How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of Funding

When a company raises a new round of funding, determining the pro rata entitlement for existing investors is a critical step to ensure fairness and transparency. Pro rata rights allow investors to maintain their ownership percentage by participating in subsequent funding rounds. Calculating this entitlement involves understanding the investor’s current stake, the new funding amount, and the company’s updated valuation. This process helps investors decide whether to exercise their rights to avoid dilution or adjust their position. This article explores the key steps and considerations in calculating pro rata entitlements, providing clarity for investors navigating the complexities of equity financing in growing companies.

How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of Funding

Understanding Pro Rata Rights

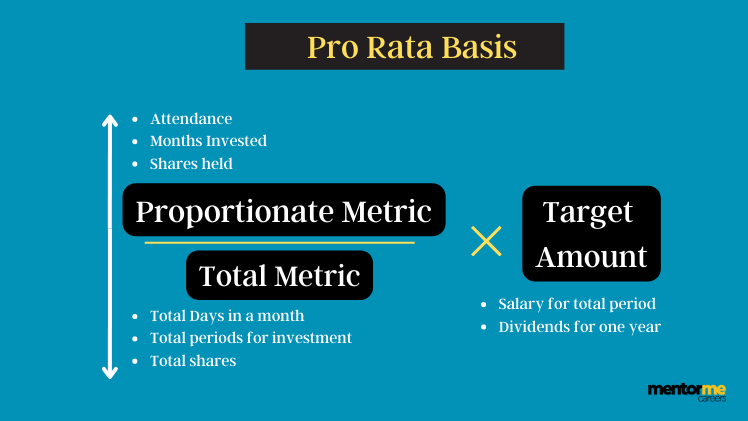

Pro rata rights allow existing investors to maintain their percentage ownership in a company by participating in future funding rounds. These rights are typically outlined in the investment agreement and ensure that investors can avoid dilution of their stake. To calculate pro rata entitlement, you need to know the investor's current ownership percentage and the total amount of new funding being raised.

See Also What Are Typical Finders Fees Vcs Are Ready to Pay for a Unique Lead on a Start Up

What Are Typical Finders Fees Vcs Are Ready to Pay for a Unique Lead on a Start UpStep-by-Step Calculation of Pro Rata Entitlement

To calculate pro rata entitlement, follow these steps:

1. Determine the investor's current ownership percentage.

2. Identify the total amount of new funding being raised.

3. Multiply the investor's ownership percentage by the total new funding amount.

4. The result is the amount the investor is entitled to invest to maintain their ownership percentage.

For example:

- Investor owns 10% of the company.

- New funding round is $1,000,000.

- Pro rata entitlement = 10% x $1,000,000 = $100,000.

I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make Sense

I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make SenseFactors Influencing Pro Rata Entitlement

Several factors can influence pro rata entitlement:

- Valuation of the Company: A higher valuation may reduce the percentage ownership an investor can maintain.

- Terms of the Investment Agreement: Some agreements may limit pro rata rights or require board approval.

- Investor's Willingness to Participate: Not all investors may choose to exercise their pro rata rights.

Common Challenges in Calculating Pro Rata Entitlement

Calculating pro rata entitlement can be complex due to:

- Multiple Funding Rounds: Each round may have different terms and valuations.

- Convertible Notes: These can convert into equity, affecting ownership percentages.

- Dilution from Employee Stock Options: Issuing new shares to employees can dilute existing ownership.

Example Table: Pro Rata Entitlement Calculation

| Investor | Current Ownership | New Funding Round | Pro Rata Entitlement |

|---|---|---|---|

| Investor A | 15% | $2,000,000 | $300,000 |

| Investor B | 5% | $2,000,000 | $100,000 |

| Investor C | 20% | $2,000,000 | $400,000 |

Legal and Financial Considerations

When calculating pro rata entitlement, it's crucial to consider:

- Legal Agreements: Ensure the terms are clearly defined in the investment agreement.

- Financial Capacity: Investors must have the financial resources to participate in the new funding round.

- Tax Implications: Participating in a new round may have tax consequences for the investor.

How to calculate investor pro rata?

How Will Venture Capital Change in the Next Decade?

How Will Venture Capital Change in the Next Decade?Understanding Pro Rata Rights

Pro rata rights allow investors to maintain their ownership percentage in a company by participating in future funding rounds. This ensures that their stake is not diluted when new shares are issued. To calculate pro rata, you need to know the investor's current ownership percentage and the total number of new shares being issued.

- Determine the investor's current ownership percentage.

- Identify the total number of new shares being issued in the funding round.

- Multiply the investor's ownership percentage by the total new shares to find their pro rata share.

Steps to Calculate Investor Pro Rata

Calculating pro rata involves a straightforward formula. First, gather the necessary data, including the investor's current stake and the total new shares. Then, apply the formula to determine the number of shares the investor is entitled to purchase.

See Also How Do Investment Banking Venture Capital and Private Equity Differ in Terms of Prestige

How Do Investment Banking Venture Capital and Private Equity Differ in Terms of Prestige- Gather the investor's current shareholding and total shares outstanding.

- Calculate the investor's ownership percentage by dividing their shares by the total shares.

- Multiply the ownership percentage by the total new shares to determine the pro rata amount.

Importance of Pro Rata in Investment Rounds

Pro rata rights are crucial for investors who want to protect their investment from dilution. By exercising these rights, investors can maintain their influence and financial stake in the company as it grows.

- Pro rata rights help investors maintain control over their investment.

- They prevent dilution of the investor's ownership stake.

- These rights are often negotiated during the initial investment agreement.

Common Mistakes in Pro Rata Calculations

Errors in pro rata calculations can lead to disputes or financial losses. It's essential to ensure accuracy by double-checking the numbers and understanding the terms of the investment agreement.

