LLC Filing Fee: Massachusetts

When forming a limited liability company (LLC) in Massachusetts, understanding the associated filing fees is crucial for entrepreneurs and business owners. The state requires a one-time payment to officially register an LLC, which covers the cost of processing legal documents and establishing the business entity. As of the latest guidelines, the standard filing fee for Massachusetts LLCs is $500, submitted alongside the Certificate of Organization to the Secretary of the Commonwealth. Additional costs, such as expedited service fees or annual reporting obligations, may also apply. Properly budgeting for these expenses ensures compliance with state regulations and smooth entry into Massachusetts’ competitive business landscape.

Understanding LLC Filing Fees in Massachusetts

When forming an LLC in Massachusetts, understanding the associated filing fees is critical. The state requires specific payments to legally establish and maintain your business entity. These fees cover the Certificate of Organization, annual reports, and other administrative processes. Below, we break down key details about Massachusetts LLC filing fees, including costs for initial formation, amendments, and compliance.

See Also What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan

What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business PlanInitial LLC Formation Fee in Massachusetts

To form an LLC in Massachusetts, you must file a Certificate of Organization with the Secretary of the Commonwealth. The filing fee for this document is $500. This fee is non-refundable and must be submitted online or by mail. Below is a table summarizing the initial filing costs:

| Fee Type | Amount |

| Certificate of Organization Filing Fee | $500 |

| Online Processing Fee | +$20 (optional expedited service) |

Annual Report Fee for Massachusetts LLCs

Massachusetts requires LLCs to file an annual report to stay compliant. The fee for this report is $500, due by the anniversary date of your LLC’s formation. Failure to file on time may result in penalties.

See Also What is It Like to Be an Analyst at a Venture Capital Firm?

What is It Like to Be an Analyst at a Venture Capital Firm?| Requirement | Details |

| Annual Report Fee | $500 |

| Due Date | LLC Formation Anniversary Date |

| Late Penalty | $50 |

Expedited Processing Fee Options

Massachusetts offers expedited processing for LLC filings. For an additional $50, you can reduce the processing time to 24 hours. This service applies to the Certificate of Organization, amendments, and other documents.

| Service Type | Fee |

| 24-Hour Expedited Service | $50 |

| Standard Processing | 5-7 business days |

Amending an LLC Certificate: Costs

If you need to update your LLC’s information (e.g., business address or member changes), filing a Certificate of Amendment costs $100. Expedited processing is available for an extra fee.

See Also What is the Business Model of Venture Capital Firms?

What is the Business Model of Venture Capital Firms?| Document | Fee |

| Certificate of Amendment | $100 |

| Expedited Amendment Processing | $50 |

Reinstatement Fees for Dissolved LLCs

If your Massachusetts LLC is administratively dissolved, reinstatement requires paying $520. This includes the $500 annual report fee and a $20 penalty. Additional overdue fees may apply.

| Reinstatement Component | Cost |

| Annual Report Fee | $500 |

| Reinstatement Penalty | $20 |

How much does it cost to file an LLC in Massachusetts?

Massachusetts LLC Filing Fees: State Costs Breakdown

The cost to officially form an LLC in Massachusetts includes a state filing fee of $500 to submit the Certificate of Organization to the Secretary of the Commonwealth. Additional state-mandated costs may apply depending on your business needs.

- $500 filing fee for submitting the Certificate of Organization online or by mail.

- $20 fee for certified copies of formation documents (optional).

- $15 fee for expedited processing if filing by mail (optional).

Annual Report Fees for Massachusetts LLCs

Massachusetts requires LLCs to file an annual report to maintain good standing. Failure to file may result in penalties or dissolution.

See AlsoLLC Operating Agreement: Montana- $500 annual report fee due every year by the LLC’s formation anniversary date.

- Late filings incur a $50 penalty if submitted after the deadline.

- No fee reductions for early or partial-year filings.

Name Reservation Costs in Massachusetts

Reserving a business name before LLC formation ensures exclusivity for 60 days. This step is optional but recommended if you’re not ready to file immediately.

- $30 fee to reserve an LLC name with the Secretary of the Commonwealth.

- Name reservations can be renewed for another 60 days for an additional $30.

- Online reservations are processed faster than paper submissions.

Optional Costs for Forming an LLC in Massachusetts

Additional expenses may arise depending on your LLC’s operational needs. These are not state-mandated but often necessary for compliance and functionality.

- Registered agent fees: $100–$300 annually if outsourcing this service.

