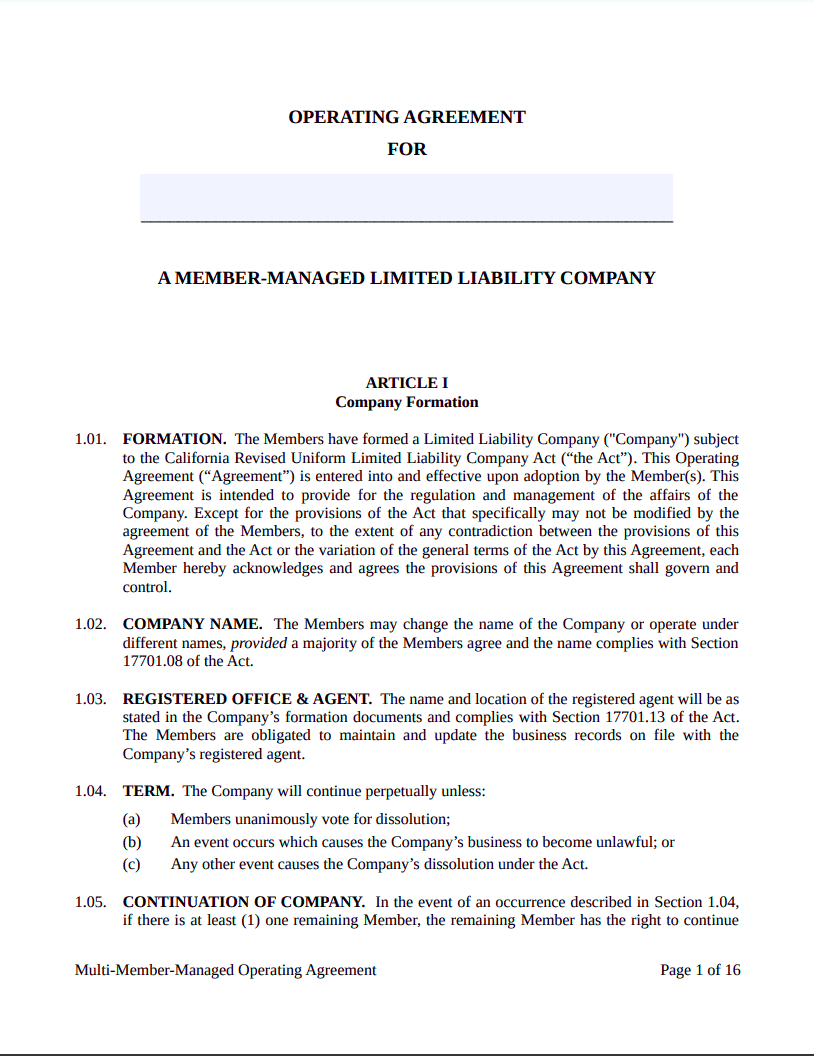

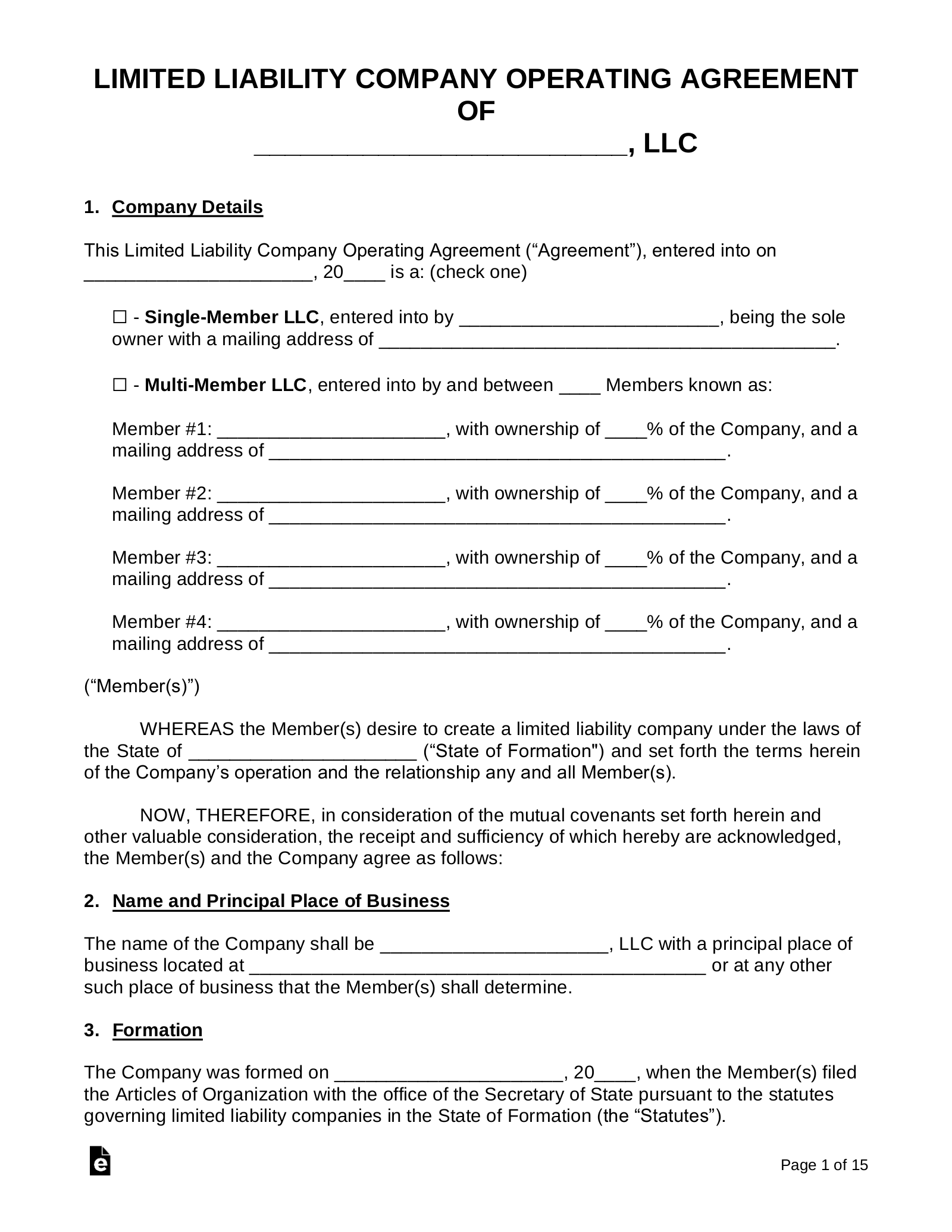

Sample California LLC Operating Agreement

A California LLC Operating Agreement serves as the foundational document outlining the ownership structure, management, and operational procedures of a limited liability company within the state. While California law does not legally require LLCs to adopt an operating agreement, drafting one is highly recommended to establish clear guidelines, protect members’ limited liability status, and prevent disputes. This customizable document details member roles, profit-sharing arrangements, voting rights, and procedures for adding or removing members. It also ensures compliance with state regulations while providing flexibility to tailor rules to the business’s unique needs. A well-crafted operating agreement is essential for safeguarding the LLC’s legal integrity and fostering transparent governance.

Understanding the Sample California LLC Operating Agreement

A Sample California LLC Operating Agreement is a foundational document outlining the rules, roles, and responsibilities governing a Limited Liability Company (LLC) in California. It establishes the framework for internal operations, including profit-sharing, management structure, voting rights, and procedures for resolving disputes or dissolving the business. While California law does not legally require LLCs to have an operating agreement, creating one ensures clarity, legal protection, and compliance with state-specific regulations. This document is customizable to meet the unique needs of the business, covering scenarios like member additions/withdrawals, capital contributions, and financial reporting.

