MA LLC Filing Fee

Forming a Limited Liability Company (LLC) in Massachusetts requires careful attention to legal and financial requirements, including the state-mandated filing fee. The MA LLC filing fee is a critical component of the formation process, ensuring compliance with state regulations and officially establishing the business entity. Currently set at $500, this fee accompanies the submission of the Articles of Organization to the Massachusetts Secretary of the Commonwealth. While the cost may vary depending on processing speed or additional services, understanding this expense is essential for entrepreneurs budgeting their startup costs. This article explores the details of the MA LLC filing fee, its purpose, and factors that could influence the total investment required to launch an LLC in the state.

Understanding the MA LLC Filing Fee: Costs and Requirements

What Is the MA LLC Filing Fee?

The MA LLC filing fee is the mandatory cost required by the state of Massachusetts to legally register a Limited Liability Company (LLC). As of 2023, the standard fee is $500, paid to the Massachusetts Secretary of the Commonwealth. This fee covers the processing of your Certificate of Organization, which formally establishes your LLC. Additional costs may apply for expedited processing or optional services like certified copies.

See Also What Do Vcs Look for in a Financial Model?

What Do Vcs Look for in a Financial Model?| Fee Component | Cost |

| Standard Filing Fee | $500 |

| Expedited Processing (24-hour) | $50 |

| Certified Copy of Certificate | $15 |

How Does the MA LLC Fee Compare to Other States?

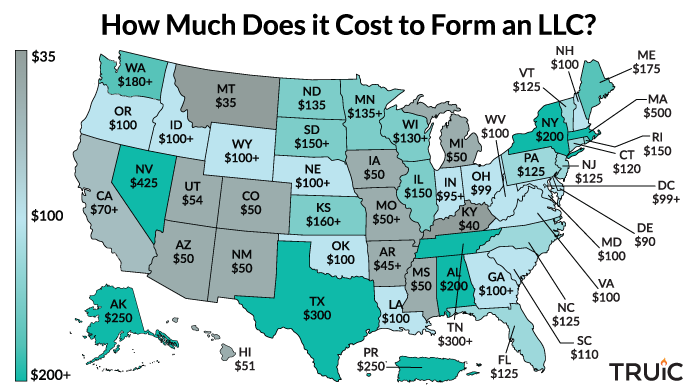

Massachusetts has a higher-than-average LLC filing fee compared to many states. For example, neighboring states like New Hampshire ($100) and Connecticut ($120) charge significantly less. However, states like California ($70 + annual franchise tax) and New York ($200) have varying fee structures. The $500 fee in Massachusetts reflects its streamlined processing and business-friendly legal framework.

| State | Filing Fee |

| Massachusetts | $500 |

| California | $70 + annual tax |

| New York | $200 |

| Texas | $300 |

Payment Methods for the MA LLC Filing Fee

The Massachusetts Secretary of the Commonwealth accepts online payments (credit/debit cards or ACH transfers) for LLC filings, which is the fastest method. Alternatively, you can pay by check or money order if filing by mail. In-person payments are also accepted at the Boston office. Note that expedited services require separate payment authorization.

See AlsoHow Do I Get Break Into Private Equity/ Venture Capital?| Payment Method | Processing Time |

| Online | 1-2 business days |

| 7-10 business days | |

| In-Person | Immediate (if expedited) |

What Happens If You Don’t Pay the MA LLC Filing Fee?

Failing to pay the required $500 fee will result in your LLC application being rejected by the state. Without payment, your business will not receive a Certificate of Organization, meaning it won’t be legally recognized. Late submissions or incomplete payments may also delay your launch date and incur additional costs for resubmission.

| Consequence | Resolution |

| Application rejection | Re-submit with full payment |

| Legal non-compliance | Delay business operations |

Are There Discounts or Exemptions for the MA LLC Fee?

Massachusetts does not offer discounts for LLC filing fees in most cases. However, certain non-profit organizations or entities formed for specific public purposes may qualify for exemptions. Veterans or low-income entrepreneurs should consult state resources for potential grants or fee assistance programs, though these are rare.

See Also What Are Vc Associate Interview Case Studies Like?

What Are Vc Associate Interview Case Studies Like?| Eligibility | Fee Adjustment |

| Non-profit LLCs | Possible exemption |

| Veteran-owned businesses | Case-by-case review |

How much does it cost to file an LLC in Massachusetts?

State Filing Fees for Forming an LLC in Massachusetts

The primary cost to officially form an LLC in Massachusetts is the state filing fee. To file the Certificate of Organization, the Massachusetts Secretary of the Commonwealth requires a fee of $500. This fee is mandatory and covers the basic processing of your LLC formation documents. Additional details include:

See Also What Are the Different Positions Available in a Venture Capital Firm

What Are the Different Positions Available in a Venture Capital Firm- $500 filing fee submitted online, by mail, or in person.

