Which Vc Firms Have a Business Development Team That Works With Portfolio Companies

Venture capital (VC) firms play a pivotal role in shaping the success of startups and portfolio companies. Beyond providing capital, many VC firms offer strategic support through dedicated business development teams. These teams work closely with portfolio companies to unlock growth opportunities, forge partnerships, and navigate market challenges. By leveraging their networks, industry expertise, and resources, business development teams help startups scale efficiently and achieve long-term success. This article explores which VC firms prioritize this value-added service, highlighting how their business development efforts contribute to the growth and sustainability of the companies they invest in. Understanding these dynamics can provide valuable insights for entrepreneurs seeking more than just financial backing.

-

Which VC Firms Have a Business Development Team That Works With Portfolio Companies?

- 1. What is a Business Development Team in VC Firms?

- 2. Why Do VC Firms Invest in Business Development Teams?

- 3. Top VC Firms with Dedicated Business Development Teams

- 4. How Do Business Development Teams Add Value to Portfolio Companies?

- 5. Key Metrics for Evaluating Business Development Teams in VC Firms

- What is business development in venture capital?

- How do VCs help portfolio companies?

- Who are the Tier 1 VCs?

- What is portfolio management in VC?

-

Frequently Asked Questions by our Community

- Which venture capital firms have dedicated business development teams for portfolio companies?

- What services do business development teams at VC firms provide to startups?

- How do VC firms with business development teams differ from those without?

- Can startups request assistance from a VC firm's business development team?

Which VC Firms Have a Business Development Team That Works With Portfolio Companies?

1. What is a Business Development Team in VC Firms?

A business development team in venture capital (VC) firms is a specialized group that focuses on helping portfolio companies grow by providing strategic support, networking opportunities, and access to resources. These teams often assist with partnerships, customer acquisition, market expansion, and fundraising efforts. Their goal is to maximize the success of portfolio companies, which in turn benefits the VC firm.

See Also What Does It Mean to Be a Partner in a Venture Capital Firm?

What Does It Mean to Be a Partner in a Venture Capital Firm?2. Why Do VC Firms Invest in Business Development Teams?

VC firms invest in business development teams to enhance the value of their portfolio companies. These teams act as a bridge between startups and potential partners, customers, or investors. By offering hands-on support, VC firms can increase the likelihood of their portfolio companies achieving significant milestones, such as scaling operations or securing additional funding.

3. Top VC Firms with Dedicated Business Development Teams

Several prominent VC firms are known for their dedicated business development teams. These include:

- Andreessen Horowitz (a16z): Known for its extensive network and operational support.

- Sequoia Capital: Offers strategic guidance and access to global markets.

- Accel: Provides tailored business development resources for startups.

- Bessemer Venture Partners: Focuses on scaling portfolio companies through partnerships.

- GV (formerly Google Ventures): Leverages Google’s ecosystem for portfolio growth.

What Are the Advantages and Disadvantages of Using Each of the Top Venture Capital Firms for Founders

What Are the Advantages and Disadvantages of Using Each of the Top Venture Capital Firms for Founders4. How Do Business Development Teams Add Value to Portfolio Companies?

Business development teams add value by:

- Facilitating introductions to potential partners, customers, and investors.

- Providing market insights and competitive analysis.

- Assisting with go-to-market strategies and product launches.

- Offering mentorship and strategic advice from experienced professionals.

- Enabling access to exclusive networks and industry events.

5. Key Metrics for Evaluating Business Development Teams in VC Firms

When evaluating the effectiveness of a business development team, consider the following metrics:

- Number of successful partnerships facilitated.

- Growth in revenue for portfolio companies.

- Increase in customer acquisition rates.

- Number of follow-on funding rounds secured.

- Portfolio company survival and success rates.

Are There Any Venture Capital Funds or Firms That Focus Specifically on the College Startup Scene Nationwide

Are There Any Venture Capital Funds or Firms That Focus Specifically on the College Startup Scene Nationwide| VC Firm | Business Development Focus | Notable Portfolio Companies |

|---|---|---|

| Andreessen Horowitz | Operational support and networking | Airbnb, Lyft, Slack |

| Sequoia Capital | Global market expansion | Apple, Google, WhatsApp |

| Accel | Tailored business development | Facebook, Dropbox, Spotify |

| Bessemer Venture Partners | Partnerships and scaling | LinkedIn, Pinterest, Shopify |

| GV (Google Ventures) | Leveraging Google’s ecosystem | Uber, Nest, Stripe |

What is business development in venture capital?

:max_bytes(150000):strip_icc()/bdc.asp-Final-6c4e490db7bb494194b4777023761e3a.jpg)

Understanding Business Development in Venture Capital

Business development in venture capital refers to the strategic activities aimed at fostering growth and creating value for portfolio companies. This involves identifying and capitalizing on opportunities that can enhance a company's market position, revenue streams, and overall success. Key responsibilities include:

- Market Research: Analyzing industry trends and identifying emerging markets.