- Incorrectly calculating the ownership percentage.

- Failing to account for preferred shares or other equity types.

- Misinterpreting the terms of the investment agreement.

Practical Example of Pro Rata Calculation

Let's say an investor owns 10% of a company, and the company is issuing 1,000 new shares. The investor's pro rata share would be 10% of 1,000, which is 100 shares. This ensures their ownership percentage remains unchanged.

- Investor owns 10% of the company.

- Company issues 1,000 new shares.

- Investor's pro rata share is 100 shares (10% of 1,000).

How do you calculate pro rata offer?

What is a Pro Rata Offer?

A pro rata offer is a proportional allocation of something, such as a salary, bonus, or benefit, based on the amount of time worked or the portion of a period completed. It ensures fairness by distributing resources or payments according to the actual contribution or time spent.

How to Calculate a Pro Rata Salary

To calculate a pro rata salary, follow these steps:

- Determine the full-time salary: Identify the annual or monthly salary for a full-time position.

- Calculate the proportion: Divide the number of hours or days worked by the total hours or days in the full-time schedule.

- Multiply the proportion by the full-time salary: This gives the pro rata salary for the partial period.

How to Calculate Pro Rata for Part-Time Work

Calculating pro rata for part-time work involves:

- Identify the full-time equivalent: Determine the full-time hours or days for the role.

- Determine the part-time hours: Note the actual hours or days worked.

- Calculate the ratio: Divide the part-time hours by the full-time hours.

- Apply the ratio to the full-time salary: Multiply the ratio by the full-time salary to get the pro rata amount.

How to Calculate Pro Rata for Bonuses

To calculate a pro rata bonus, follow these steps:

- Determine the full bonus amount: Identify the total bonus for the full period.

- Calculate the time worked: Determine the portion of the period the employee worked.

- Multiply the bonus by the proportion: Apply the proportion to the full bonus to get the pro rata amount.

How to Calculate Pro Rata for Benefits

Calculating pro rata for benefits involves:

- Identify the full benefit value: Determine the total value of the benefit for the full period.

- Calculate the proportion of time: Determine the portion of the period the employee is eligible for the benefit.

- Multiply the benefit by the proportion: Apply the proportion to the full benefit to get the pro rata amount.

How do you exercise pro rata rights?

Understanding Pro Rata Rights

Pro rata rights allow existing shareholders to maintain their ownership percentage in a company by purchasing additional shares during a new equity issuance. This is particularly important in funding rounds to prevent dilution of their stake. To exercise these rights:

- Review the company's bylaws or shareholder agreement to confirm the existence and terms of pro rata rights.

- Monitor funding announcements to stay informed about new equity issuances.

- Communicate with the company to express your intention to exercise your pro rata rights.

Steps to Exercise Pro Rata Rights

Exercising pro rata rights involves a series of steps to ensure compliance and effectiveness:

- Confirm eligibility by verifying your current shareholding percentage.

- Submit a formal request to the company or its legal representatives within the specified timeframe.

- Provide necessary documentation such as proof of ownership and financial capability to purchase the shares.

Legal Considerations for Pro Rata Rights

Legal frameworks govern the exercise of pro rata rights, and understanding them is crucial:

- Consult legal counsel to ensure compliance with local laws and regulations.

- Understand the terms of the new equity issuance, including pricing and deadlines.

- Review any restrictions on the transfer or sale of newly acquired shares.

Financial Implications of Exercising Pro Rata Rights

Exercising pro rata rights can have significant financial implications:

- Assess your financial capacity to purchase additional shares without overextending.

- Evaluate the potential return on investment based on the company's growth prospects.

- Consider the impact on your portfolio diversification and overall financial strategy.

Common Challenges in Exercising Pro Rata Rights

Shareholders may face challenges when exercising pro rata rights:

- Limited timeframes for decision-making and action.

- Liquidity constraints that may hinder the ability to purchase additional shares.

- Complex legal and financial requirements that require expert guidance.

Frequently Asked Questions (FAQs)

What is a pro rata entitlement in the context of a new funding round?

A pro rata entitlement refers to the right of an existing investor to maintain their percentage ownership in a company by participating in a new round of funding. When a company raises additional capital, existing investors may have the option to invest more money to prevent their ownership stake from being diluted. This right is often outlined in the company's shareholder agreement or term sheet and is crucial for investors who wish to retain their influence and financial interest in the company.

How is the pro rata entitlement calculated for an existing investor?

The pro rata entitlement is calculated based on the investor's current ownership percentage in the company. For example, if an investor owns 10% of the company before the new funding round, they are entitled to purchase 10% of the new shares being issued. The formula is: (Current Ownership Percentage) × (Total New Shares Issued). This ensures the investor maintains their proportional stake. However, the exact calculation may vary depending on the terms of the funding round and any anti-dilution provisions in place.

What happens if an existing investor does not exercise their pro rata rights?

If an existing investor chooses not to exercise their pro rata rights, their ownership percentage in the company will be diluted. This means their stake will decrease as new shares are issued to other investors. For instance, if an investor owns 10% of the company and does not participate in the new funding round, their ownership could drop to 8% or lower, depending on the size of the round. This dilution can reduce their influence and potential returns in the company.

Can pro rata rights be negotiated or waived during a funding round?

Yes, pro rata rights can often be negotiated or waived during a funding round. Some investors may voluntarily waive their rights to allow new investors to take a larger stake in the company. Alternatively, the company and its existing investors may agree to modify the terms of the pro rata rights to accommodate specific needs or strategic goals. However, any changes to these rights typically require mutual agreement and should be documented in the investment agreement or amended shareholder agreement.

Leave a Reply

Our Recommended Articles