What Types of Businesses Do Venture Capitalists Prefer to Invest in

Venture capitalists (VCs) play a pivotal role in fueling innovation and growth by investing in high-potential businesses. However, not all companies attract their attention equally. VCs typically seek businesses with scalable models, disruptive technologies, and the potential for exponential returns. Industries like technology, healthcare, and fintech are often favored due to their rapid growth trajectories and transformative impact. Startups with strong leadership, clear market opportunities, and a competitive edge are more likely to secure funding. Understanding the types of businesses that align with venture capitalists' investment criteria can provide valuable insights for entrepreneurs aiming to navigate the competitive landscape of venture funding.

- What Types of Businesses Do Venture Capitalists Prefer to Invest in?

- What type of companies do venture capitalists invest in?

- What business form do venture capitalists typically prefer?

- What types of businesses are most likely to attract venture capital?

-

What do venture capital firms primarily invest in?

- What Types of Companies Do Venture Capital Firms Invest In?

- What Industries Are Most Attractive to Venture Capital Firms?

- What Stages of Business Do Venture Capital Firms Focus On?

- What Criteria Do Venture Capital Firms Use to Evaluate Investments?

- What Are the Risks and Rewards for Venture Capital Firms?

- Frequently Asked Questions (FAQs)

What Types of Businesses Do Venture Capitalists Prefer to Invest in?

Venture capitalists (VCs) are typically drawn to businesses that demonstrate high growth potential, scalability, and the ability to generate significant returns on investment. They often focus on industries that are innovative, disruptive, and have the potential to transform markets. Below, we explore the types of businesses that attract venture capital funding, along with key factors that make these businesses appealing to investors.

See Also What Are the Questions Venture Capitalists Should Ask During Each Pitch From an Entrepreneur

What Are the Questions Venture Capitalists Should Ask During Each Pitch From an Entrepreneur1. Technology and Software Companies

Technology and software companies are among the most favored by venture capitalists. These businesses often have scalable business models, low marginal costs, and the potential to disrupt traditional industries. Examples include SaaS (Software as a Service) platforms, AI-driven solutions, and fintech innovations. VCs are particularly interested in companies that can rapidly expand their user base and generate recurring revenue.

| Key Factors | Why VCs Invest |

|---|---|

| Scalability | Ability to grow quickly with minimal additional costs. |

| Innovation | Disruptive technologies that solve significant problems. |

| Recurring Revenue | Steady income streams from subscriptions or licenses. |

2. Healthcare and Biotech Startups

Healthcare and biotech startups are another prime target for venture capitalists. These businesses often focus on cutting-edge medical technologies, drug development, or healthtech solutions. The high barriers to entry and the potential for blockbuster products make this sector attractive. VCs look for companies with strong intellectual property, regulatory approvals, and a clear path to market.

See Also What is the Typical Gp Contribution to a Venture Capital Fund?

What is the Typical Gp Contribution to a Venture Capital Fund?| Key Factors | Why VCs Invest |

|---|---|

| High Margins | Potential for significant profitability. |

| Long-Term Impact | Solutions that address critical health challenges. |

| Regulatory Milestones | Clear progress in obtaining approvals. |

3. E-commerce and Consumer Brands

E-commerce and consumer brands that demonstrate strong growth metrics and customer loyalty are also attractive to venture capitalists. VCs often invest in businesses that leverage digital marketing, data analytics, and direct-to-consumer (DTC) models. Companies with a unique value proposition and the ability to scale globally are particularly appealing.

| Key Factors | Why VCs Invest |

|---|---|

| Customer Acquisition | Efficient and scalable marketing strategies. |

| Brand Loyalty | Strong customer retention and repeat purchases. |

| Global Expansion | Potential to enter new markets. |

4. Green Tech and Sustainability Ventures

With the growing emphasis on environmental sustainability, green tech startups are increasingly attracting venture capital. These businesses focus on renewable energy, waste reduction, and sustainable practices. VCs are drawn to companies that align with global sustainability goals and have the potential to create long-term environmental and economic impact.

See Also What Are the Major Advantages of Being a Venture Capitalist?

