Who Are the Top Vcs Angel Investors and Tech Entrepreneurs in the Dc Nova Area

The Washington, D.C. and Northern Virginia (DC-NOVA) region has emerged as a thriving hub for innovation, attracting top venture capitalists (VCs), angel investors, and tech entrepreneurs. Known for its proximity to government agencies, defense contractors, and leading research institutions, the area fosters a unique ecosystem where cutting-edge technology meets strategic partnerships. From cybersecurity and artificial intelligence to biotech and SaaS, the DC-NOVA corridor is home to visionary leaders and investors driving transformative change. This article highlights the key players shaping the region’s tech landscape, exploring their contributions, investment strategies, and the startups poised to redefine industries in the years to come.

Who Are the Top VCs, Angel Investors, and Tech Entrepreneurs in the DC-NOVA Area?

The DC-NOVA (District of Columbia and Northern Virginia) area has emerged as a thriving hub for technology and innovation, attracting a diverse group of venture capitalists (VCs), angel investors, and tech entrepreneurs. This region, often referred to as the Capital of Innovation, is home to a mix of established players and rising stars who are shaping the future of industries such as cybersecurity, artificial intelligence, SaaS, and more. Below, we explore the key figures and organizations driving this ecosystem.

See Also Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs

Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs1. Prominent Venture Capital Firms in the DC-NOVA Area

The DC-NOVA area is home to several influential venture capital firms that have been instrumental in funding and nurturing startups. These firms provide not only capital but also strategic guidance and access to extensive networks. Some of the top VCs in the region include:

- New Enterprise Associates (NEA): One of the largest and most respected venture capital firms globally, with a strong presence in the DC area. NEA has invested in companies like Workday and Databricks.

- Revolution: Founded by Steve Case, co-founder of AOL, Revolution focuses on investing in companies outside Silicon Valley, with a particular interest in the DC-NOVA region.

- Updata Partners: A growth equity firm specializing in B2B software companies, Updata has been a key player in the region's tech ecosystem.

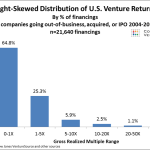

What Percent of Venture Capital Funds Fail?

What Percent of Venture Capital Funds Fail?| VC Firm | Notable Investments |

|---|---|

| New Enterprise Associates (NEA) | Workday, Databricks |

| Revolution | Sweetgreen, DraftKings |

| Updata Partners | Vidyard, Axonify |

2. Leading Angel Investors in the DC-NOVA Region

Angel investors play a critical role in the early stages of startup development. In the DC-NOVA area, several high-net-worth individuals have made significant contributions to the tech ecosystem. Notable angel investors include:

- Tige Savage: A managing partner at Revolution, Savage has personally invested in numerous startups and is known for his keen eye for disruptive technologies.

- Don Rainey: A partner at Grotech Ventures, Rainey has been an active angel investor, supporting early-stage companies in the region.

- Jonathan Aberman: Founder of Tandem NSI, Aberman is a well-known figure in the DC startup community, providing both funding and mentorship.

What Does a Series 1 Financing/funding Mean?

What Does a Series 1 Financing/funding Mean?| Angel Investor | Key Investments |

|---|---|

| Tige Savage | Revolution, Sweetgreen |

| Don Rainey | Grotech Ventures, early-stage startups |

| Jonathan Aberman | Tandem NSI, local tech startups |

3. Influential Tech Entrepreneurs in the DC-NOVA Area

The DC-NOVA region has produced a number of successful tech entrepreneurs who have built companies that have gone on to achieve national and global recognition. Some of the most influential figures include:

- Steve Case: Co-founder of AOL, Case is a pioneer of the internet era and continues to be a major advocate for entrepreneurship in the region.

- Ted Leonsis: Founder of SnagFilms and owner of the Washington Wizards, Leonsis is a prominent figure in both tech and sports.

- Julia Hartz: Co-founder and CEO of Eventbrite, Hartz has built one of the most successful event management platforms in the world.

| Entrepreneur | Company |

|---|---|

| Steve Case | AOL, Revolution |

| Ted Leonsis | SnagFilms, Monumental Sports |

| Julia Hartz | Eventbrite |

4. Key Industries Driving Innovation in the DC-NOVA Area

The DC-NOVA region is known for its focus on industries that align with the area's strengths, such as government contracting, cybersecurity, and SaaS. Some of the key industries include:

- Cybersecurity: With its proximity to the federal government, the region has become a hotspot for cybersecurity startups like Tenable and Mandiant.

- Artificial Intelligence: Companies like Appian and C3.ai are leveraging AI to transform industries.

- SaaS: The region is home to numerous SaaS companies, including Blackboard and FiscalNote.

