What is the Best Deal Flow Management Tool for Venture Capital Firms

In the fast-paced world of venture capital, managing deal flow efficiently is critical to identifying and securing the most promising investment opportunities. With an overwhelming number of startups vying for attention, venture capital firms need robust tools to streamline their processes, track potential deals, and make data-driven decisions. The right deal flow management tool can significantly enhance productivity, collaboration, and decision-making, giving firms a competitive edge. This article explores the top deal flow management tools available today, evaluating their features, usability, and scalability to help venture capital professionals determine the best solution for their unique needs and investment strategies.

- What is the Best Deal Flow Management Tool for Venture Capital Firms?

- What is deal flow software in venture capital?

- What is the best CRM for venture capital?

- What is the 10x rule for venture capital?

- What is venture capital deal flow analysis?

-

Frequently Asked Questions (FAQs)

- What features should a deal flow management tool offer for venture capital firms?

- How does a deal flow management tool improve efficiency for venture capital firms?

- What are the key considerations when choosing a deal flow management tool?

- Can a deal flow management tool help in identifying high-potential investment opportunities?

What is the Best Deal Flow Management Tool for Venture Capital Firms?

Deal flow management is a critical aspect of venture capital (VC) operations, enabling firms to efficiently track, evaluate, and manage investment opportunities. The best deal flow management tool for venture capital firms is one that combines robust functionality, user-friendly design, and scalability to meet the unique needs of VC professionals. These tools help streamline the investment process, from sourcing deals to closing them, while providing actionable insights and fostering collaboration among team members.

See Also What is the Best Crm for Venture/seed Capital Firms to Manage Deal Flow

What is the Best Crm for Venture/seed Capital Firms to Manage Deal FlowKey Features to Look for in a Deal Flow Management Tool

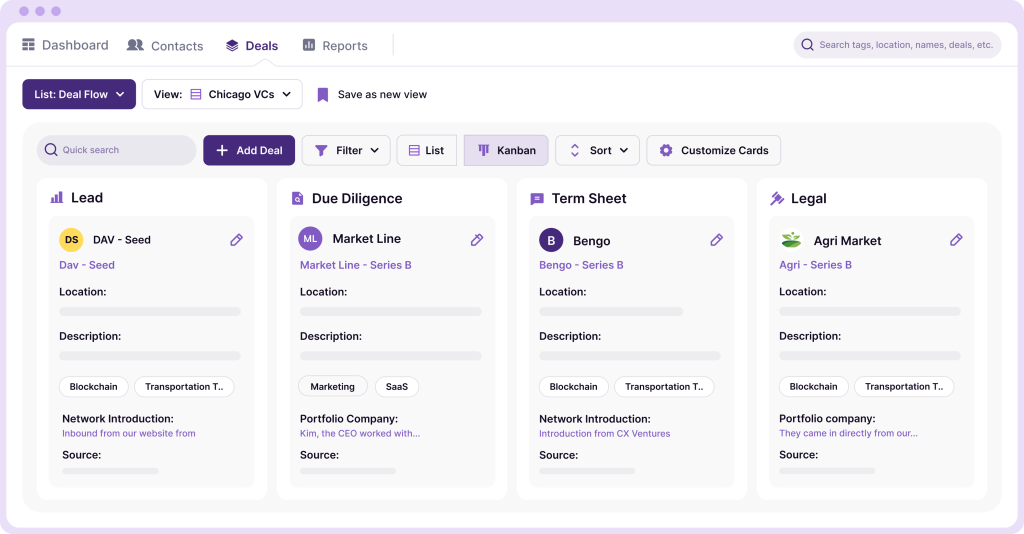

When evaluating deal flow management tools, venture capital firms should prioritize features such as deal tracking, pipeline management, analytics, and collaboration capabilities. A tool that integrates with other platforms, such as CRM systems or email, can significantly enhance efficiency. Additionally, customizable workflows and data security are essential for adapting to the firm's specific processes and safeguarding sensitive information.

Top Deal Flow Management Tools for Venture Capital Firms

Several tools stand out in the market for their ability to meet the demands of venture capital firms. Some of the most popular options include Affinity, DealCloud, Visible.vc, and Altvia. Each of these tools offers unique features tailored to the VC industry, such as relationship intelligence, investor reporting, and portfolio management. Below is a comparison table of these tools:

See Also What is the Best Software for Vc Fund Management?

What is the Best Software for Vc Fund Management?| Tool | Key Features | Pricing |

|---|---|---|

| Affinity | Relationship intelligence, deal tracking, email integration | Custom pricing |

| DealCloud | Pipeline management, analytics, CRM integration | Custom pricing |

| Visible.vc | Investor reporting, portfolio tracking, fundraising tools | Starts at $49/month |

| Altvia | Deal flow management, LP reporting, data visualization | Custom pricing |

How to Choose the Right Tool for Your Firm

Selecting the right deal flow management tool depends on your firm's size, investment focus, and budget. Smaller firms may prioritize affordability and ease of use, while larger firms might require advanced features like AI-driven insights or custom integrations. It's also important to consider the tool's scalability to ensure it can grow with your firm's needs.