- Optional expedited processing for an extra cost (e.g., $20 for 24-hour service).

- Corrections or amendments to filed documents may incur additional fees.

Annual Report Costs for Massachusetts LLCs

Massachusetts LLCs must file an Annual Report each year, which comes with its own fee. The $500 annual report fee is due by the anniversary date of your LLC’s formation. Key points include:

- $500 fee submitted online through the state’s Corporations Division.

- Late filings incur a $50 penalty plus interest.

- Failure to file may result in administrative dissolution of the LLC.

Registered Agent Fees in Massachusetts

Massachusetts requires LLCs to designate a registered agent to receive legal documents. While you can act as your own agent, many businesses hire professional services. Costs vary based on the provider:

- $100–$300 annually for commercial registered agent services.

- Free if you or a member of the LLC serves as the agent.

- Additional fees may apply for compliance reminders or document scanning.

Expedited Processing and Additional Service Fees

If you need faster processing for your LLC formation, Massachusetts offers expedited services at an added cost. These options include:

- $20 for 24-hour processing (online filings only).

- $50 for same-day in-person submissions.

- $100 for immediate walk-in service (subject to availability).

Other Potential Costs for Massachusetts LLCs

Beyond state fees, forming an LLC in Massachusetts may involve additional expenses, such as:

- Legal or professional fees for drafting operating agreements ($200–$1,000+).

- Business licenses or permits, depending on your industry or location.

- Employer Identification Number (EIN) application (free via the IRS).

Certificate of Good Standing Fees

A Certificate of Good Standing verifies your LLC’s compliance with state requirements. In Massachusetts, obtaining this document costs:

- $10 for the standard certificate (issued in 7–10 business days).

- $35 for expedited processing (within 24 hours).

- Required for opening business bank accounts or securing loans.

How much does an LLC usually cost?

State Filing Fees for Forming an LLC

The cost to form an LLC varies by state, primarily due to differences in state filing fees. These fees cover the administrative process of registering your LLC with the state government. Below are key cost factors:

- Basic filing fees: Range from $40 (Kentucky) to $500 (Massachusetts), depending on the state.

- Expedited processing: Costs an additional $50–$300 for faster approval in states like California or New York.

- Name reservation fees: Optional fees ($10–$50) to secure your LLC name before filing.

Legal and Professional Service Costs

While you can file an LLC yourself, many opt for professional assistance to ensure compliance. Here’s a breakdown:

- DIY online services: Platforms like LegalZoom charge $0–$400 + state fees for basic formation packages.

- Attorney fees: Hiring a lawyer typically costs $500–$2,000 for full legal guidance and document preparation.

- Registered agent services: Third-party agents often charge $50–$300 annually to handle legal notices.

Ongoing Compliance and Maintenance Expenses

LLCs require ongoing costs to maintain good standing. Key recurring expenses include:

- Annual report fees: States like California levy an $800 annual franchise tax, while others charge $10–$500 yearly.

- Business licenses: Local permits or licenses may cost $50–$700 annually, depending on industry and location.

- Tax preparation fees: Accountants may charge $200–$1,500+ for annual LLC tax filings.

Unanticipated expenses can arise during or after LLC formation. Notable examples include:

- Publication requirements: States like New York mandate publishing formation notices in newspapers, costing $200–$2,000.

- Operating agreement drafting: Custom legal contracts may cost $100–$500 if not using free templates.

- Foreign qualification fees: Expanding to other states incurs $50–$500 per state in registration fees.

Cost-Saving Strategies for LLC Formation

Reducing LLC expenses is achievable with careful planning. Effective strategies include:

- Self-filing: Submitting documents directly to the state avoids third-party service fees.

- Bundled services: Some platforms offer discounts for combining registered agent services with formation packages.

- Tax deductions: Deduct formation and operational costs as business expenses during tax filings.

Do you have to renew LLC every year in Massachusetts?

Annual Report Requirement for Massachusetts LLCs

In Massachusetts, LLCs (Limited Liability Companies) are required to file an Annual Report with the Secretary of the Commonwealth each year. This is not a renewal but a mandatory filing to keep the business in good standing. Key details include:

- The report must be submitted online through the state’s Corporate Annual Report System.

- It updates the state on basic business details, such as registered agent information and principal office address.

- Failure to file may result in penalties or administrative dissolution.

Due Date and Penalties for Late Filing

The Annual Report must be filed by the anniversary date of the LLC’s formation each year. For example, if your LLC was formed on March 15, the report is due by March 15 of the following year. Important considerations:

- A $25 late fee applies if the report is filed after the deadline.

- Continued non-compliance for three consecutive years may lead to administrative dissolution of the LLC.

