How Much Irr Does a Vc Fund Typically Target?

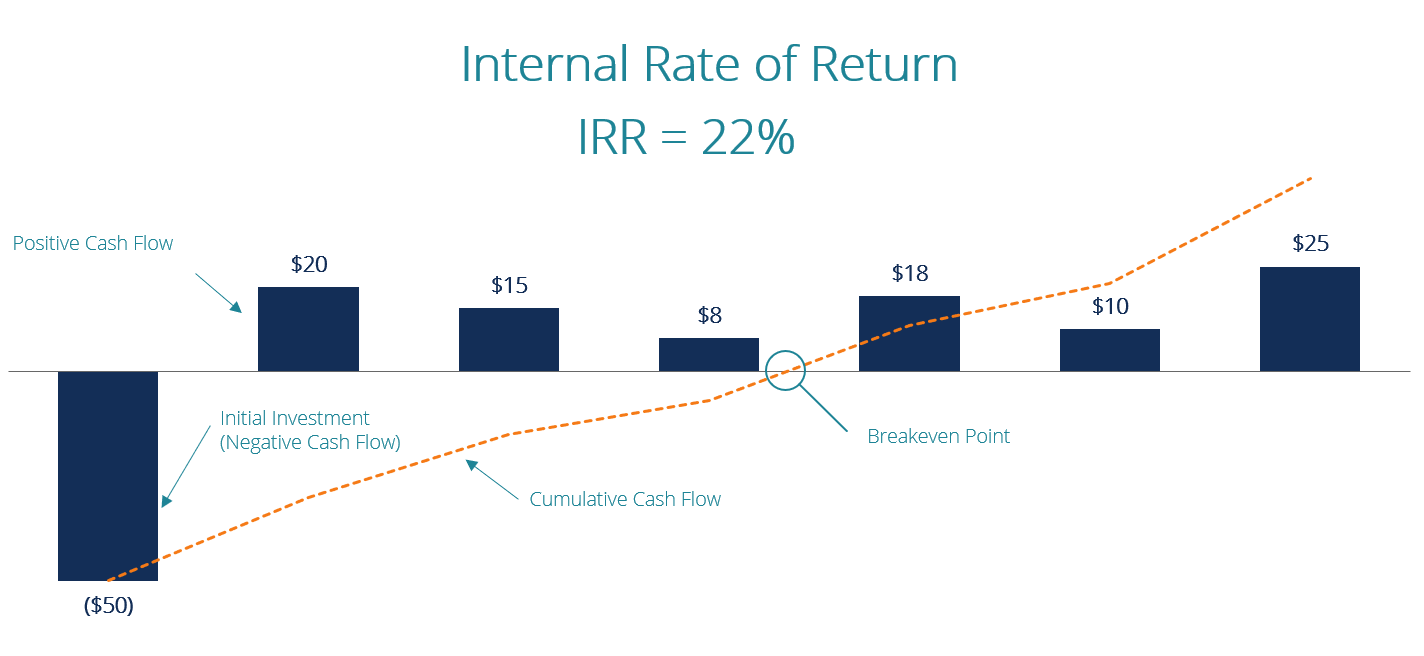

Venture capital (VC) funds play a pivotal role in fueling innovation by investing in high-potential startups and early-stage companies. A critical metric for evaluating the success of these investments is the Internal Rate of Return (IRR), which measures the profitability of the fund over time. Understanding the typical IRR targets for VC funds is essential for both investors and entrepreneurs, as it sets expectations and benchmarks for performance. This article explores the standard IRR targets that VC funds aim to achieve, the factors influencing these targets, and how they align with the high-risk, high-reward nature of venture capital investments.

How Much IRR Does a VC Fund Typically Target?

Venture Capital (VC) funds typically target an Internal Rate of Return (IRR) that aligns with the high-risk nature of their investments. On average, VC funds aim for an IRR of 20% to 30%, though this can vary depending on the fund's strategy, stage of investment, and market conditions. Achieving such returns is challenging due to the inherent risks in early-stage startups, but successful exits through IPOs or acquisitions can significantly boost returns.

See Also What Percent of Venture Capital Funds Fail?

What Percent of Venture Capital Funds Fail?What Is IRR and Why Is It Important for VC Funds?