- Partnerships: Forming strategic alliances to drive growth.

- Networking: Building relationships with potential investors, clients, and partners.

Role of Business Development Managers in VC Firms

Business development managers in venture capital firms play a crucial role in bridging the gap between startups and growth opportunities. Their primary duties include:

- Deal Sourcing: Identifying and evaluating potential investment opportunities.

- Due Diligence: Conducting thorough assessments of target companies.

- Value Addition: Providing strategic guidance to portfolio companies to ensure their growth and scalability.

Strategies for Effective Business Development in VC

Effective business development in venture capital requires a combination of strategic planning and execution. Key strategies include:

- Leveraging Networks: Utilizing existing connections to open doors for portfolio companies.

- Focusing on Innovation: Encouraging portfolio companies to innovate and stay ahead of competitors.

- Scaling Operations: Assisting companies in scaling their operations efficiently to meet market demands.

Challenges in Business Development for Venture Capital

Business development in venture capital is not without its challenges. Some of the common obstacles include:

- Market Volatility: Navigating through unpredictable market conditions.

- Competition: Facing intense competition from other VC firms and investors.

- Resource Allocation: Ensuring optimal allocation of resources to maximize returns.

Measuring Success in Business Development

Success in business development within venture capital can be measured through various metrics. Important indicators include:

- Portfolio Growth: Monitoring the growth and performance of portfolio companies.

- Return on Investment (ROI): Evaluating the financial returns generated from investments.

- Strategic Milestones: Achieving key milestones that align with the overall business strategy.

How do VCs help portfolio companies?

Providing Capital for Growth

Venture capitalists (VCs) provide capital to portfolio companies to fuel their growth and expansion. This funding is often used for:

- Scaling operations: Expanding production, hiring talent, or entering new markets.

- Research and development: Innovating new products or improving existing ones.

- Marketing and sales: Increasing brand visibility and customer acquisition.

Strategic Guidance and Mentorship

VCs offer strategic guidance to help portfolio companies navigate challenges and make informed decisions. This includes:

- Business planning: Assisting with long-term strategies and goal setting.

- Operational expertise: Sharing insights on improving efficiency and processes.

- Mentorship: Providing access to experienced advisors and industry experts.

Access to Networks and Partnerships

VCs connect portfolio companies with valuable networks and partnerships, which can include:

- Industry connections: Introducing companies to potential clients, suppliers, or collaborators.

- Investor networks: Facilitating follow-on funding rounds or introductions to other investors.

- Talent acquisition: Helping recruit top-tier executives and employees.

Assisting with Fundraising and Financial Planning

VCs play a crucial role in helping portfolio companies with fundraising and financial planning by:

- Preparing for future rounds: Advising on valuation, pitch decks, and investor relations.

- Financial modeling: Assisting with budgeting, forecasting, and cash flow management.

- Exit strategies: Guiding companies on IPOs, acquisitions, or mergers.

Enhancing Credibility and Market Positioning

VCs help portfolio companies build credibility and improve their market positioning through:

- Brand association: Leveraging the VC's reputation to gain trust and visibility.

- Media exposure: Securing press coverage and public relations opportunities.

- Industry validation: Providing endorsements that attract customers and partners.

Who are the Tier 1 VCs?

What Defines a Tier 1 Venture Capital Firm?

Tier 1 venture capital firms are distinguished by their extensive track records, significant capital under management, and the ability to consistently identify and invest in high-growth startups. These firms often lead funding rounds and have a reputation for backing companies that achieve substantial exits, such as IPOs or acquisitions. Key characteristics include:

- Proven success in funding startups that become industry leaders.

- Access to large pools of capital, often exceeding billions of dollars.

- A network of experienced partners and advisors who provide strategic guidance.

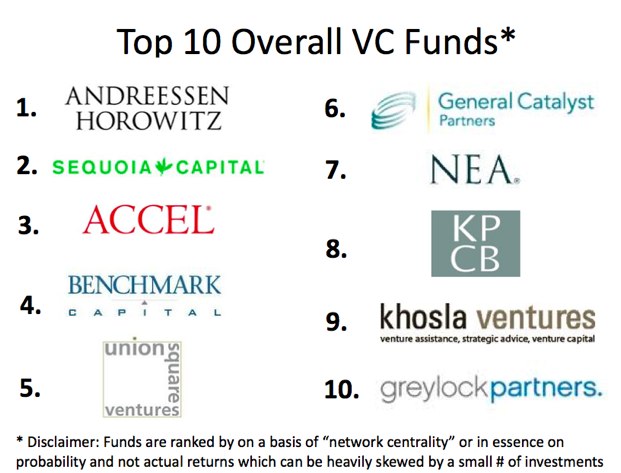

Top Tier 1 Venture Capital Firms in the Industry

Some of the most prominent Tier 1 VCs include firms like Sequoia Capital, Andreessen Horowitz, and Accel. These firms are known for their ability to identify and nurture groundbreaking companies. Notable examples include:

- Sequoia Capital: Backed companies like Apple, Google, and Airbnb.

