, focus on technology startups, including SaaS, e-commerce, and fintech. Others, like OCA Ventures, have a broader scope, investing in industries such as healthcare, manufacturing, and consumer products. This diversity reflects Chicago's robust and multifaceted economy.

How do Chicago venture capital firms support startups beyond funding?

Beyond providing financial support, Chicago-based venture capital firms offer a range of resources to help startups succeed. Firms like MATH Venture Partners and Hyde Park Venture Partners provide mentorship, strategic guidance, and access to extensive networks of industry experts. They often assist with business development, talent acquisition, and market expansion, ensuring that startups have the tools they need to grow and thrive in competitive markets.

Are there any notable success stories from Chicago venture capital firms?

Yes, Chicago's venture capital firms have been instrumental in the success of several high-profile companies. For example, Lightbank was an early investor in Groupon, which became one of the fastest-growing companies in history. Similarly, Hyde Park Venture Partners has backed successful startups like G2 Crowd, a leading software review platform. These success stories highlight the impact of Chicago's venture capital ecosystem on fostering innovation and entrepreneurship.

Leave a Reply

Our Recommended Articles