The Internal Rate of Return (IRR) is a metric used to estimate the profitability of investments. For VC funds, it represents the annualized return on invested capital over the fund's lifecycle. A high IRR is crucial because it compensates for the high failure rate of startups and aligns with the expectations of limited partners (LPs) who invest in VC funds.

Factors Influencing IRR Targets in VC Funds

Several factors influence the IRR targets of VC funds, including:

- Investment Stage: Early-stage funds often target higher IRRs due to higher risk.

- Market Conditions: Economic trends and industry growth can impact returns.

- Fund Size: Smaller funds may target higher IRRs compared to larger funds.

- Portfolio Diversification: A balanced portfolio can mitigate risks and stabilize returns.

What's the Reputation of Dcm Venture Capital?

What's the Reputation of Dcm Venture Capital?How Do VC Funds Achieve High IRRs?

VC funds achieve high IRRs by:

- Investing in High-Growth Startups: Identifying companies with disruptive potential.

- Active Portfolio Management: Providing mentorship and resources to portfolio companies.

- Successful Exits: Achieving liquidity events like IPOs or acquisitions.

- Timing Investments: Entering and exiting investments at optimal times.

Comparing IRR Targets Across Different Fund Stages

The IRR targets vary depending on the investment stage:

See AlsoWhat is a Reasonable Hourly Rate to Charge for a Contract Business Analyst?| Fund Stage | Typical IRR Target |

|---|---|

| Seed Stage | 30%+ |

| Early Stage | 20%-30% |

| Growth Stage | 15%-25% |

Challenges in Meeting IRR Targets

Meeting IRR targets is challenging due to:

- High Failure Rates: Many startups fail to achieve significant returns.

- Market Volatility: Economic downturns can impact valuations and exits.

- Long Investment Horizons: VC funds often take 7-10 years to realize returns.

- Competition: Increased competition for high-quality deals can drive up valuations.

How LPs Evaluate VC Fund Performance Based on IRR

Limited Partners (LPs) evaluate VC fund performance by comparing the IRR to benchmarks and peer funds. A strong IRR indicates effective fund management and successful investment strategies. LPs also consider other metrics like TVPI (Total Value to Paid-In) and DPI (Distributions to Paid-In) to assess overall fund performance.

See Also How Do I Become an Lp in a Vc Fund?

How Do I Become an Lp in a Vc Fund?What is a good IRR for a VC fund?

What is a Good IRR for a VC Fund?

A good Internal Rate of Return (IRR) for a Venture Capital (VC) fund typically ranges between 20% to 30%. This range is considered strong because VC funds invest in high-risk, high-reward startups, and achieving such returns compensates for the inherent risks. However, the actual IRR can vary based on factors like the fund's strategy, market conditions, and the performance of portfolio companies.

Factors Influencing a VC Fund's IRR

Several factors can influence the IRR of a VC fund:

- Investment Stage: Early-stage investments often yield higher IRRs due to the potential for exponential growth, but they also carry higher risks.

- Market Conditions: Economic downturns or booms can significantly impact the performance of portfolio companies and, consequently, the fund's IRR.

- Fund Management: The expertise and track record of the fund managers play a crucial role in selecting and nurturing successful startups.

Benchmarking VC Fund Performance

VC funds are often benchmarked against industry standards to evaluate their performance:

- Top Quartile Funds: These funds typically achieve IRRs above 25%, placing them in the top 25% of performers.

- Median Funds: Median-performing funds usually have IRRs around 15% to 20%.

- Lower Quartile Funds: Funds in the bottom 25% often struggle to achieve double-digit IRRs.

Why High IRRs are Expected in VC Funds

High IRRs are expected in VC funds due to the following reasons:

- High Risk: VC funds invest in unproven startups, which have a high likelihood of failure but also the potential for outsized returns.

- Long Investment Horizon: VC investments often take 7 to 10 years to mature, requiring significant patience and capital.

- Illiquidity: Investments in startups are illiquid, meaning they cannot be easily sold or converted to cash, which justifies higher returns.

How to Evaluate a VC Fund's IRR

Evaluating a VC fund's IRR involves considering several key aspects:

- Historical Performance: Review the fund's past IRRs to gauge its consistency and ability to deliver returns.

