Which Venture Capitalists Tend to Like Investing in Music Related Startups

The music industry has undergone a significant transformation in recent years, driven by technological advancements and shifting consumer behaviors. This evolution has created a fertile ground for innovative startups aiming to disrupt traditional models and redefine how music is created, distributed, and consumed. Venture capitalists, always on the lookout for high-growth opportunities, have increasingly turned their attention to music-related ventures. However, not all investors approach this space equally. Certain venture capitalists have developed a keen interest in music startups, often influenced by their expertise, portfolio focus, or belief in the sector's potential. This article explores which venture capitalists are most inclined to invest in music-related startups and why.

- Which Venture Capitalists Tend to Like Investing in Music-Related Startups

- Who invests in music artists?

-

What business form do venture capitalists typically prefer?

- Why Do Venture Capitalists Prefer Corporations?

- What Are the Key Features of a Corporation That Attract Venture Capitalists?

- How Does the Corporate Structure Facilitate Venture Capital Investments?

- What Are the Alternatives to Corporations for Venture Capitalists?

- What Legal Considerations Influence Venture Capitalists' Choice of Business Form?

- How do I find investors for my music?

- What type of companies do venture capitalists invest in?

- Frequently Asked Questions (FAQs)

1. Venture Capitalists with a Focus on Media and Entertainment

Venture capitalists who specialize in media and entertainment are often drawn to music-related startups. These investors understand the unique dynamics of the music industry, including content creation, distribution, and monetization strategies. They are more likely to invest in startups that offer innovative solutions for streaming platforms, artist discovery, or music licensing. Examples include firms like Andreessen Horowitz and Sequoia Capital, which have a history of backing tech-driven entertainment ventures.

See Also What Are Some of the Top Vcs in the Travel and Tourism Space?

What Are Some of the Top Vcs in the Travel and Tourism Space?2. Investors with a Passion for Music and Culture

Some venture capitalists are personally passionate about music and culture, which drives their investment decisions. These investors often seek startups that align with their interests, such as those focused on live events, music production tools, or fan engagement platforms. Their enthusiasm for the industry can lead to more hands-on involvement and mentorship for the startups they fund. Notable examples include Sony Music Entertainment and Warner Music Group, which actively invest in emerging music tech companies.

3. Early-Stage Investors in Tech-Driven Music Startups

Early-stage venture capitalists are particularly interested in tech-driven music startups that leverage artificial intelligence, blockchain, or data analytics. These investors are attracted to startups that disrupt traditional models, such as royalty tracking systems, AI-generated music, or decentralized music platforms. Firms like Y Combinator and 500 Startups have a track record of supporting innovative music tech companies in their early phases.

See Also What Do Venture Capitalists Look for When Deciding to Invest in an Idea and a Team

What Do Venture Capitalists Look for When Deciding to Invest in an Idea and a Team4. Venture Capitalists Focused on Creator Economy Platforms

With the rise of the creator economy, many venture capitalists are investing in platforms that empower musicians and content creators. These startups often provide tools for monetization, audience growth, or collaboration. Investors in this space are drawn to companies that enable artists to take control of their careers, such as Patreon or Bandcamp. Firms like Union Square Ventures and Index Ventures are known for their focus on creator-centric platforms.

5. Investors Targeting Global Music Markets

Venture capitalists with a global perspective often invest in startups that cater to international music markets. These investors recognize the potential of emerging markets and seek startups that address challenges like localized content distribution or cross-border royalty payments. Examples include Tiger Global Management and SoftBank Vision Fund, which have backed companies expanding music services in regions like Asia, Africa, and Latin America.

See Also Where Can I Find Examples of Investment Deal Memos Writen by Venture Capitalists

Where Can I Find Examples of Investment Deal Memos Writen by Venture Capitalists| Venture Capitalist | Focus Area | Notable Investments |

|---|---|---|

| Andreessen Horowitz | Media and Entertainment | Spotify, SoundCloud |

| Sony Music Entertainment | Music and Culture | AWAL, Kobalt |

| Y Combinator | Tech-Driven Startups | Amper Music, Splice |

| Union Square Ventures | Creator Economy | Patreon, Bandcamp |

| Tiger Global Management | Global Music Markets | Gaana, JioSaavn |

Who invests in music artists?

