How Are Advisors to a Vc Firm Compensated?

Venture capital (VC) firms rely heavily on the expertise of advisors to guide investment decisions and support portfolio companies. These advisors, often seasoned professionals with deep industry knowledge, play a critical role in shaping the firm’s success. But how are they compensated for their contributions? Advisor compensation structures vary widely, typically including a mix of cash, equity, or carried interest, depending on their level of involvement and the firm’s policies. Understanding these arrangements is essential for both advisors and VC firms to align incentives and foster productive relationships. This article explores the common compensation models and factors influencing how advisors are rewarded in the venture capital ecosystem.

How Are Advisors to a VC Firm Compensated?

Advisors to a venture capital (VC) firm play a crucial role in guiding investment decisions, providing industry expertise, and offering strategic insights. Their compensation structure is designed to align their interests with the success of the firm and its portfolio companies. Below, we explore the various ways advisors to a VC firm are compensated, along with detailed explanations and a summary table.

See Also How Does One Become an Entrepreneur in Residence at a Venture Capital Firm

How Does One Become an Entrepreneur in Residence at a Venture Capital Firm1. Equity-Based Compensation

Advisors often receive equity in the form of stock options or shares in the VC firm or its portfolio companies. This aligns their incentives with the long-term success of the investments. Equity compensation is typically structured as a percentage of the fund's profits or as a direct stake in specific startups.

2. Cash Fees or Retainers

Some advisors are paid cash fees or retainers for their ongoing services. This is common for advisors who provide regular, hands-on support. The amount varies based on the advisor's expertise, the scope of their involvement, and the size of the VC firm.

See Also How Does Carry in a Vc Partnership Vest

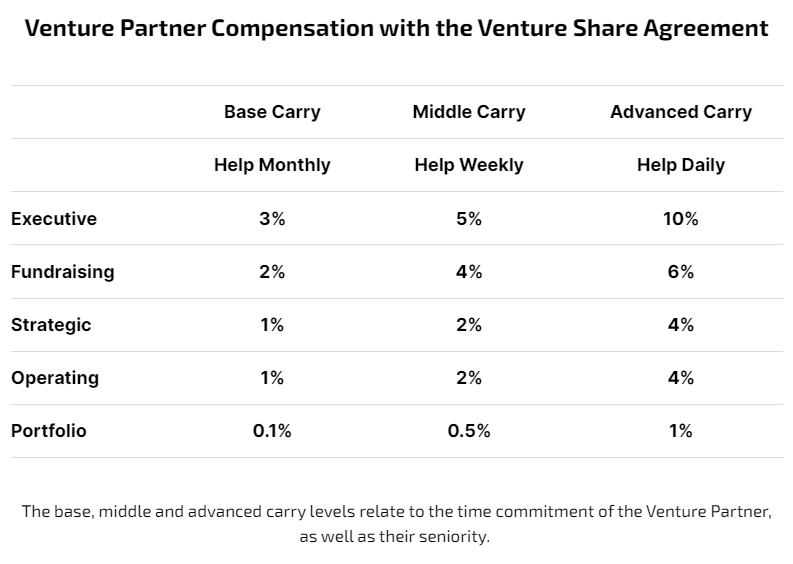

How Does Carry in a Vc Partnership Vest3. Profit Sharing (Carried Interest)

Advisors may receive a share of the carried interest, which is the profit distributed to the VC firm after returning the initial capital to investors. This is usually a smaller percentage compared to the general partners but serves as a strong incentive for advisors to contribute to the fund's success.

4. Success Fees or Bonuses

In some cases, advisors earn success fees or bonuses tied to specific milestones, such as a successful exit (e.g., an IPO or acquisition) of a portfolio company. These payments reward advisors for their direct contributions to achieving significant outcomes.

See AlsoWhat is the Absolute Best Book on Venture Capital?5. Hybrid Compensation Models

Many VC firms use a hybrid model that combines equity, cash, and performance-based incentives. This approach ensures advisors are motivated to provide value across different stages of the investment lifecycle.

| Compensation Type | Description | Key Benefits |

|---|---|---|

| Equity-Based | Stock options or shares in the VC firm or portfolio companies. | Aligns incentives with long-term success. |

| Cash Fees/Retainers | Regular payments for ongoing advisory services. | Provides steady income for advisors. |

| Profit Sharing | Share of carried interest from fund profits. | Rewards contributions to overall fund performance. |

| Success Fees/Bonuses | Payments tied to specific milestones or exits. | Incentivizes achieving significant outcomes. |

| Hybrid Models | Combination of equity, cash, and performance-based incentives. | Balances short-term and long-term motivations. |

Do VC advisors get paid?

What Does It Mean to Be a Partner in a Venture Capital Firm?