What Are the Major Advantages of Being a Venture Capitalist?| Key Factors | Why VCs Invest |

|---|---|

| Regulatory Support | Government incentives for green initiatives. |

| Market Demand | Increasing consumer and corporate interest in sustainability. |

| Innovation | Breakthrough technologies in energy and resource management. |

5. Fintech and Financial Services

Fintech companies that offer innovative financial solutions are highly sought after by venture capitalists. These businesses often focus on digital payments, blockchain technology, lending platforms, and wealth management tools. VCs are attracted to fintech startups that can streamline financial processes, reduce costs, and improve accessibility for consumers and businesses.

| Key Factors | Why VCs Invest |

|---|---|

| Market Size | Massive global financial services industry. |

| Disruption Potential | Ability to challenge traditional banking systems. |

| Regulatory Compliance | Strong adherence to financial regulations. |

What type of companies do venture capitalists invest in?

What Are the Good Ways to Calculate Percentage of Equity Giving to Venture Capital When a Startup Gets Funded

What Are the Good Ways to Calculate Percentage of Equity Giving to Venture Capital When a Startup Gets FundedEarly-Stage Startups

Venture capitalists often invest in early-stage startups that show high growth potential. These companies are typically in the seed or Series A funding stages and require capital to develop their products, build their teams, and scale their operations. Key characteristics of these startups include:

- Innovative ideas with the potential to disrupt existing markets.

- A strong founding team with a clear vision and execution plan.

- A scalable business model that can grow rapidly with investment.

Technology-Driven Companies

Venture capitalists are particularly drawn to technology-driven companies that leverage advancements in software, hardware, or artificial intelligence. These companies often operate in sectors like fintech, healthtech, and edtech. Key factors that attract investment include:

See Also Are There Historical Returns Comparing Pe and Vc?

Are There Historical Returns Comparing Pe and Vc?- Cutting-edge technology that solves real-world problems.

- A large and growing market opportunity.

- Proven traction, such as early customer adoption or revenue growth.

High-Growth Industries

Venture capitalists focus on industries with high-growth potential, such as renewable energy, biotechnology, and e-commerce. These sectors are attractive because they offer significant returns on investment due to their rapid expansion. Key considerations include:

- Market trends indicating sustained growth over the long term.

- Regulatory support or incentives that favor industry growth.

- Competitive advantages that position the company as a market leader.

Companies with Scalable Business Models

Venture capitalists prioritize companies with scalable business models that can grow exponentially without proportional increases in costs. Examples include SaaS (Software as a Service) platforms and marketplace businesses. Key features of these models include:

- Recurring revenue streams that ensure long-term profitability.

- Low marginal costs for serving additional customers.

- Global reach potential, allowing for rapid expansion into new markets.

Companies with Strong Exit Potential

Venture capitalists look for companies with strong exit potential, such as those likely to be acquired by larger corporations or go public through an IPO. These companies often have a clear path to profitability and a competitive edge. Key indicators include:

- Strategic partnerships that enhance the company's value.

- A track record of meeting milestones and achieving growth targets.

- Interest from potential acquirers or public market investors.

What business form do venture capitalists typically prefer?

Why Venture Capitalists Prefer Corporations

Venture capitalists typically prefer investing in corporations due to their structured and scalable nature. Corporations offer several advantages that align with the goals of venture capitalists:

- Limited Liability: Shareholders are not personally liable for the company's debts, reducing financial risk.

- Ease of Transferring Ownership: Shares can be easily bought and sold, providing liquidity for investors.

- Ability to Raise Capital: Corporations can issue stocks and bonds, making it easier to attract additional funding.

The Role of C-Corporations in Venture Capital

C-Corporations are the most common business form favored by venture capitalists. This preference is driven by specific characteristics:

- Tax Flexibility: C-Corporations can retain earnings and reinvest them without immediate tax implications.

- Investor-Friendly Structure: They allow for multiple classes of stock, which is useful for creating preferred shares for investors.

- Global Recognition: C-Corporations are widely recognized and accepted, making them ideal for international expansion.

Why LLCs Are Less Preferred by Venture Capitalists

While LLCs (Limited Liability Companies) offer flexibility, they are less favored by venture capitalists for several reasons:

- Tax Complexity: LLCs are typically pass-through entities, which can complicate tax situations for investors.

- Limited Growth Potential: They are less suited for large-scale fundraising compared to corporations.

- Ownership Restrictions: Transferring ownership in an LLC can be more cumbersome, which is a disadvantage for investors seeking liquidity.