- Portfolio Composition: Analyze the mix of startups in the fund's portfolio, including their stages, industries, and growth potential.

- Exit Strategies: Assess the fund's track record in achieving successful exits, such as IPOs or acquisitions, which directly impact IRR.

Is 7% a good IRR?

What Does a 7% IRR Mean?

A 7% Internal Rate of Return (IRR) represents the annualized rate of return an investment is expected to generate over its lifetime. It is a metric used to evaluate the profitability of an investment. Here are some key points to consider:

- IRR is the discount rate that makes the net present value (NPV) of all cash flows equal to zero.

- A 7% IRR means the investment is expected to grow at an average annual rate of 7%.

- This rate is often compared to the cost of capital or alternative investment opportunities to assess its attractiveness.

Is 7% IRR Considered Good?

Whether a 7% IRR is considered good depends on several factors, including the risk profile of the investment and the market conditions. Here’s a breakdown:

- For low-risk investments, such as bonds or real estate, a 7% IRR might be considered attractive.

- For high-risk ventures, such as startups or speculative projects, a 7% IRR may be seen as insufficient.

- It’s important to compare the 7% IRR to the inflation rate and other benchmarks to determine its real value.

How Does 7% IRR Compare to Other Investments?

Comparing a 7% IRR to other investment opportunities can provide context for its performance. Consider the following:

- The S&P 500 has historically returned about 10% annually, making a 7% IRR lower in comparison.

- Government bonds typically offer lower returns, often around 2-4%, making 7% IRR more appealing in this context.

- Private equity investments often target IRRs of 15-20%, which makes 7% seem modest.

Factors Influencing the Attractiveness of a 7% IRR

Several factors can influence whether a 7% IRR is considered a good return. These include:

- Risk tolerance: Lower-risk investors may find 7% IRR acceptable, while higher-risk investors may seek greater returns.

- Investment horizon: Longer-term investments may justify a lower IRR due to compounding effects.

- Economic conditions: In a low-interest-rate environment, a 7% IRR may be more attractive than in a high-interest-rate scenario.

When Is a 7% IRR Not Good Enough?

There are scenarios where a 7% IRR might not meet expectations. Here are some examples:

- If the cost of capital is higher than 7%, the investment may not be worthwhile.

- For high-growth industries, such as technology, a 7% IRR may be considered too low.

- When inflation is high, a 7% IRR may not provide sufficient real returns.

What is the 100 10 1 rule in venture capital?

What is the 100 10 1 Rule in Venture Capital?

The 100 10 1 rule is a principle used by venture capitalists to evaluate potential investments. It suggests that for every 100 opportunities reviewed, only 10 will be seriously considered, and ultimately, only 1 will receive funding. This rule highlights the highly selective nature of venture capital, where investors focus on identifying the most promising startups with the potential for significant returns.

Why is the 100 10 1 Rule Important in Venture Capital?

The 100 10 1 rule is crucial because it emphasizes the rigorous due diligence process in venture capital. Investors must sift through numerous opportunities to find the most viable ones. This rule helps manage risk and ensures that resources are allocated to startups with the highest potential for success.

- It reduces the risk of investing in unviable startups.

- It ensures a disciplined approach to evaluating opportunities.

- It maximizes the chances of achieving high returns on investment.

How Does the 100 10 1 Rule Work in Practice?

In practice, the 100 10 1 rule involves a multi-step process. Venture capitalists review a large number of pitches, conduct thorough research, and narrow down their options based on factors like market potential, team expertise, and scalability.

- Review 100 initial opportunities or pitches.

- Shortlist 10 for in-depth analysis and due diligence.

- Select 1 startup to invest in after rigorous evaluation.

What Factors Influence the 100 10 1 Rule?

Several factors influence the application of the 100 10 1 rule, including market trends, the startup's business model, and the experience of the founding team. Investors also consider the competitive landscape and the potential for scalability.

- Market size and growth potential.

- Team expertise and track record.

- Innovation and uniqueness of the product or service.

What Are the Challenges of Applying the 100 10 1 Rule?

Applying the 100 10 1 rule comes with challenges, such as the time and resources required for due diligence. Additionally, the competitive nature of venture capital means that even promising startups may not secure funding if they don't stand out.

- High time investment in evaluating opportunities.