What Does It Mean to Be a Partner in a Venture Capital Firm?How Do VC Advisors Typically Get Compensated?

VC advisors are usually compensated through a combination of cash payments, equity stakes, or a mix of both. The compensation structure depends on the agreement between the advisor and the venture capital firm or startup. Below are common methods:

- Cash Fees: Advisors may receive a fixed monthly or quarterly payment for their services.

- Equity Grants: They might be granted shares or stock options in the company they advise.

- Success Fees: Some advisors earn bonuses based on the success of deals or milestones achieved.

What Factors Influence VC Advisor Compensation?

The compensation for VC advisors is influenced by several factors, including their experience, network, and the value they bring to the table. Here are key factors:

- Expertise: Advisors with specialized knowledge or industry experience often command higher fees.

- Reputation: Well-known advisors with a proven track record may negotiate better terms.

- Scope of Work: The level of involvement and time commitment required can impact compensation.

Are VC Advisors Paid Differently in Early-Stage vs. Late-Stage Companies?

Yes, the stage of the company can significantly affect how VC advisors are paid. Early-stage and late-stage companies often have different compensation structures:

- Early-Stage Companies: Advisors may receive more equity and less cash due to limited funding.

- Late-Stage Companies: These companies often offer higher cash payments and smaller equity stakes.

- Risk vs. Reward: Early-stage advisors take on more risk, which is often offset by potentially higher equity rewards.

What Are the Common Roles of VC Advisors That Justify Their Pay?

VC advisors play critical roles that justify their compensation. Their responsibilities often include:

- Strategic Guidance: Providing insights and strategies to help companies grow.

- Network Access: Introducing startups to potential investors, partners, or clients.

- Mentorship: Offering advice and support to founders and management teams.

Can VC Advisors Negotiate Their Compensation Terms?

Yes, VC advisors often have the flexibility to negotiate their compensation terms based on their value and the needs of the company. Key negotiation points include:

- Payment Structure: Deciding between cash, equity, or a combination of both.

- Performance Bonuses: Including clauses for additional pay based on specific achievements.

- Duration of Engagement: Determining the length of the advisory relationship and renewal terms.

What is the 2 20 rule in VC?

:max_bytes(150000):strip_icc()/dotdash_Final_Two_and_Twenty_Oct_2020-01-7ca86fbd38b64e59a879a71b9ad779eb.jpg)

What is the 2 20 Rule in Venture Capital?

The 2 20 rule in venture capital refers to the standard fee structure that venture capital (VC) firms charge their investors. This structure consists of two main components:

- 2% Management Fee: VC firms typically charge an annual management fee of 2% of the total assets under management (AUM). This fee covers operational costs, salaries, and other expenses.

- 20% Performance Fee (Carried Interest): In addition to the management fee, VC firms take 20% of the profits generated from investments. This is known as carried interest and is only earned after the fund returns the initial capital to investors.

Why is the 2 20 Rule Important in VC?

The 2 20 rule is crucial because it aligns the interests of the VC firm with those of its investors. Here’s why:

- Incentivizes Performance: The 20% carried interest motivates VC firms to maximize returns, as their earnings depend on the success of the investments.

- Covers Operational Costs: The 2% management fee ensures that the firm can operate effectively without relying solely on investment returns.

- Standardizes Industry Practices: This rule has become a benchmark in the industry, making it easier for investors to compare different VC funds.

How Does the 2 20 Rule Impact Investors?

The 2 20 rule has significant implications for investors in venture capital funds:

- Higher Costs: Investors must account for the 2% annual fee, which reduces their net returns over time.

- Profit Sharing: The 20% carried interest means investors share a portion of their profits with the VC firm, which can impact overall returns.

- Alignment of Interests: The structure ensures that VC firms are motivated to achieve high returns, benefiting both parties.

Are There Variations to the 2 20 Rule?

While the 2 20 rule is standard, some VC firms may negotiate different terms based on their reputation or the size of the fund:

- Lower Management Fees: Larger funds or established firms may charge less than 2% due to economies of scale.

- Higher Carried Interest: Some firms may negotiate a higher percentage, such as 25%, for exceptional performance.

- Hurdle Rates: Certain funds implement hurdle rates, where carried interest is only paid after achieving a minimum return threshold.

What Are the Criticisms of the 2 20 Rule?

Despite its widespread use, the 2 20 rule has faced criticism for several reasons:

- High Costs: Critics argue that the 2% management fee can be excessive, especially for underperforming funds.

- Misaligned Incentives: Some believe the 20% carried interest may encourage risky investments to maximize returns.

- Lack of Transparency: Investors may find it difficult to assess whether the fees are justified by the fund's performance.

How are advisors compensated?