The Importance of Preferred Stock in Venture Capital Deals

Venture capitalists often insist on preferred stock when investing in corporations. This type of stock provides specific benefits:

- Priority in Dividends: Preferred stockholders receive dividends before common stockholders.

- Liquidation Preference: In the event of a sale or liquidation, preferred stockholders are paid out before common stockholders.

- Voting Rights: Preferred stock often comes with enhanced voting rights, giving investors more control over company decisions.

How Corporations Facilitate Exit Strategies for Venture Capitalists

Corporations are preferred by venture capitalists because they facilitate smoother exit strategies, such as IPOs or acquisitions:

- IPO Readiness: Corporations are better positioned to go public, providing a lucrative exit for investors.

- Mergers and Acquisitions: The corporate structure simplifies the process of merging with or being acquired by another company.

- Clear Valuation: Corporations have a more straightforward valuation process, making it easier to negotiate deals.

What types of businesses are most likely to attract venture capital?

Technology and Software Startups

Technology and software startups are among the most attractive businesses for venture capital due to their high growth potential and scalability. These companies often operate in industries like artificial intelligence, cloud computing, and SaaS (Software as a Service). Venture capitalists are drawn to these businesses because:

- Scalability: Software products can be easily scaled to serve a global market with minimal additional costs.

- Innovation: These startups often introduce disruptive technologies that can transform industries.

- High Margins: Software businesses typically have high-profit margins due to low production and distribution costs.

Biotechnology and Healthcare

Biotechnology and healthcare companies are another prime target for venture capital, especially those focused on groundbreaking medical treatments, diagnostics, or healthcare technology. These businesses attract investment because:

- High Impact: Innovations in this sector can significantly improve or save lives, creating substantial value.

- Regulatory Support: Governments often provide incentives and funding for healthcare advancements.

- Long-Term Growth: The healthcare industry is recession-resistant and has consistent demand.

Fintech and Financial Services

Fintech startups, which leverage technology to improve financial services, are highly appealing to venture capitalists. These businesses often focus on areas like digital payments, blockchain, and personal finance management. Key reasons for their attractiveness include:

- Market Size: The financial services industry is massive, offering significant opportunities for disruption.

- Efficiency Gains: Fintech solutions often reduce costs and improve efficiency for both consumers and businesses.

- Regulatory Tailwinds: Many governments are encouraging innovation in financial services through supportive regulations.

E-commerce and Consumer Goods

E-commerce and consumer goods businesses, particularly those with unique value propositions or direct-to-consumer models, are also likely to attract venture capital. These companies stand out because:

- Global Reach: Online platforms enable businesses to access a worldwide customer base.

- Data-Driven Insights: E-commerce companies can leverage data to optimize marketing and operations.

- Brand Loyalty: Strong consumer brands can generate recurring revenue and long-term value.

Clean Energy and Sustainability

Clean energy and sustainability-focused businesses are increasingly attracting venture capital as the world shifts toward greener solutions. These companies often focus on renewable energy, waste reduction, or sustainable materials. Reasons for their appeal include:

- Environmental Impact: Investors are drawn to businesses that address climate change and environmental challenges.

- Government Incentives: Many countries offer subsidies and tax breaks for clean energy initiatives.

- Market Demand: Consumers and corporations are increasingly prioritizing sustainability in their purchasing decisions.

What do venture capital firms primarily invest in?

What Types of Companies Do Venture Capital Firms Invest In?

Venture capital firms primarily invest in startups and early-stage companies with high growth potential. These companies are often in sectors like technology, healthcare, and biotechnology. The goal is to support businesses that can scale rapidly and generate significant returns. Key characteristics of these companies include:

- Innovative business models or disruptive technologies.

- Strong potential for market expansion.

- A capable and experienced management team.

What Industries Are Most Attractive to Venture Capital Firms?

Venture capital firms are particularly drawn to industries that offer high growth opportunities and technological advancements. The most attractive sectors include:

- Technology: Software, artificial intelligence, and fintech.

- Healthcare: Biotechnology, medical devices, and digital health solutions.

- Clean Energy: Renewable energy and sustainability-focused startups.