Benefits of Using a Deal Flow Management Tool

Implementing a deal flow management tool can provide numerous benefits, including improved efficiency, better decision-making, and enhanced collaboration. These tools centralize data, making it easier to track deals and identify trends. They also reduce manual tasks, allowing teams to focus on strategic activities like sourcing and evaluating opportunities.

See AlsoWhat's the Best Database to Find Venture Capital Deals?Common Challenges in Deal Flow Management and How Tools Can Help

Venture capital firms often face challenges such as data overload, inefficient workflows, and lack of visibility into the pipeline. A robust deal flow management tool can address these issues by providing centralized data storage, automated workflows, and real-time analytics. This ensures that firms can make informed decisions and stay competitive in a fast-paced industry.

By leveraging the right deal flow management tool, venture capital firms can optimize their operations and maximize their investment potential.

See Also Who Are the Best Vc Investors in Luxury Goods and Premium Food Market

Who Are the Best Vc Investors in Luxury Goods and Premium Food MarketWhat is deal flow software in venture capital?

What is Deal Flow Software in Venture Capital?

Deal flow software in venture capital refers to specialized tools designed to help venture capital firms manage, track, and analyze potential investment opportunities. These platforms streamline the process of sourcing, evaluating, and monitoring deals, enabling investors to make data-driven decisions efficiently. The software typically includes features such as pipeline management, communication tracking, and analytics to optimize the deal flow process.

Key Features of Deal Flow Software

Deal flow software offers a range of features tailored to the needs of venture capital firms. These features enhance productivity and ensure that no potential opportunity is overlooked. Below are some of the most critical functionalities:

- Pipeline Management: Organizes and tracks deals at various stages, from initial contact to final investment.

- Communication Tracking: Logs all interactions with founders, co-investors, and other stakeholders.

- Data Analytics: Provides insights into deal performance, portfolio health, and market trends.

Benefits of Using Deal Flow Software

Implementing deal flow software can significantly improve the efficiency and effectiveness of venture capital operations. Here are some of the primary benefits:

- Enhanced Efficiency: Automates repetitive tasks, saving time and reducing manual errors.

- Improved Decision-Making: Offers data-driven insights to evaluate deals more accurately.

- Better Collaboration: Facilitates seamless communication and information sharing among team members.

How Deal Flow Software Improves Investment Strategies

Deal flow software plays a crucial role in refining investment strategies by providing actionable insights and streamlining processes. Here’s how it contributes:

- Market Trend Analysis: Identifies emerging trends and sectors with high growth potential.

- Portfolio Optimization: Helps in balancing risk and reward by analyzing portfolio performance.

- Deal Prioritization: Enables investors to focus on the most promising opportunities.

Popular Deal Flow Software Tools

Several deal flow software tools are widely used in the venture capital industry. These tools vary in features and pricing but share the common goal of optimizing deal management. Below are some notable examples:

- Affinity: Known for its relationship intelligence and CRM capabilities.

- DealCloud: Offers comprehensive deal management and analytics features.

- Visible.vc: Focuses on portfolio management and investor reporting.

What is the best CRM for venture capital?

What is the Best CRM for Venture Capital?

The best CRM for venture capital firms is one that offers deal flow management, investor tracking, and analytics tailored to the unique needs of the industry. A CRM like Affinity, DealCloud, or Salesforce for Venture Capital is often recommended due to their specialized features. These platforms help streamline processes, improve collaboration, and provide insights into portfolio performance.

Key Features to Look for in a Venture Capital CRM

When selecting a CRM for venture capital, consider the following features:

- Deal Pipeline Management: Track and manage potential investments efficiently.

- Investor Relationship Tracking: Maintain detailed records of limited partners (LPs) and their commitments.

- Analytics and Reporting: Generate insights into portfolio performance and fund metrics.

- Integration Capabilities: Seamlessly connect with tools like email, calendars, and financial software.

- Collaboration Tools: Enable team members to share notes, documents, and updates in real-time.

Top CRM Options for Venture Capital Firms

Here are some of the top CRM platforms tailored for venture capital:

- Affinity: Known for its intuitive interface and relationship intelligence features.

- DealCloud: Offers robust deal management and customizable workflows.

- Salesforce for Venture Capital: Provides extensive customization and scalability.

- HubSpot CRM: A cost-effective option with strong marketing and sales tools.

- Zoho CRM: Ideal for smaller firms with limited budgets.