- Risk of missing out on hidden gems due to strict filtering.

- Pressure to identify high-growth startups in a crowded market.

What is the target return for a VC fund?

What is the Target Return for a VC Fund?

The target return for a venture capital (VC) fund typically ranges between 20% to 30% annually. This high return expectation is due to the high-risk nature of investing in early-stage startups, where many investments may fail, but a few successful ones can generate outsized returns. VC funds aim to achieve these returns over a 10-year fund lifecycle, balancing the risks and rewards of their portfolio.

Why Do VC Funds Aim for High Returns?

VC funds target high returns to compensate for the inherent risks associated with startup investments. Here are the key reasons:

- High failure rates: Most startups fail, so VC funds need a few home runs to offset losses.

- Illiquidity: Investments are locked in for years, requiring higher returns to justify the lack of liquidity.

- Opportunity cost: Investors could allocate capital to less risky assets, so VC funds must offer higher potential rewards.

How Do VC Funds Calculate Target Returns?

VC funds use a combination of metrics and benchmarks to calculate target returns:

- Internal Rate of Return (IRR): Measures the annualized return over the fund's lifecycle.

- Multiple on Invested Capital (MOIC): Compares the total value returned to the amount invested.

- Benchmarking: Compares performance against industry standards and peer funds.

What Factors Influence VC Fund Returns?

Several factors impact the returns of a VC fund:

- Portfolio diversification: A well-diversified portfolio reduces risk and increases the chances of high returns.

- Fund size: Larger funds may struggle to achieve high returns due to the difficulty of deploying capital effectively.

- Market conditions: Economic trends and industry cycles significantly affect startup success rates.

What Are the Risks of Not Meeting Target Returns?

Failing to meet target returns can have significant consequences for VC funds:

- Investor dissatisfaction: Limited partners (LPs) may withdraw future commitments.

- Reputation damage: Poor performance can harm the fund's ability to attract top startups.

- Fund closure: Consistently underperforming funds may struggle to raise new capital.

How Do VC Funds Achieve Their Target Returns?

VC funds employ various strategies to achieve their target returns:

- Active involvement: Providing mentorship and resources to portfolio companies to increase their chances of success.

- Strategic exits: Facilitating IPOs, acquisitions, or secondary sales to realize returns.

- Focus on high-growth sectors: Investing in industries with exponential growth potential, such as technology or biotech.

Frequently Asked Questions by our Community

What is the typical Internal Rate of Return (IRR) target for a VC fund?

Venture Capital (VC) funds typically target an Internal Rate of Return (IRR) of 20% to 30% annually. This range is considered the benchmark for success in the venture capital industry, as it accounts for the high-risk nature of investing in early-stage startups. Achieving this level of return is challenging, given that many startups fail, but the potential for outsized returns from a few successful investments drives the overall fund performance.

Why do VC funds aim for such high IRR targets?

VC funds aim for high IRR targets because they invest in high-risk, high-reward startups. These investments often involve significant uncertainty, and many portfolio companies may fail to generate returns. To compensate for these risks and to deliver value to their limited partners (LPs), VC funds need to target substantial returns. The 20% to 30% IRR range reflects the need to outperform traditional asset classes like public equities or bonds, which typically offer lower returns.

How do VC funds calculate their IRR targets?

VC funds calculate their IRR targets based on the expected performance of their portfolio companies. This involves analyzing factors such as the growth potential of the startups, market size, competitive landscape, and exit opportunities (e.g., IPOs or acquisitions). Fund managers also consider historical data from similar investments and adjust their targets based on the fund's risk appetite and investment strategy. The goal is to ensure that the fund's overall returns meet or exceed the 20% to 30% IRR benchmark.

What happens if a VC fund fails to meet its IRR target?

If a VC fund fails to meet its IRR target, it may face challenges in raising capital for future funds. Limited partners (LPs), such as institutional investors and high-net-worth individuals, expect strong returns to justify the high risk of venture capital investments. Consistently underperforming funds may lose credibility and struggle to attract new investors. However, it's important to note that not all funds will hit their IRR targets, as the success of individual startups can be unpredictable. Some funds may still achieve respectable returns even if they fall short of the 20% to 30% range.

Leave a Reply

Our Recommended Articles