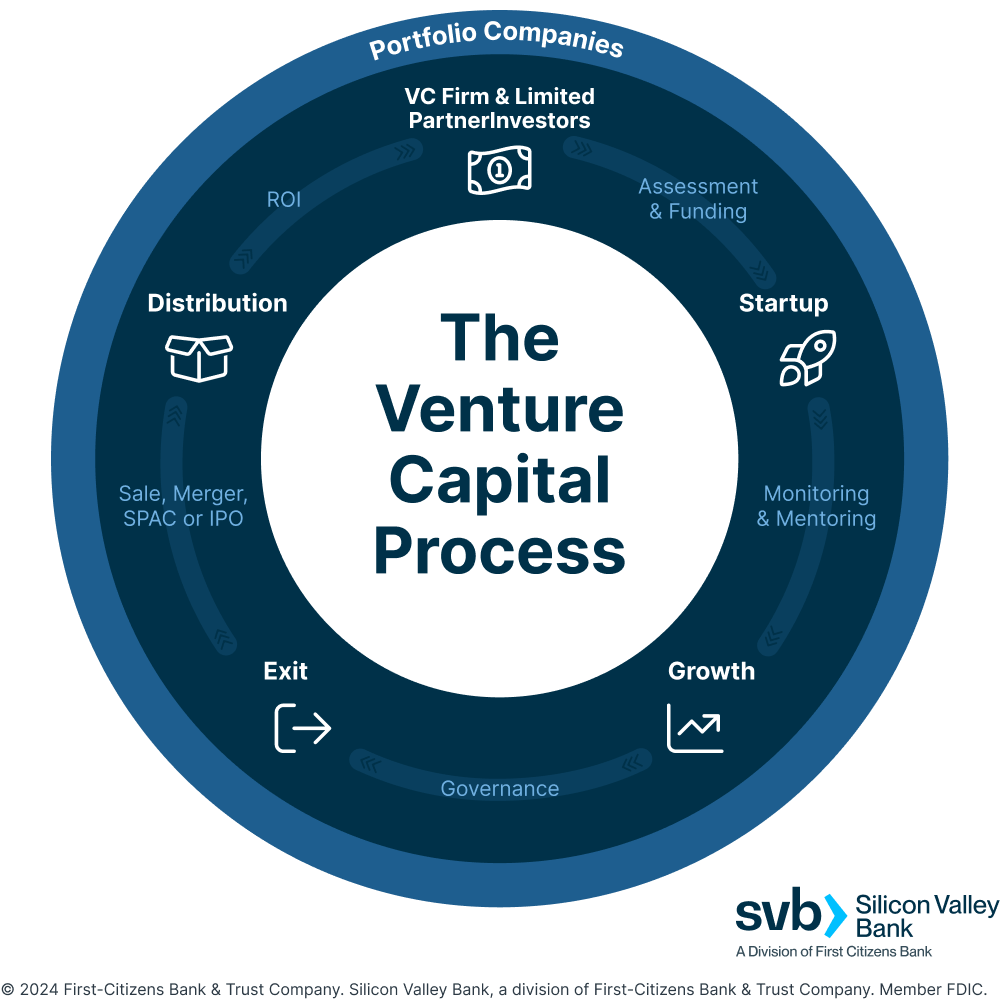

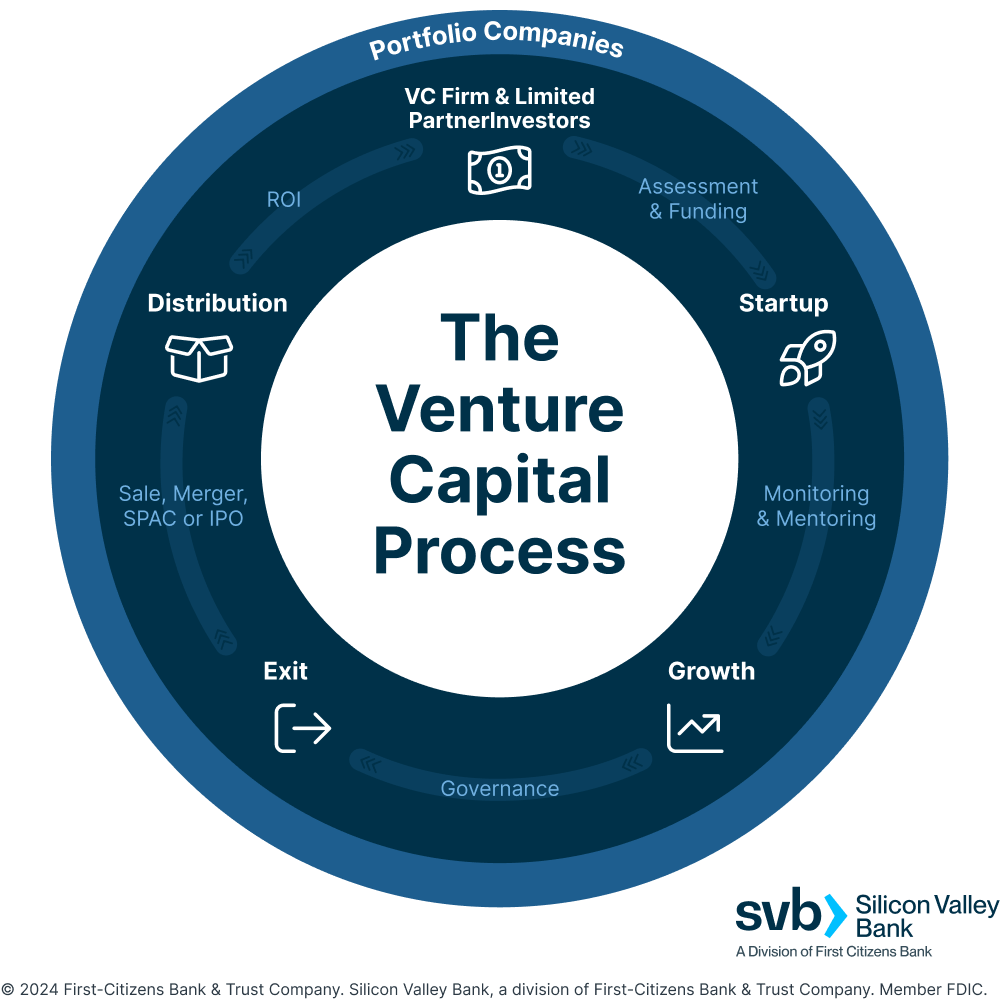

What Stages of Business Do Venture Capital Firms Focus On?

Venture capital firms typically invest in businesses at specific stages of their development. These stages include:

- Seed Stage: Early funding to develop a product or idea.

- Early Stage: Funding for companies with a working prototype or initial market traction.

- Growth Stage: Investments to scale operations and expand market reach.

What Criteria Do Venture Capital Firms Use to Evaluate Investments?

Venture capital firms use a set of criteria to assess potential investments. These include:

- Market Size: The potential for the company to capture a large market share.

- Team Expertise: The experience and capability of the founding team.

- Scalability: The ability to grow rapidly with minimal incremental costs.

What Are the Risks and Rewards for Venture Capital Firms?

Investing in startups and early-stage companies involves both risks and rewards. Key points include:

- High Risk: Many startups fail, leading to potential losses.

- High Reward: Successful investments can yield exponential returns.

- Portfolio Diversification: Firms mitigate risk by investing in multiple companies across different sectors.

Frequently Asked Questions (FAQs)

What industries do venture capitalists typically focus on?

Venture capitalists often prefer to invest in high-growth industries such as technology, biotechnology, clean energy, and artificial intelligence. These sectors are known for their potential to deliver significant returns on investment due to rapid innovation and scalability. Additionally, industries like fintech and e-commerce are also popular because they address large markets and have the potential to disrupt traditional business models.

Do venture capitalists invest in early-stage startups?

Yes, venture capitalists frequently invest in early-stage startups, particularly those with a strong innovative idea and a scalable business model. However, they often look for startups that have already demonstrated some level of market validation, such as a working prototype, initial traction, or a clear path to profitability. Early-stage investments are considered high-risk but can yield substantial rewards if the startup succeeds.

What characteristics make a business attractive to venture capitalists?

Venture capitalists are drawn to businesses with a strong management team, a unique value proposition, and a large addressable market. They also look for companies with a clear competitive advantage and the potential for rapid growth. Additionally, businesses that operate in industries with high barriers to entry or those that can scale quickly with minimal incremental costs are particularly appealing to venture capitalists.

Are venture capitalists interested in businesses outside of tech?

While technology remains a dominant focus for venture capitalists, they also invest in non-tech industries such as healthcare, consumer goods, and education. These industries can offer significant growth opportunities, especially when they incorporate innovative technologies or business models. For example, a healthcare startup leveraging AI for diagnostics or a consumer goods company using direct-to-consumer strategies might attract venture capital interest.

Leave a Reply

Our Recommended Articles