See AlsoNew Jersey LLC Operating AgreementKey Provisions in a California LLC Operating Agreement

A well-drafted operating agreement includes critical provisions to prevent disputes and ensure smooth operations. These include:

- Management structure (member-managed vs. manager-managed).

- Voting rights and decision-making processes.

- Profit and loss allocation among members.

- Procedures for admitting new members or handling member exits.

- Dissolution terms and asset distribution.

| Provision | Purpose |

| Management Structure | Defines who controls daily operations |

| Capital Contributions | Outlines member investments |

| Voting Thresholds | Specifies requirements for major decisions |

| Dispute Resolution | Provides methods to resolve conflicts |

Member Roles and Responsibilities in a California LLC

Members of a California LLC must understand their rights and obligations under the operating agreement. Roles may vary based on whether the LLC is member-managed or manager-managed. Key responsibilities include:

- Financial contributions as outlined in the agreement.

- Participation in voting on major decisions (e.g., mergers, dissolution).

- Compliance with fiduciary duties (acting in the LLC’s best interest).

| Role | Responsibility |

| Member | Invest capital, vote on key issues |

| Manager | Oversee daily operations (if applicable) |

| Registered Agent | Receive legal documents on behalf of the LLC |

Profit and Loss Allocation in a California LLC

The operating agreement specifies how profits and losses are distributed among members. California defaults to equal distribution unless otherwise stated. Common allocation methods include:

- Percentage-based (aligned with ownership stakes).