What is Equity Financing and What Are Its Major Sources?

What is Equity Financing and What Are Its Major Sources?| Industry | Notable Companies |

|---|---|

| Cybersecurity | Tenable, Mandiant |

| Artificial Intelligence | Appian, C3.ai |

| SaaS | Blackboard, FiscalNote |

5. Networking and Support Organizations for Entrepreneurs

The DC-NOVA area boasts a robust network of organizations that support entrepreneurs through mentorship, funding, and resources. Some of the most notable include:

- 1776: A global incubator and venture fund that supports startups in industries like healthcare, education, and energy.

- Tandem NSI: Focused on connecting national security innovators with the resources they need to succeed.

- DC Tech Meetup: A community-driven organization that hosts events to connect tech professionals and entrepreneurs.

| Organization | Focus Area |

|---|---|

| 1776 | Startup Incubation, Venture Funding |

| Tandem NSI | National Security Innovation |

DC Tech

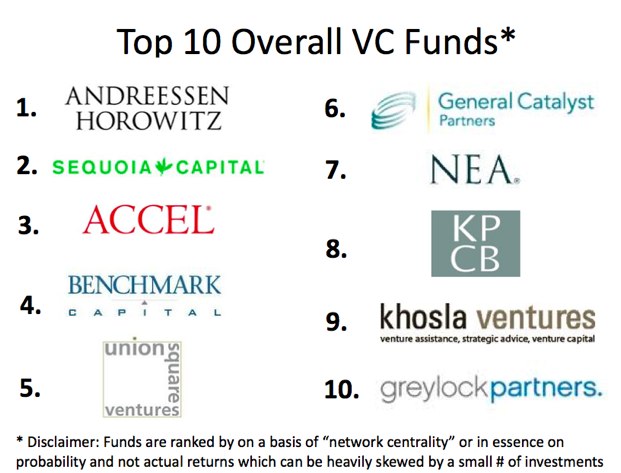

Who are the Tier 1 VCs?

What Defines a Tier 1 VC Firm?Tier 1 venture capital (VC) firms are the most prestigious and influential investors in the startup ecosystem. They are characterized by their ability to consistently identify and fund high-potential startups, often leading to significant returns. These firms typically have:

Top Tier 1 VC Firms in the IndustrySome of the most renowned Tier 1 VC firms include:

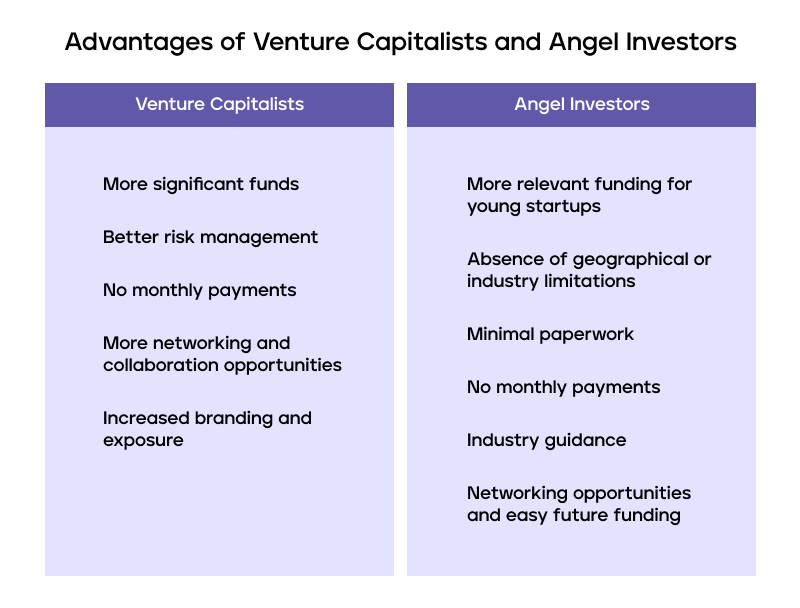

Why Startups Seek Tier 1 VC FundingStartups often prioritize securing funding from Tier 1 VCs because:

Investment Strategies of Tier 1 VCsTier 1 VCs employ unique strategies to maximize returns:

Challenges of Working with Tier 1 VCsWhile Tier 1 VCs offer significant advantages, there are challenges:

How do I find angel investors and venture capitalists?