Benefits of Using a CRM in Venture Capital

Implementing a CRM in venture capital offers several advantages:

- Improved Deal Flow Management: Centralize and organize potential investment opportunities.

- Enhanced Investor Relations: Build stronger relationships with LPs through detailed tracking.

- Data-Driven Decision Making: Leverage analytics to make informed investment decisions.

- Time Efficiency: Automate repetitive tasks and focus on high-value activities.

- Scalability: Grow your firm’s operations without compromising on organization.

How to Choose the Right CRM for Your Venture Capital Firm

To select the best CRM for your venture capital firm, follow these steps:

- Assess Your Needs: Identify the specific challenges and goals of your firm.

- Compare Features: Evaluate CRMs based on their deal management, investor tracking, and reporting capabilities.

- Consider Budget: Choose a solution that aligns with your financial constraints.

- Test the Platform: Take advantage of free trials or demos to evaluate usability.

- Check Integration Options: Ensure the CRM integrates with your existing tools and workflows.

What is the 10x rule for venture capital?

What is the 10x Rule in Venture Capital?

The 10x rule in venture capital refers to the expectation that a startup should have the potential to return 10 times the initial investment to its investors. This rule is based on the high-risk nature of venture capital, where many investments fail, and only a few generate significant returns. Investors apply this rule to ensure that the successful investments compensate for the losses incurred from failed ones. For example, if a venture capitalist invests $1 million in a startup, they expect the startup to eventually be worth at least $10 million.

Why is the 10x Rule Important for Investors?

The 10x rule is crucial for venture capitalists because it aligns with their high-risk, high-reward investment strategy. Here’s why:

- Risk Mitigation: Since most startups fail, the 10x rule ensures that the few successful investments cover the losses of the unsuccessful ones.

- Portfolio Strategy: Investors build a diversified portfolio, expecting only a small percentage of startups to achieve 10x returns.

- Attracting Limited Partners: Venture capitalists need to demonstrate the potential for high returns to attract funding from limited partners.

How Do Startups Achieve the 10x Return?

Achieving a 10x return requires startups to focus on scalable and high-growth strategies. Key factors include:

- Market Size: Targeting a large and growing market to ensure significant revenue potential.

- Innovation: Developing a unique product or service that solves a critical problem.

- Execution: Building a strong team capable of executing the business plan effectively.

What Are the Challenges of the 10x Rule?

While the 10x rule is a guiding principle, it comes with challenges:

- High Expectations: Startups face immense pressure to deliver exponential growth, which can lead to burnout or poor decision-making.

- Competition: The market is saturated with startups vying for venture capital, making it harder to stand out.

- Economic Factors: External factors like market downturns can hinder a startup’s ability to achieve 10x returns.

How Do Investors Evaluate 10x Potential?

Venture capitalists use specific criteria to assess whether a startup has 10x potential:

- Traction: Evidence of early customer adoption or revenue growth.

- Team: A capable and experienced founding team with a track record of success.

- Scalability: The ability to grow rapidly without proportional increases in costs.

What is venture capital deal flow analysis?

What is Venture Capital Deal Flow Analysis?

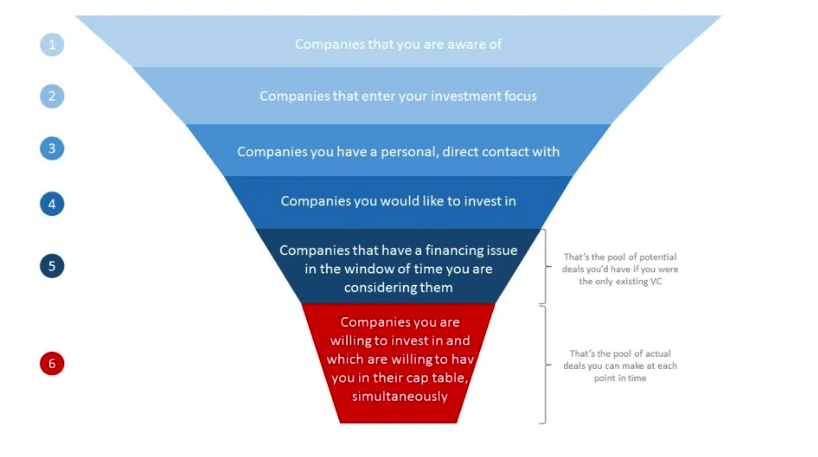

Venture capital deal flow analysis refers to the systematic process of evaluating, tracking, and managing the pipeline of potential investment opportunities that venture capital (VC) firms consider. This process involves assessing the quality, quantity, and viability of startups or businesses seeking funding. The goal is to identify high-potential deals that align with the VC firm's investment thesis and risk appetite. Key components of this analysis include:

- Deal sourcing: Identifying potential investment opportunities through networks, referrals, or platforms.