- Special allocations (custom splits for tax or operational reasons).

| Method | Description |

| Pro Rata | Distributions match ownership percentages |

| Targeted Allocations | Adjustments for tax optimization |

| Priority Returns | Preferred payouts to specific members |

Amending the California LLC Operating Agreement

The process for amending the agreement should be clearly defined. Typically, amendments require:

- A majority or supermajority vote by members.

- Written consent documented in meeting minutes.

- Updated filings if changes affect public records (e.g., LLC name).

| Step | Requirement |

| Proposal | Submit amendment details in writing |

| Vote | Meet specified approval threshold |

| Documentation | Update agreement and retain records |

Dissolution Process for a California LLC

The operating agreement should outline steps for dissolving the LLC, including:

- Voting requirements to approve dissolution.

- Liquidation of assets and debt repayment.

- Final tax filings and termination paperwork.

| Step | Action |

| Member Approval | Vote to dissolve per agreement terms |

| Asset Distribution | Sell assets, pay creditors, distribute leftovers |

| Form LLC-3 | File dissolution documents with California SOS |

Does California require an operating agreement for LLC?

Legal Requirements for LLC Operating Agreements in California

California does not legally require an LLC to have an operating agreement. However, the state strongly recommends creating one under California Corporations Code §17701.02. While the document isn’t mandatory, it is critical for defining internal rules and avoiding state default regulations. Key considerations include:

- State statutes do not enforce penalties for lacking an operating agreement.

- Single-member LLCs and multi-member LLCs equally benefit from drafting one.

- Without an agreement, California’s default LLC rules govern the business.

Benefits of Creating an Operating Agreement in California

An operating agreement provides legal clarity and operational structure for an LLC. Advantages include:

- Protecting limited liability status by separating personal and business assets.

- Defining management roles (member-managed vs. manager-managed).

- Outlining procedures for dispute resolution, profit distribution, and member exits.

Key Components of a California LLC Operating Agreement

A well-drafted operating agreement should address essential elements to ensure compliance and functionality:

- Ownership percentages and capital contributions.

- Voting rights and decision-making processes.

- Procedures for admitting or removing members.

- Rules for dissolution or sale of the LLC.

Consequences of Not Having an Operating Agreement in California

Failing to create an operating agreement exposes the LLC to risks, such as:

- Defaulting to California’s generic LLC laws, which may not align with members’ intentions.

- Potential loss of liability protection in legal disputes.

- Increased likelihood of internal conflicts over profit splits or management authority.

How to Draft an Operating Agreement for a California LLC

Steps to create a compliant and effective operating agreement include:

- Using templates tailored to California law or hiring a business attorney.

- Specifying custom clauses for unique business needs (e.g., intellectual property rights).

- Ensuring all members review and sign the document, even if not legally required.

- Updating the agreement as the LLC evolves (e.g., adding members or changing goals).

Can I write my own operating agreement for my LLC?

Yes, you can write your own operating agreement for your LLC. While most states do not legally require an operating agreement, creating one is highly recommended to establish clear rules, ownership structures, and operational procedures. Drafting your own agreement allows customization to fit your business needs and avoids generic templates. However, ensure it complies with your state’s LLC laws and covers critical areas like profit distribution, management roles, and dispute resolution. Consulting a legal professional is advisable to avoid oversights, but many small business owners successfully create their own using reliable resources.

Is a DIY Operating Agreement Legally Valid?

A DIY operating agreement is legally valid if it meets your state’s requirements and is properly executed. While states rarely require filing this document, it becomes enforceable once signed by all members.

- State compliance: Ensure clauses align with your state’s LLC statutes.

- Signatures: All members must sign to validate the agreement.

- Clarity: Ambiguous terms may lead to disputes or unenforceability.

What Should Be Included in a Self-Drafted Operating Agreement?

A comprehensive operating agreement should outline ownership percentages, management structure, and decision-making processes. Key components ensure smooth operations and conflict resolution.

- Member roles: Define managerial duties and voting rights.

- Profit distribution: Specify how profits and losses are allocated.

- Dissolution terms: Outline procedures for closing the business.

What Are the Risks of Writing Your Own Operating Agreement?

The primary risks include omitting critical clauses or misinterpreting state laws, which could lead to disputes or legal vulnerabilities.

- Incomplete provisions: Missing buyout rules or dispute mechanisms.

- State law conflicts: Overlooking state-specific regulations.

- Ambiguity: Unclear language may invalidate terms.