- Andreessen Horowitz: Known for investments in Facebook, Twitter, and Slack.

- Accel: Early investor in Facebook, Dropbox, and Spotify.

How Tier 1 VCs Differ from Other Venture Capital Firms

Tier 1 VCs stand out due to their ability to secure access to the most promising startups and their influence in shaping industries. Unlike smaller or newer firms, Tier 1 VCs often have:

- Exclusive deal flow, giving them first access to top-tier startups.

- The ability to lead large funding rounds, often in the hundreds of millions.

- A global presence, with offices and networks spanning multiple continents.

The Role of Tier 1 VCs in Startup Ecosystems

Tier 1 venture capital firms play a critical role in fostering innovation by providing not only capital but also mentorship and strategic resources. Their involvement often signals credibility to other investors and stakeholders. Key contributions include:

- Mentorship from seasoned entrepreneurs and industry experts.

- Access to corporate partnerships and global markets.

- Support in scaling operations and achieving sustainable growth.

Challenges Faced by Tier 1 Venture Capital Firms

Despite their success, Tier 1 VCs face challenges such as increased competition and the pressure to maintain high returns. Common obstacles include:

- Intense competition from emerging VC firms and corporate investors.

- The need to consistently identify and invest in unicorn startups.

- Managing portfolio risks in volatile markets.

What is portfolio management in VC?

What is Portfolio Management in Venture Capital?

Portfolio management in venture capital (VC) refers to the strategic oversight and optimization of a collection of investments made by a VC firm. This involves monitoring, supporting, and managing the performance of portfolio companies to maximize returns. The process includes activities such as tracking financial metrics, providing strategic guidance, and ensuring alignment with the VC firm's investment thesis. Effective portfolio management helps mitigate risks and enhances the potential for successful exits, such as acquisitions or IPOs.

Key Responsibilities in VC Portfolio Management

VC portfolio managers have several critical responsibilities to ensure the success of their investments. These include:

- Monitoring financial performance: Regularly reviewing revenue, burn rate, and other key metrics to assess the health of portfolio companies.

- Providing strategic guidance: Assisting startups with business strategy, scaling operations, and entering new markets.

- Facilitating networking opportunities: Connecting portfolio companies with potential partners, customers, and investors.

Why Portfolio Management is Crucial for VC Success

Portfolio management is essential for VC firms because it directly impacts the overall success of their investments. Key reasons include:

- Risk mitigation: Diversifying investments and actively managing them reduces the likelihood of significant losses.

- Value creation: By providing resources and expertise, VCs can help startups grow faster and achieve milestones.

- Alignment with investment goals: Ensures that portfolio companies are on track to meet the VC firm's return objectives.

Tools and Techniques Used in VC Portfolio Management

VC firms utilize various tools and techniques to manage their portfolios effectively. These include:

- Data analytics platforms: Tools like Tableau or Power BI to track and visualize performance metrics.

- Regular reporting: Quarterly or monthly updates from portfolio companies to assess progress.

- Board participation: Active involvement in board meetings to influence strategic decisions.

Challenges in VC Portfolio Management

Managing a VC portfolio comes with its own set of challenges, such as:

- Resource allocation: Balancing time and resources across multiple investments can be difficult.

- Market volatility: External economic factors can impact the performance of portfolio companies.

- Founder dynamics: Managing relationships with founders and ensuring alignment with the VC's vision.

Frequently Asked Questions by our Community

Which venture capital firms have dedicated business development teams for portfolio companies?

Several venture capital firms have established dedicated business development teams to support their portfolio companies. Firms like Andreessen Horowitz (a16z), Sequoia Capital, and Accel are known for their robust business development teams. These teams focus on helping startups with strategic partnerships, market expansion, and customer acquisition. By leveraging their networks and expertise, these firms aim to accelerate the growth of their portfolio companies.

What services do business development teams at VC firms provide to startups?

Business development teams at VC firms offer a wide range of services to startups. These include introductions to potential partners, assistance with fundraising, and guidance on scaling operations. Additionally, they help startups navigate industry-specific challenges and provide access to mentorship programs. The goal is to ensure that portfolio companies have the resources and connections needed to succeed in competitive markets.

How do VC firms with business development teams differ from those without?

VC firms with business development teams differentiate themselves by offering hands-on support beyond just financial investment. These firms actively engage with their portfolio companies to provide strategic advice and operational assistance. In contrast, firms without such teams may focus solely on capital allocation and board oversight. The presence of a business development team often signals a deeper commitment to the long-term success of their investments.

Can startups request assistance from a VC firm's business development team?

Yes, startups can typically request assistance from a VC firm's business development team, especially if they are part of the firm's portfolio. These teams are usually proactive in identifying areas where they can add value, but startups are encouraged to communicate their specific needs. Whether it's help with partnership negotiations, market entry strategies, or talent acquisition, the business development team is there to provide tailored support to drive growth.

Leave a Reply

Our Recommended Articles