What Are Some Good Methods for Finding Venture Capital Vc Funding for Startups What Should One Do Right at the Beginning of Their Search So That Its Not All for Naught if No Investor Bites

Securing venture capital (VC) funding is a critical step for many startups aiming to scale their operations and achieve long-term success. However, the process can be daunting, especially for first-time entrepreneurs. To maximize the chances of success, it’s essential to approach the search strategically from the very beginning. This involves understanding the VC landscape, refining your business model, and building a compelling pitch that resonates with potential investors. By laying a strong foundation and aligning your startup’s goals with investor expectations, you can avoid wasted effort and increase the likelihood of securing the funding needed to propel your venture forward.

Effective Strategies for Securing Venture Capital Funding for Startups

Securing venture capital (VC) funding is a critical step for many startups aiming to scale their operations. However, the process can be daunting, especially for first-time entrepreneurs. To ensure your efforts are not in vain, it's essential to approach the search strategically from the very beginning. Below, we explore some proven methods and actionable steps to increase your chances of attracting VC investment.

See Also What is the Difference Between Early and Late Stage Venture Capital

What is the Difference Between Early and Late Stage Venture Capital1. Build a Strong Foundation with a Solid Business Plan

A well-crafted business plan is the cornerstone of any successful VC pitch. Investors want to see a clear vision, a scalable business model, and a detailed roadmap for growth. Ensure your plan includes:

- A compelling value proposition.

- Market analysis and competitive advantage.

- Financial projections and revenue streams.

- A clear explanation of how the funding will be utilized.

| Key Element | Description |

|---|---|

| Value Proposition | What makes your product or service unique? |

| Market Analysis | Identify your target audience and market size. |

| Financial Projections | Provide realistic revenue and growth forecasts. |

2. Identify the Right Investors for Your Startup

Not all VCs are the same. Research and target investors who have a history of funding startups in your industry or at your stage of development. Use platforms like Crunchbase or AngelList to find investors who align with your vision. Key steps include:

- Reviewing the investor's portfolio.

- Understanding their investment thesis.

- Reaching out through warm introductions or networking events.

What is Difference Between Angel Investor and Venture Capitalist

What is Difference Between Angel Investor and Venture Capitalist3. Develop a Compelling Pitch Deck

Your pitch deck is your first impression on potential investors. It should be concise, visually appealing, and tell a compelling story. Key slides to include are:

- Problem and solution.

- Market opportunity.

- Business model.

- Traction and milestones.

- Team overview.

- Financials and funding ask.

4. Leverage Your Network for Warm Introductions

Cold emails often go unnoticed. Instead, leverage your professional network to secure warm introductions to investors. Attend industry events, join startup communities, and connect with mentors who can vouch for your credibility. A warm introduction significantly increases your chances of getting a meeting.

See Also How Does Equity Dilution Work When a Start Up Goes Through Several Rounds of Funding From Seed to Vc Etc

How Does Equity Dilution Work When a Start Up Goes Through Several Rounds of Funding From Seed to Vc Etc5. Prepare for Due Diligence and Build Traction

Investors will scrutinize your startup during the due diligence process. To build confidence, focus on achieving traction early on. This could include:

- Securing early customers or partnerships.

- Demonstrating product-market fit.

- Showcasing consistent growth metrics.

| Traction Metric | Why It Matters |

|---|---|

| Customer Acquisition | Proves demand for your product. |

| Revenue Growth | Indicates financial viability. |

| User Engagement | Shows product adoption and retention. |

How to find VC for startups?

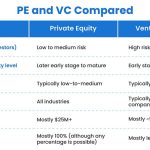

What is the Difference Between Fundraising Venture Capital and Private Investments

What is the Difference Between Fundraising Venture Capital and Private InvestmentsUnderstanding Venture Capital (VC) Basics

Before seeking venture capital, it is crucial to understand what it entails. Venture capital is a form of private equity financing that investors provide to early-stage, high-potential startups. Here are key points to consider:

- VC firms invest in startups with high growth potential in exchange for equity.

- They typically focus on industries like technology, biotech, and clean energy.

- VCs often provide not just funding but also mentorship and strategic guidance.

Identifying the Right VC Firms

Finding the right VC firm is essential for aligning your startup's goals with the investor's expertise. Follow these steps:

- Research firms that specialize in your industry or stage of growth.

- Look for VCs with a track record of successful investments in similar startups.

- Check their portfolio to ensure they have experience in your market.

Building a Strong Pitch Deck

A compelling pitch deck is critical to attracting VC interest. It should clearly communicate your startup's value proposition. Key elements include:

- Problem statement: Clearly define the problem your startup solves.

- Solution: Explain how your product or service addresses the problem.

- Market opportunity: Highlight the size and potential of your target market.

Networking and Building Relationships

Building relationships with VCs is a long-term process. Here’s how to approach it:

- Attend industry events, conferences, and startup meetups to meet potential investors.

- Leverage your existing network for warm introductions to VCs.

- Engage with VCs on platforms like LinkedIn to establish a connection.

Preparing for Due Diligence

Once a VC shows interest, they will conduct due diligence to evaluate your startup. Be prepared by:

- Organizing all financial records, including revenue, expenses, and projections.

- Providing detailed information about your team, product, and market strategy.

- Being transparent about potential risks and challenges.

What are the methods of venture capital funding?

1. Seed Funding

Seed funding is the initial stage of venture capital financing, typically used to support the development of a business idea or prototype. This stage is crucial for startups to prove their concept and attract further investment. Key aspects include:

- Small investments: Usually ranging from $10,000 to $2 million.