How to Ensure Compliance When Drafting an Operating Agreement?

Research your state’s LLC laws and use state-specific templates or guides to align your agreement with legal standards.

- Review statutes: Check your state’s business code for requirements.

- Use verified resources: Leverage templates from reputable legal sites.

- Annual updates: Revise the agreement as laws or business needs change.

When Should You Consult a Lawyer for an Operating Agreement?

Seek legal advice if your LLC has complex ownership structures, multi-state operations, or potential liability risks.

- Multi-member disputes: Lawyers can mediate and draft neutral terms.

- Regulatory complexity: Compliance for regulated industries (e.g., healthcare).

- Tax implications: Ensure profit-sharing aligns with tax strategies.

Does an LLC operating agreement need to be notarized?

Does an LLC Operating Agreement Legally Require Notarization?

In most U.S. states, an LLC operating agreement does not need to be notarized to be legally valid. The primary requirement is that all members sign the document, making it a binding contract under state law. However, notarization can add an extra layer of authenticity, especially if disputes arise.

- State laws govern LLCs, and none universally mandate notarization for operating agreements.

- Some states, like Louisiana, may require notarization for certain LLC documents, but this is rare.

- Notarizing may help in scenarios involving international transactions or third-party validations.

Why Consider Notarizing an LLC Operating Agreement?

While not legally required, notarizing an LLC operating agreement can provide practical benefits. A notary public verifies the identity of signers, reducing the risk of fraud.

- Strengthens legal enforceability in court by confirming signatures are genuine.

- May satisfy banking or lender requirements when opening business accounts or securing loans.

- Helps prevent future member disputes over the validity of signatures.

State-Specific Rules for LLC Operating Agreements

State laws vary, so it’s critical to review local regulations. For example:

- Louisiana requires notarization for LLC documents under Civil Law.

- New York mandates publishing a formation notice but does not require notarizing operating agreements.

- Most states, like Delaware and California, focus on member consent rather than formal notarization.

How to Notarize an LLC Operating Agreement

If you choose to notarize, follow these steps:

- Ensure all members sign the agreement in the presence of a notary.

- Provide government-issued IDs to the notary for verification.

- The notary will attach a certificate or stamp confirming the signatures’ authenticity.

Alternatives to Notarizing an LLC Operating Agreement

If notarization isn’t feasible, consider these alternatives:

- Include witness signatures to validate member consent.

- File the agreement with the state (if required) to create a public record.

- Use digital signature platforms with audit trails for added security.

Frequently Asked Questions About LLCs (FAQs)

What is the purpose of a California LLC Operating Agreement?

A California LLC Operating Agreement serves as the foundational legal document that outlines the ownership structure, management roles, and operational procedures of a limited liability company (LLC) in California. While not legally required by the state, this agreement is critical for defining members' rights, profit-sharing arrangements, and decision-making processes. It also helps protect the LLC’s limited liability status by demonstrating a formal separation between the business and its owners. Without it, California’s default LLC rules under the Corporations Code would govern the company, which may not align with the members’ intentions.

Is an Operating Agreement legally required for a California LLC?

Although California law does not mandate an Operating Agreement for LLCs, creating one is strongly recommended. The absence of this document leaves the LLC vulnerable to disputes among members and potential legal ambiguities. For example, without a written agreement, decisions about profit distribution, management authority, or member exit strategies default to state statutes, which may not suit the LLC’s unique needs. Additionally, banks and external partners often require an Operating Agreement to verify the company’s structure before opening accounts or entering contracts.

What key provisions should a California LLC Operating Agreement include?

A comprehensive California LLC Operating Agreement should address membership percentages, capital contributions, profit and loss allocations, and voting rights. It must also outline management structures (member-managed vs. manager-managed), procedures for adding or removing members, and protocols for dissolving the LLC. Including clauses for dispute resolution, such as mediation or arbitration, can prevent costly litigation. Additionally, it’s advisable to specify rules for holding meetings, amending the agreement, and handling tax elections to ensure compliance with both state and federal regulations.

Can a California LLC Operating Agreement be amended after formation?

Yes, a California LLC Operating Agreement can be amended post-formation, provided the changes follow the amendment process outlined in the original document. Typically, amendments require a majority vote or unanimous consent from all members, depending on the terms. Proposed changes should be documented in writing, signed by authorized members, and kept with the company’s records. Regular updates are essential to reflect shifts in ownership, business goals, or legal requirements. However, amendments must not violate California law or undermine the LLC’s compliance with state filing obligations.

Leave a Reply

Our Recommended Articles