Record Labels

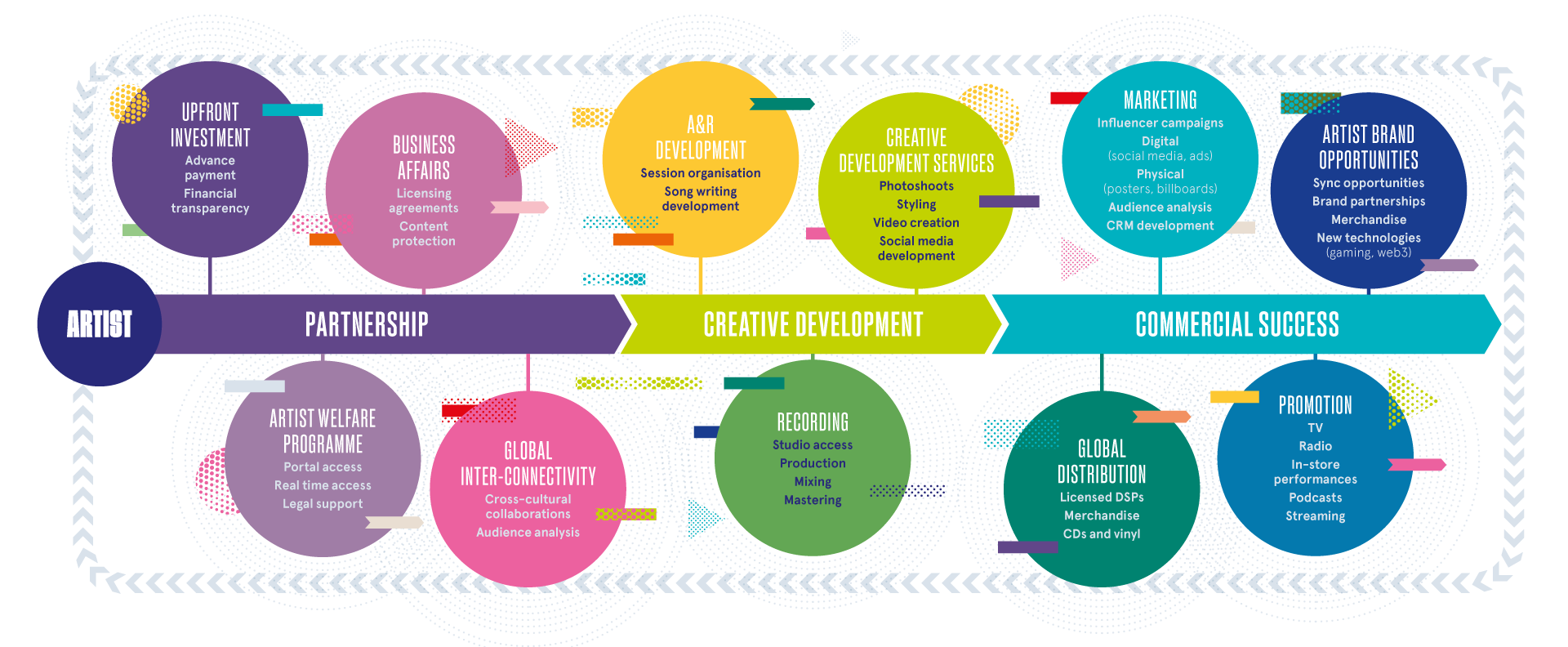

Record labels are one of the primary investors in music artists. They provide financial support, marketing, and distribution to help artists reach a wider audience. Here are some key points about record labels:

See Also Which Scenario Would a Venture Capitalist Prefer?

Which Scenario Would a Venture Capitalist Prefer?- Financial Backing: Record labels often offer advances to artists, which are essentially loans that need to be recouped from future earnings.

- Marketing and Promotion: Labels invest heavily in promoting artists through various channels, including social media, radio, and television.

- Distribution Networks: They have established networks to distribute music globally, ensuring that the artist's work reaches a broad audience.

Music Publishers

Music publishers play a crucial role in investing in music artists by managing their intellectual property and ensuring they earn royalties. Here are some key points about music publishers:

- Royalty Collection: Publishers help artists collect royalties from various sources, including streaming platforms, radio, and live performances.

- Licensing Deals: They negotiate licensing deals for the use of an artist's music in films, commercials, and other media.

- Creative Support: Publishers often provide creative support, helping artists refine their songs and connect with other industry professionals.

Private Investors and Venture Capitalists

Private investors and venture capitalists are increasingly investing in music artists, especially in the digital age. Here are some key points about private investors and venture capitalists:

See Also Which of the Following Statements is Not True About Entrepreneurship It Creates a New Business It Creates New Jobs or Its About Profit Maximization

Which of the Following Statements is Not True About Entrepreneurship It Creates a New Business It Creates New Jobs or Its About Profit Maximization- Equity Investments: These investors may take an equity stake in an artist's career, sharing in the profits from album sales, tours, and merchandise.