- Legal or professional services: $500–$2,000+ for attorney-assisted filings.

- Business license fees: Vary by industry and local jurisdiction.

Massachusetts Business Licenses and Permit Costs

Depending on your industry, additional licenses or permits may be required. These costs vary widely and are separate from LLC formation fees.

- Local permits: $50–$500+ for zoning, health, or signage permits.

- Professional licenses: Required for regulated industries (e.g., healthcare, construction).

- State-specific licenses: Check the Massachusetts Business License Directory for requirements.

Do you have to renew LLC every year in Massachusetts?

Annual Report Requirement for Massachusetts LLCs

In Massachusetts, LLCs are required to file an Annual Report with the Secretary of the Commonwealth each year. This is not a renewal in the traditional sense but a mandatory filing to keep the business compliant. Key details include:

- The Annual Report deadline is November 1st of every year.

- A $500 filing fee is required, regardless of the LLC’s income or activity level.

- Failure to file may result in penalties, fines, or administrative dissolution of the LLC.

How to File the Massachusetts LLC Annual Report

The process for submitting the Annual Report is straightforward but time-sensitive. Here’s what you need to know:

- File online through the Massachusetts Secretary of the Commonwealth’s Corporations Division portal.

- Ensure all business information (e.g., registered agent, address) is up to date before submitting.

- Keep a record of the payment confirmation for future reference.

Consequences of Missing the Annual Report Deadline

Failing to file the Annual Report on time can lead to severe repercussions:

- A $50 late fee is applied immediately after November 1st.

- Continued non-compliance may trigger tax liens or loss of good standing with the state.

- After one year of non-filing, the state may administratively dissolve the LLC.

Benefits of Timely Annual Report Compliance

Submitting the Annual Report punctually ensures your LLC maintains its legal protections and operational privileges:

- Preserves limited liability protection for members.

- Avoids disruptions to business licenses or contracts tied to good standing.

- Simplifies future filings, such as amendments or certificates of existence.

Differences Between Massachusetts and Other States

Massachusetts’ LLC Annual Report requirements differ significantly from other states:

- Higher fee: Massachusetts charges $500 annually, whereas states like Arizona charge $0.

- No biennial option: Unlike New York or California, Massachusetts mandates yearly filings.

- Strict deadlines: Late penalties apply immediately, unlike states with grace periods.

How much does an LLC usually cost?

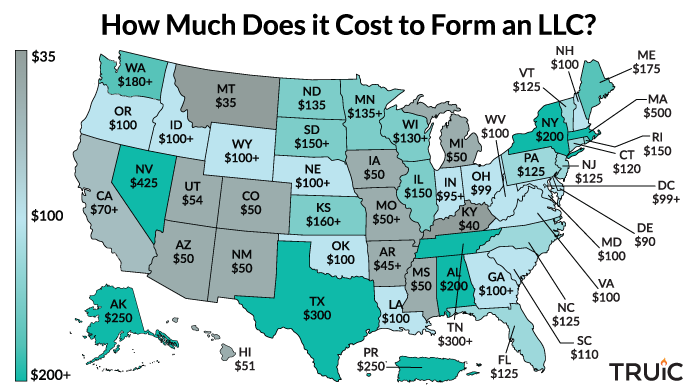

The cost to form an LLC varies by state and circumstances but typically ranges between $50 to $500 for state filing fees. Additional expenses, such as registered agent services, legal assistance, or annual reporting fees, can raise the total initial cost to $1,000 or more. Below is a detailed breakdown of common expenses.

State Filing Fees for Forming an LLC

Every state charges a filing fee to officially register an LLC. These fees vary widely:

- Low-cost states: Arizona ($50) and New Mexico ($50).

- Mid-range states: Texas ($300) and New York ($200).

- High-cost states: Massachusetts ($500) and Illinois ($500).

Registered Agent Service Costs

A registered agent is required in most states and typically costs $50 to $300 annually:

- Basic services: Around $50–$100/year for mail forwarding.

- Premium services: Up to $300/year for compliance alerts or document scanning.

- DIY option: Free if you act as your own agent, but requires a physical address in the state.

Annual Report and Maintenance Fees

Many states require annual reports or franchise taxes, adding ongoing costs:

- No annual fees: States like Arizona and New Mexico.

- Moderate fees: California ($20 annual tax) and Texas (no annual report but a franchise tax).

- High fees: Massachusetts ($500 annual report fee) and New York ($9 biennial fee).

Business License and Permit Costs

Depending on your industry and location, licenses and permits may apply:

- Local licenses: $50–$100 for general business permits.