- Initial screening: Evaluating basic criteria such as market size, team expertise, and business model.

- Due diligence: Conducting in-depth research on the startup's financials, technology, and market potential.

- Portfolio fit: Assessing how the deal aligns with the VC firm's existing portfolio and strategic goals.

- Decision-making: Deciding whether to proceed with the investment, negotiate terms, or pass on the opportunity.

Why is Deal Flow Analysis Important for Venture Capital Firms?

Deal flow analysis is crucial for venture capital firms because it ensures they invest in the most promising startups while minimizing risks. A robust analysis helps firms:

- Optimize resource allocation: Focus time and capital on high-quality deals.

- Enhance decision-making: Make informed choices based on data-driven insights.

- Maintain competitive advantage: Stay ahead by identifying emerging trends and innovative startups.

- Mitigate risks: Avoid poor investments by thoroughly vetting opportunities.

- Build a strong portfolio: Create a diversified and balanced investment portfolio.

Key Metrics Used in Venture Capital Deal Flow Analysis

Venture capital firms rely on specific metrics to evaluate potential deals effectively. These metrics provide a quantitative and qualitative assessment of a startup's potential. Common metrics include:

- Total Addressable Market (TAM): The overall revenue opportunity for the startup's product or service.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Lifetime Value (LTV): The projected revenue a customer will generate over their lifetime.

- Burn Rate: The rate at which the startup spends its capital.

- Team Experience: The background and expertise of the founding team.

Challenges in Venture Capital Deal Flow Analysis

Despite its importance, deal flow analysis presents several challenges for venture capital firms. These challenges can impact the accuracy and efficiency of the evaluation process. Common challenges include:

- Information asymmetry: Limited or incomplete data about the startup.

- High competition: Intense competition for high-quality deals among VC firms.

- Time constraints: Limited time to evaluate and act on opportunities.

- Market volatility: Rapid changes in market conditions and trends.

- Bias and subjectivity: Personal biases affecting investment decisions.

Tools and Technologies for Effective Deal Flow Analysis

To streamline the deal flow analysis process, venture capital firms leverage various tools and technologies. These tools enhance efficiency, accuracy, and collaboration. Popular tools include:

- Customer Relationship Management (CRM) software: Tracks and manages deal pipelines.

- Data analytics platforms: Provides insights into market trends and startup performance.

- Due diligence platforms: Facilitates in-depth research on startups.

- Portfolio management tools: Monitors and analyzes existing investments.

- Artificial Intelligence (AI) tools: Automates deal sourcing and evaluation processes.

Frequently Asked Questions (FAQs)

What features should a deal flow management tool offer for venture capital firms?

A deal flow management tool for venture capital firms should offer a range of features to streamline the investment process. Key functionalities include pipeline tracking, which allows firms to monitor deals at various stages, from initial contact to closing. Data analytics and reporting capabilities are essential for evaluating deal performance and identifying trends. Additionally, the tool should provide collaboration features to enable seamless communication among team members and external stakeholders. Integration with other platforms, such as CRM systems or financial software, is also crucial for maintaining a centralized and efficient workflow.

How does a deal flow management tool improve efficiency for venture capital firms?

A deal flow management tool significantly enhances efficiency by automating repetitive tasks and centralizing data. By using such a tool, venture capital firms can reduce manual errors and save time on administrative tasks like data entry and document management. The tool also enables real-time updates, ensuring that all team members have access to the latest information. This leads to faster decision-making and a more organized approach to evaluating and pursuing investment opportunities. Ultimately, the tool helps firms focus on strategic activities rather than getting bogged down by operational inefficiencies.

What are the key considerations when choosing a deal flow management tool?

When selecting a deal flow management tool, venture capital firms should consider several factors. First, the tool should be user-friendly and intuitive, ensuring that team members can quickly adopt it without extensive training. Second, it should offer customization options to align with the firm's specific workflows and requirements. Security is another critical factor, as the tool will handle sensitive financial and proprietary data. Additionally, firms should evaluate the tool's scalability to ensure it can grow with their business. Finally, customer support and regular updates are essential for maintaining the tool's effectiveness over time.

Can a deal flow management tool help in identifying high-potential investment opportunities?

Yes, a deal flow management tool can play a pivotal role in identifying high-potential investment opportunities. By leveraging data analytics and advanced filtering options, the tool can help firms sift through large volumes of deals to pinpoint those that align with their investment criteria. Features like scoring systems and predictive analytics can further enhance the ability to assess deal quality. Additionally, the tool's ability to track historical data and performance metrics allows firms to refine their selection process over time, increasing the likelihood of identifying successful investments.

Leave a Reply

Our Recommended Articles