- Tech Startups: Many venture capitalists invest in tech startups that support artists, such as streaming platforms and music distribution services.

- Strategic Partnerships: They often form strategic partnerships with artists to leverage their brand and reach new markets.

Music Streaming Platforms

Music streaming platforms like Spotify and Apple Music also invest in music artists through various initiatives. Here are some key points about music streaming platforms:

- Exclusive Deals: Platforms may offer exclusive deals to artists, providing them with significant financial incentives to release their music exclusively on their platform.

- Playlist Placement: Being featured on popular playlists can significantly boost an artist's visibility and streaming numbers.

- Artist Development Programs: Some platforms have programs designed to help emerging artists grow their careers through funding and mentorship.

Fan Funding and Crowdfunding

Fan funding and crowdfunding have become popular ways for music artists to secure investment directly from their fans. Here are some key points about fan funding and crowdfunding:

- Direct Support: Fans can directly support their favorite artists by contributing to crowdfunding campaigns, often in exchange for exclusive content or experiences.

- Creative Control: Artists retain full creative control over their projects, as they are not beholden to traditional investors or labels.

- Community Building: Crowdfunding helps artists build a loyal community of supporters who are invested in their success.

What business form do venture capitalists typically prefer?

:max_bytes(150000):strip_icc()/venture-capitalist-4187107-1-279ebe8e1bb9410a9f8c3cf7dc47c7cb.jpg)

Why Do Venture Capitalists Prefer Corporations?

Venture capitalists typically prefer investing in corporations due to their structured and scalable nature. Corporations offer several advantages that align with the goals of venture capitalists:

- Limited Liability: Shareholders are not personally liable for the company's debts, reducing financial risk.

- Ease of Raising Capital: Corporations can issue stock, making it easier to attract investors and raise funds.

- Transferability of Shares: Ownership can be easily transferred, providing liquidity for investors.

What Are the Key Features of a Corporation That Attract Venture Capitalists?

Corporations possess specific features that make them attractive to venture capitalists:

- Separate Legal Entity: A corporation is legally distinct from its owners, ensuring continuity and stability.

- Professional Management: Corporations often have experienced management teams, which increases the likelihood of success.

- Scalability: The corporate structure supports growth and expansion, which is crucial for high-return investments.

How Does the Corporate Structure Facilitate Venture Capital Investments?

The corporate structure is designed to facilitate investments and provide a clear framework for venture capitalists:

- Equity Financing: Corporations can issue shares, allowing venture capitalists to acquire ownership stakes.

- Board Representation: Investors often secure seats on the board, enabling them to influence strategic decisions.

- Exit Strategies: Corporations provide clear pathways for exits, such as IPOs or acquisitions, ensuring potential returns.

What Are the Alternatives to Corporations for Venture Capitalists?

While corporations are preferred, venture capitalists may consider other business forms under specific circumstances:

- Limited Liability Companies (LLCs): Offer flexibility in management and tax benefits but lack the scalability of corporations.

- Partnerships: Rarely used due to unlimited liability and lack of structure for large-scale investments.

- Sole Proprietorships: Not suitable for venture capital due to personal liability and limited growth potential.

What Legal Considerations Influence Venture Capitalists' Choice of Business Form?

Legal factors play a significant role in determining the preferred business form for venture capitalists:

- Regulatory Compliance: Corporations are subject to clear regulations, providing transparency and reducing legal risks.

- Tax Implications: Corporations may face double taxation, but this is often outweighed by the benefits of scalability and investment potential.

- Investor Protection: Corporate laws provide robust protections for shareholders, ensuring their interests are safeguarded.

How do I find investors for my music?

1. Build a Strong Music Portfolio

To attract investors, you need a compelling music portfolio that showcases your talent and potential. This includes:

- High-quality recordings of your best tracks.

- A professional press kit with your bio, photos, and achievements.

- Evidence of your fan base, such as social media followers or streaming numbers.

2. Network with Industry Professionals

Networking is crucial for finding investors. Attend music industry events and connect with:

- Music producers and record label executives.

- Music lawyers who can introduce you to potential investors.

- Other artists who have successfully secured funding.

3. Leverage Crowdfunding Platforms

Crowdfunding is a popular way to raise funds for music projects. Consider platforms like:

- Kickstarter or Indiegogo for creative projects.

- Patreon for ongoing support from fans.

- Offer exclusive rewards, such as early access to music or personalized merchandise.

4. Pitch to Music-Specific Investors

Some investors specialize in the music industry. Research and approach:

- Music venture capitalists who fund emerging artists.