Types of Compensation Models for Advisors

Advisors are compensated through various models depending on the industry and the nature of their role. Below are the most common compensation structures:

- Fee-Based: Advisors charge a fixed fee or hourly rate for their services, which is common in financial planning or consulting.

- Commission-Based: Advisors earn a percentage of the sales or transactions they facilitate, often seen in real estate or insurance.

- Retainer Fees: Clients pay a recurring fee for ongoing advisory services, typically used in legal or business consulting.

- Equity Compensation: Advisors receive shares or stock options in the company they advise, common in startups or tech firms.

- Performance-Based Bonuses: Advisors earn additional compensation based on achieving specific goals or milestones.

Factors Influencing Advisor Compensation

Several factors determine how much an advisor is compensated. These include:

- Experience and Expertise: Highly experienced advisors with specialized knowledge often command higher fees.

- Industry Standards: Compensation varies by industry, with sectors like finance and tech typically offering higher pay.

- Scope of Work: The complexity and duration of the advisory role impact the compensation structure.

- Geographic Location: Advisors in high-cost regions or major cities may earn more due to higher demand and living costs.

- Client Size and Budget: Larger clients with bigger budgets can afford to pay more for advisory services.

Common Payment Structures for Advisors

Advisors are often paid through specific structures tailored to their role and industry. These include:

- Lump-Sum Payments: A one-time payment for a specific project or consultation.

- Recurring Payments: Regular payments for ongoing advisory services, such as monthly retainers.

- Deferred Compensation: Payment is delayed until certain conditions are met, often used in long-term projects.

- Profit Sharing: Advisors receive a share of the profits generated from their advice, common in business consulting.

- Hybrid Models: A combination of fee-based and commission-based structures to align incentives.

Legal and Ethical Considerations in Advisor Compensation

Compensating advisors involves adhering to legal and ethical standards to ensure fairness and transparency. Key considerations include:

- Disclosure Requirements: Advisors must disclose their compensation structure to clients to avoid conflicts of interest.

- Regulatory Compliance: Certain industries, like finance, have strict regulations governing advisor compensation.

- Conflict of Interest Policies: Advisors must avoid situations where their compensation could influence their advice unfairly.

- Transparency: Clear communication about how and when advisors are paid builds trust with clients.

- Fair Market Value: Compensation should reflect the market rate for similar advisory services.

Trends in Advisor Compensation

The way advisors are compensated is evolving due to changing market dynamics and client expectations. Current trends include:

- Increased Use of Equity Compensation: Startups and tech companies are offering more equity-based pay to align advisors with long-term success.

- Performance-Linked Incentives: More clients are tying compensation to measurable outcomes or milestones.

- Remote Advisory Roles: The rise of remote work has led to more flexible and location-independent compensation models.

- Focus on Transparency: Clients are demanding greater clarity in how advisors are paid and what they receive in return.

- Customized Compensation Packages: Advisors and clients are increasingly tailoring compensation to fit specific needs and goals.

Frequently Asked Questions by our Community

What are the common compensation structures for advisors in a VC firm?

Advisors to a VC firm are typically compensated through a combination of cash payments, equity stakes, or a mix of both. The most common structure involves granting advisors a small percentage of equity in the form of stock options or restricted stock units (RSUs). This aligns their interests with the long-term success of the portfolio companies. In some cases, advisors may also receive cash retainers or hourly fees for their time and expertise, especially if they are providing ongoing strategic guidance.

How does the compensation of advisors vary based on their role?

The compensation of advisors in a VC firm often depends on their level of involvement and the value they bring to the firm or its portfolio companies. For example, a part-time advisor who provides occasional insights may receive a smaller equity grant or a modest cash fee. In contrast, a full-time advisor or someone with a highly specialized skill set, such as a technical expert or industry veteran, may command a larger equity stake or a higher retainer. Additionally, advisors who take on more operational roles or board positions may negotiate more substantial compensation packages.

Are there performance-based incentives for advisors in VC firms?

Yes, some VC firms offer performance-based incentives to advisors to encourage their active contribution to the success of portfolio companies. These incentives might include bonuses tied to specific milestones, such as successful fundraising rounds, exits, or revenue targets. In other cases, advisors may receive additional equity grants if the companies they advise achieve significant growth or profitability. This structure ensures that advisors are motivated to provide meaningful support and guidance to the startups they work with.

What factors influence the compensation of advisors in a VC firm?

Several factors influence how advisors to a VC firm are compensated. These include the stage of the startups they advise (early-stage companies may offer more equity but less cash), the advisor's reputation and track record, and the specific needs of the VC firm or its portfolio companies. Additionally, the geographic location and industry sector can play a role, as compensation norms vary across regions and markets. Finally, the duration and intensity of the advisor's commitment also impact the compensation structure, with longer-term or more hands-on roles typically receiving higher rewards.

Leave a Reply

Our Recommended Articles