- Reinstatement after dissolution requires additional fees and paperwork.

Annual Fee for Massachusetts LLCs

Alongside the Annual Report, Massachusetts LLCs must pay an annual fee of $500 to the state. This fee is separate from the report filing and applies regardless of revenue or activity. Key points:

- The fee is due every year, even if the LLC is inactive.

- Payment is made through the same online system as the Annual Report.

- No proration is available for businesses formed mid-year.

Consequences of Not Renewing or Filing

Failing to file the Annual Report or pay the annual fee can have serious repercussions for an LLC’s legal status. These include:

- Loss of good standing with the state, affecting the ability to conduct business.

- Accumulation of late fees and interest on unpaid balances.

- Potential administrative dissolution, stripping the LLC of its legal protections.

Steps to File an Annual Report in Massachusetts

Filing the Annual Report involves a straightforward process through the state’s online portal. Here’s how to complete it:

- Visit the Massachusetts Secretary of the Commonwealth’s website.

- Log in to the Corporate Annual Report System using your LLC’s ID.

- Verify and update business information, then pay the $500 annual fee.

- Save the confirmation receipt for your records.

What are the taxes for an LLC in Massachusetts?

Massachusetts LLC State Income Taxes

In Massachusetts, an LLC is typically treated as a pass-through entity for tax purposes. This means the business itself does not pay state income taxes; instead, profits and losses flow through to members’ personal tax returns. Key points include:

- Individual Income Tax: Members pay Massachusetts’ flat 5% income tax rate on their share of LLC profits.

- Non-Resident Members: Non-resident members must file a Massachusetts non-resident tax return if they earn income from the state.

- Estimated Taxes: Members may need to make quarterly estimated tax payments to avoid penalties.

Annual Report and Filing Fees for Massachusetts LLCs

Massachusetts requires LLCs to file an annual report and pay associated fees. Important details include:

- Annual Report Fee: A $500 fee is due each year, regardless of revenue or business activity.

- Filing Deadline: The report must be filed by the anniversary date of the LLC’s formation.

- Late Penalties: Failure to file may result in administrative dissolution of the LLC.

Sales and Use Tax Obligations

If your Massachusetts LLC sells taxable goods or services, you must comply with sales tax regulations:

- Sales Tax Rate: The current statewide sales tax rate is 6.25%.

- Registration: Obtain a Sales Tax Permit from the Massachusetts Department of Revenue.

- Filing Frequency: Taxes are typically filed monthly or quarterly, depending on sales volume.

Corporate Excise Tax for LLCs Taxed as Corporations

LLCs electing to be taxed as C corporations or S corporations face additional obligations:

- Corporate Excise Tax: Comprises a $456 minimum tax plus 8% on taxable income exceeding $456.

- S Corporation Status: Federal S corporation elections require filing Form 355S with Massachusetts.

- Double Taxation: C corporations may face double taxation (state and federal).

Local Taxes and Additional Requirements

Depending on location, Massachusetts LLCs may owe local taxes or comply with municipal rules:

- Local Option Taxes: Some cities impose additional meals, lodging, or sales taxes.

- Personal Property Tax: LLCs owning business equipment may owe local personal property taxes.

- Licensing Fees: Certain industries require local permits or licenses with associated fees.

Frequently Asked Questions About LLCs (FAQs)

What is the filing fee for forming an LLC in Massachusetts?

The standard filing fee to form an LLC in Massachusetts is $500. This fee is paid to the Massachusetts Secretary of the Commonwealth when submitting the Certificate of Organization (Form LLC-1). Additional costs may apply for expedited processing, legal assistance, or optional services like name reservations. Ensure you review the latest fee structure on the state’s official website, as rates may change over time.

How can I pay the MA LLC filing fee?

The Massachusetts Secretary of the Commonwealth accepts online payments via credit/debit cards or electronic checks when filing through their online portal. For mail-in filings, you can pay with a check or money order made payable to the “Commonwealth of Massachusetts.” Note that cash payments are not accepted. Expedited processing fees, if applicable, must also be included in your total payment.

Is the Massachusetts LLC filing fee refundable?

No, the LLC filing fee is non-refundable, even if your application is rejected or withdrawn. The state retains the fee to cover administrative processing costs. To avoid delays or rejection, double-check your submission for accuracy, including business name availability and registered agent details. If corrections are needed, you may incur additional fees to refile your Certificate of Organization.

What happens if I don’t pay the full MA LLC filing fee?

If the filing fee is underpaid or omitted, your LLC formation documents will be rejected by the Secretary of the Commonwealth. This delays your business’s legal establishment until the correct fee is submitted. Repeated errors may result in prolonged processing times or require resubmission of paperwork. Always confirm the current fee amount and include exact payment to ensure smooth processing.

Leave a Reply

Our Recommended Articles