- Industry-specific permits: Health department permits (up to $500) or construction licenses.

- State-level licenses: Required for professions like real estate or healthcare ($100–$300).

Legal and Professional Service Expenses

Optional but recommended services can increase upfront costs:

- LLC formation services: $0–$400 (e.g., LegalZoom or Northwest Registered Agent).

- Attorney fees: $500–$1,500 for customized operating agreements or compliance reviews.

- Tax consultation: $200–$500/hour for structuring your LLC’s tax elections.

What are the taxes for an LLC in Massachusetts?

Massachusetts LLC State Income Tax Requirements

In Massachusetts, an LLC is typically treated as a pass-through entity for tax purposes. This means the business itself does not pay state income taxes. Instead, profits and losses flow through to the owners’ personal tax returns. Key points include:

- Single-member LLCs are taxed as sole proprietorships, with income reported on Schedule C of the owner’s federal return (Form 1040).

- Multi-member LLCs file a federal partnership return (Form 1065) and issue Schedule K-1s to members, who then report income on their personal returns.

- Massachusetts requires LLCs to file Form 3 (individual tax return) or Form 1 (for non-residents) based on ownership structure.

Corporate Excise Tax for LLCs Electing Corporate Taxation

If an LLC elects to be taxed as a C corporation or S corporation, it becomes subject to Massachusetts’ corporate excise tax. Key details include:

- The tax consists of two parts: 8% of taxable income or a $456 minimum tax, whichever is higher.

- Corporations must file Form 355 annually, even if no tax is due.

- S corporations may qualify for a 3% excise tax rate on taxable income attributable to Massachusetts.

Sales and Use Tax Obligations for Massachusetts LLCs

LLCs engaged in retail sales or certain services must collect and remit sales tax to the state. Important considerations:

- The current Massachusetts sales tax rate is 6.25%.

- LLCs must register for a Sales Tax Permit with the Department of Revenue (Form TA-1).

- Use tax applies to items purchased tax-free out-of-state but used in Massachusetts.

Annual Reporting and Fees for LLCs in Massachusetts

Massachusetts LLCs must comply with annual filing requirements to maintain good standing:

- File an Annual Report with the Secretary of the Commonwealth, due by the anniversary date of formation.

- Pay a $500 annual fee for foreign LLCs (domestic LLCs pay no fee unless classified as a corporation).

- Failure to file may result in administrative dissolution or penalties.

Local Taxes and Additional Considerations

Depending on the LLC’s location and activities, additional local taxes may apply:

- Some cities impose local option taxes (e.g., meals or hotel taxes).

- LLCs owning property must pay local property taxes based on assessed value.

- Certain industries, like hospitality, may face specialized excise taxes.

Frequently Asked Questions About LLCs (FAQs)

What is the cost to file an LLC in Massachusetts?

The filing fee to form an LLC in Massachusetts is $500 when submitting the Certificate of Organization to the Secretary of the Commonwealth. This fee is mandatory and must be paid online via credit/debit card or by mail with a check or money order. Additional costs, such as expedited processing fees ($20–$50) or optional services like certified copies, may apply. Businesses operating in certain industries may also need separate licenses or permits, which incur extra charges.

Are there annual fees for maintaining an LLC in Massachusetts?

Yes, Massachusetts requires LLCs to file an Annual Report each year, which costs $500. This report is due by the anniversary date of the LLC’s formation and must be submitted online through the state’s corporate filing portal. Failure to file on time may result in penalties or administrative dissolution. No franchise tax applies to LLCs in Massachusetts, but other taxes, like sales or payroll taxes, may still be required.

Can I reduce the LLC filing fee in Massachusetts?

The $500 LLC formation fee is non-negotiable and standardized for all domestic LLCs in Massachusetts. However, you can avoid unnecessary costs by preparing documents accurately to prevent rejection or delays. Some online formation services offer bundled packages, but these do not reduce the state-mandated fee. Low-income entrepreneurs or nonprofits may explore grants or assistance programs, but these are not directly tied to LLC filing fees.

Is expedited processing available for LLC filings in Massachusetts?

Massachusetts offers 24-hour expedited processing for an additional fee of $20, which reduces the standard processing time (5–7 business days) significantly. For urgent requests, same-day service is available for $50, provided the submission meets specific deadlines. Expedited fees apply per document and must be requested during filing. Delays caused by errors or incomplete forms will void expedited timelines, so ensure all details are correct before submitting.

Leave a Reply

Our Recommended Articles