- Angel investors with a passion for music.

- Music incubators or accelerators that provide funding and mentorship.

5. Create a Solid Business Plan

Investors want to see a clear plan for how their money will be used. Your business plan should include:

- A detailed budget for recording, marketing, and touring.

- Revenue projections based on streaming, ticket sales, and merchandise.

- A strategy for growing your audience and monetizing your music.

What type of companies do venture capitalists invest in?

What Industries Attract Venture Capital Investments?

Venture capitalists typically invest in industries with high growth potential and scalability. Some of the most attractive sectors include:

- Technology: Software, artificial intelligence, and hardware innovations.

- Biotechnology and Healthcare: Companies developing new drugs, medical devices, or health-tech solutions.

- Fintech: Startups revolutionizing financial services through digital platforms.

- E-commerce and Consumer Goods: Businesses with innovative products or services targeting large markets.

- Clean Energy and Sustainability: Companies focused on renewable energy, waste reduction, or environmental solutions.

What Stage of Companies Do Venture Capitalists Target?

Venture capitalists often invest in companies at specific stages of growth, depending on their risk appetite and investment strategy:

- Seed Stage: Early-stage startups with a prototype or minimum viable product (MVP).

- Early Stage (Series A): Companies with a proven business model and initial traction.

- Growth Stage (Series B and C): Established businesses looking to scale operations or expand into new markets.

- Late Stage: Mature companies preparing for an IPO or acquisition.

- Bridge Financing: Companies needing capital to bridge the gap between funding rounds.

What Characteristics Make a Company Attractive to Venture Capitalists?

Venture capitalists look for specific traits in companies before investing:

- Scalability: Potential to grow rapidly and serve large markets.

- Strong Management Team: Experienced and capable leadership with a clear vision.

- Innovative Product or Service: Unique offerings that solve significant problems.

- Market Opportunity: Large and growing target market with high demand.

- Proven Traction: Demonstrated customer interest, revenue, or user growth.

What Are the Risks Venture Capitalists Consider?

Venture capitalists evaluate risks carefully before investing in a company:

- Market Risk: Uncertainty about the demand for the product or service.

- Execution Risk: Potential challenges in scaling operations or meeting goals.

- Competitive Risk: Threat from existing or emerging competitors.

- Regulatory Risk: Changes in laws or regulations that could impact the business.

- Financial Risk: High cash burn rates or difficulty in securing future funding.

How Do Venture Capitalists Exit Their Investments?

Venture capitalists aim to exit their investments profitably through various strategies:

- Initial Public Offering (IPO): Taking the company public to sell shares on the stock market.

- Acquisition: Selling the company to a larger corporation or private equity firm.

- Secondary Market Sale: Selling shares to other investors or private buyers.

- Merger: Combining with another company to create a larger entity.

- Buyback: The company repurchasing shares from the venture capitalists.

Frequently Asked Questions (FAQs)

Venture capitalists often focus on music-related startups that demonstrate innovation, scalability, and a clear market need. These can include platforms for music streaming, artist discovery, live event ticketing, or music production tools. Startups that leverage artificial intelligence or blockchain technology to disrupt traditional music industry models are particularly attractive. Additionally, ventures that cater to niche markets, such as independent artists or emerging genres, often catch the attention of investors looking for untapped potential.

Which venture capital firms are known for investing in music startups?

Several venture capital firms have a track record of investing in music-related startups. Notable examples include Andreessen Horowitz, which has backed companies like Spotify, and Sequoia Capital, which has invested in SoundCloud. Other prominent firms include Bessemer Venture Partners, Index Ventures, and Sony Innovation Fund. These firms often look for startups that align with their broader investment themes, such as digital transformation or consumer technology.

What factors make a music startup attractive to venture capitalists?

Venture capitalists are drawn to music startups that exhibit strong growth potential, a unique value proposition, and a talented founding team. Startups with a clear monetization strategy, such as subscription models or partnerships with major labels, are particularly appealing. Additionally, startups that address pain points in the music industry, such as royalty distribution or copyright management, often stand out. A proven ability to attract and retain users, as well as a scalable business model, are also critical factors.

How do venture capitalists evaluate the potential success of a music startup?

Venture capitalists evaluate music startups based on several key metrics, including user engagement, revenue growth, and market size. They also assess the startup's ability to differentiate itself from competitors and its potential to capture a significant share of the market. Factors such as intellectual property, strategic partnerships, and industry expertise of the founding team are also considered. Additionally, VCs often look for startups that align with broader trends, such as the rise of streaming services or the increasing demand for live music experiences.

Leave a Reply

Our Recommended Articles