1. Research and Identify Potential InvestorsTo find angel investors and venture capitalists, start by conducting thorough research. Identify investors who have a history of funding businesses in your industry or niche. Use online platforms, industry reports, and networking events to gather information. Here’s how to proceed:

2. Leverage Your NetworkYour personal and professional network can be a valuable resource for connecting with angel investors and venture capitalists. Attend industry events, join entrepreneurial communities, and seek introductions through mutual connections. Here’s how to make the most of your network:

3. Prepare a Compelling PitchA strong pitch is essential to attract angel investors and venture capitalists. Your pitch should clearly communicate your business idea, market potential, and growth strategy. Here’s what to include:

4. Approach Investors StrategicallyWhen reaching out to angel investors and venture capitalists, tailor your approach to each individual or firm. Personalize your communication and demonstrate how your business aligns with their investment goals. Here’s how to approach them effectively:

5. Utilize Accelerators and IncubatorsAccelerators and incubators are excellent platforms to connect with angel investors and venture capitalists. These programs often provide mentorship, resources, and access to investor networks. Here’s how to benefit from them:

What is the most prestigious venture capital company?

What Defines a Prestigious Venture Capital Company?A prestigious venture capital company is typically characterized by its track record of successful investments, influential portfolio companies, and a strong reputation in the industry. These firms often have:

Top Venture Capital Firms in the WorldSome of the most prestigious venture capital firms globally include:

Key Factors That Make a Venture Capital Firm PrestigiousThe prestige of a venture capital firm is often determined by:

Sequoia Capital: A Case Study in PrestigeSequoia Capital is often regarded as one of the most prestigious venture capital firms due to:

How Prestigious Venture Capital Firms Shape IndustriesPrestigious venture capital firms play a critical role in shaping industries by:

Who is the biggest angel investor?

The title of the biggest angel investor is often attributed to Ron Conway, a prominent figure in Silicon Valley. Known as the Godfather of Silicon Valley, Conway has invested in over 1,000 startups, including major companies like Google, Facebook, and Twitter. His early-stage investments have significantly shaped the tech industry, making him one of the most influential angel investors globally. What makes Ron Conway the biggest angel investor?Ron Conway's reputation as the biggest angel investor stems from several key factors:

Which companies has Ron Conway invested in?Ron Conway's investment portfolio includes some of the most successful tech companies:

How does Ron Conway choose startups to invest in?Ron Conway's investment strategy is based on several principles:

What is Ron Conway's impact on the startup ecosystem?Ron Conway's influence extends far beyond his investments:

How does Ron Conway compare to other angel investors?While there are many notable angel investors, Ron Conway stands out due to:

Frequently Asked Questions by our CommunityWho are the top venture capitalists (VCs) in the DC-NOVA area?The DC-NOVA area is home to several prominent venture capitalists who play a significant role in funding and supporting startups. Some of the top VCs include Steve Case, co-founder of AOL and founder of Revolution, which focuses on investing in companies outside Silicon Valley. Another notable figure is Mark Ein, founder of Venturehouse Group and Capitol Investment Corp, known for his investments in tech and real estate. Additionally, Don Rainey of Grotech Ventures and Tige Savage of Revolution are key players in the region, providing capital and mentorship to emerging businesses. Who are the most active angel investors in the DC-NOVA region?The DC-NOVA region boasts a vibrant community of angel investors who support early-stage startups. Among the most active are Mario Morino, co-founder of Venture Philanthropy Partners, and Jonathan Aberman, founder of Amplifier Ventures and Tandem NSI. These investors are known for their hands-on approach and commitment to fostering innovation. Additionally, Esther Lee, a seasoned investor and advisor, and John May, founder of New Vantage Group, are prominent figures in the angel investing scene, providing both funding and strategic guidance to startups. Which tech entrepreneurs are leading the innovation in the DC-NOVA area?The DC-NOVA area is a hub for tech entrepreneurs driving innovation across various industries. Tim O'Shaughnessy, co-founder of LivingSocial, is a well-known figure in the tech community. Another influential entrepreneur is Raul Fernandez, chairman of Monumental Sports & Entertainment and former CEO of ObjectVideo. Additionally, Julie Lenzer, co-founder of the Startup Maryland initiative, and Joe Lonsdale, co-founder of Palantir Technologies, are making significant contributions to the tech ecosystem in the region. What makes the DC-NOVA area attractive for VCs and tech entrepreneurs?The DC-NOVA area is attractive to VCs and tech entrepreneurs due to its unique combination of resources, talent, and proximity to government and regulatory bodies. The region benefits from a highly educated workforce, thanks to institutions like Georgetown University and George Mason University. Additionally, the presence of federal agencies and defense contractors creates opportunities for startups in sectors like cybersecurity, AI, and government tech. The area's strong network of incubators, accelerators, and co-working spaces further supports the growth of innovative businesses, making it a thriving ecosystem for tech entrepreneurship. Leave a Reply |

Our Recommended Articles