- High risk: Investors take significant risks as the business is still in its infancy.

- Equity exchange: Investors often receive equity in the company in return for their funding.

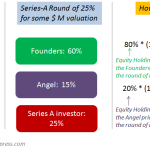

2. Series A Funding

Series A funding is the next stage after seed funding, aimed at scaling the business. At this point, the startup has a proven concept and is looking to expand. Key aspects include:

- Larger investments: Typically ranging from $2 million to $15 million.

- Focus on growth: Funds are used for product development, market expansion, and hiring key personnel.

- Valuation: The company's valuation is more established, influencing the amount of equity given to investors.

3. Series B Funding

Series B funding is aimed at taking the business to the next level, often focusing on market penetration and scaling operations. Key aspects include:

- Substantial investments: Usually ranging from $7 million to $30 million.

- Proven track record: The company has demonstrated growth and revenue generation.

- Strategic partnerships: Investors may bring in expertise and networks to help the company grow.

4. Series C Funding

Series C funding is typically used for further expansion, acquisitions, or preparing for an IPO. Key aspects include:

- Large-scale investments: Often exceeding $30 million.

- Established business: The company is well-established with significant market presence.

- Diverse investor base: May include private equity firms, hedge funds, and investment banks.

5. Mezzanine Financing and Bridge Loans

Mezzanine financing and bridge loans are used to support companies in the final stages before an IPO or acquisition. Key aspects include:

- Debt and equity mix: Combines elements of both debt and equity financing.

- Short-term focus: Typically used to bridge the gap until a larger financing event.

- Higher interest rates: Reflecting the higher risk associated with this stage of funding.

What is the best way to approach venture capitalists VCs through?

1. Research and Identify the Right Venture Capitalists

Before approaching venture capitalists (VCs), it is crucial to conduct thorough research to identify the ones that align with your business. Not all VCs invest in the same industries or stages of business growth. Here’s how to do it:

- Focus on VCs that specialize in your industry or sector.

- Look for VCs that have a history of investing in companies at your stage of development (e.g., seed, early-stage, or growth).

- Review their portfolio companies to understand their investment preferences and success stories.

2. Build a Strong Network and Get Warm Introductions

Approaching VCs through a warm introduction significantly increases your chances of getting their attention. Here’s how to leverage your network:

- Use platforms like LinkedIn to identify mutual connections who can introduce you to the VC.

- Attend industry events, conferences, and networking sessions where VCs are present.

- Seek introductions from mentors, advisors, or other entrepreneurs who have successfully raised funding.

3. Prepare a Compelling Pitch Deck

A well-crafted pitch deck is essential to capture the interest of VCs. It should clearly communicate your business model, market opportunity, and growth potential. Key elements to include:

- Problem and solution: Clearly define the problem your business solves and how it addresses the market need.

- Market size: Demonstrate the potential of your target market and its growth trajectory.

- Business model: Explain how your company generates revenue and achieves profitability.

4. Demonstrate Traction and Metrics

VCs are more likely to invest in companies that show traction and measurable progress. Here’s what to highlight:

- Revenue growth: Provide data on your sales and revenue trends over time.

- Customer acquisition: Showcase your ability to attract and retain customers.

- Key performance indicators (KPIs): Highlight metrics that demonstrate your business’s success and scalability.

5. Be Clear About Your Funding Needs and Use of Funds

VCs want to know exactly how much funding you need and how you plan to use it. Be transparent and specific about your funding requirements:

- Specify the amount of funding you are seeking and the equity you are willing to offer.

- Outline how the funds will be allocated (e.g., product development, marketing, hiring).

- Provide a clear timeline for achieving key milestones with the funding.

Frequently Asked Questions (FAQs)

What are the first steps to take when searching for venture capital funding?

When beginning your search for venture capital funding, it's crucial to start by refining your business idea and ensuring it has a clear value proposition. Investors are drawn to startups that solve real problems or address significant market needs. Next, create a comprehensive business plan that outlines your vision, target market, revenue model, and growth strategy. Additionally, build a strong founding team with complementary skills, as investors often bet on the team as much as the idea. Finally, research and identify VC firms that align with your industry and stage of development to increase your chances of success.

How can networking help in securing venture capital funding?

Networking plays a vital role in securing venture capital funding. Start by attending industry events, startup conferences, and pitch competitions to connect with potential investors and other entrepreneurs. Leverage platforms like LinkedIn to build relationships with venture capitalists and angel investors. Additionally, seek introductions from mentors, advisors, or other founders who have successfully raised funding. Building a strong network not only increases your visibility but also helps you gain valuable insights and feedback to refine your pitch and business strategy.

What should be included in a pitch deck to attract venture capital investors?

A compelling pitch deck is essential to attract venture capital investors. It should include a clear problem statement and how your product or service provides a unique solution. Highlight your market opportunity and the size of the target audience. Include details about your business model, revenue streams, and traction achieved so far, such as user growth or revenue milestones. Showcase your competitive advantage and the expertise of your founding team. Finally, outline your funding requirements and how the investment will be used to achieve key milestones.

What are some common mistakes to avoid when seeking venture capital funding?

When seeking venture capital funding, avoid common mistakes such as approaching the wrong investors who don’t align with your industry or stage. Ensure your financial projections are realistic and backed by data, as overly optimistic forecasts can deter investors. Don’t neglect the importance of a strong online presence, including a professional website and active social media profiles. Additionally, avoid being unprepared for tough questions during pitches; practice thoroughly and anticipate potential concerns. Lastly, don’t give up too soon—persistence is key, as securing funding often takes time and multiple attempts.

Leave a Reply

Our Recommended Articles