LLC Operating Agreement: Utah

An LLC operating agreement is a foundational document that outlines the structure, management, and financial arrangements of a limited liability company in Utah. While the state does not legally require businesses to adopt this agreement, creating one is critical for clarifying roles, responsibilities, and processes among members. A well-drafted operating agreement helps prevent disputes, ensures compliance with Utah-specific regulations, and safeguards the limited liability protection that LLCs are designed to provide. This article explores key components of a Utah LLC operating agreement, including membership interests, voting rights, profit distribution, and dissolution procedures, offering essential guidance for business owners navigating state requirements.

- Understanding the Importance of an LLC Operating Agreement in Utah

- Does Utah require an operating agreement for LLC?

- Can I write my own operating agreement for my LLC?

- Should an LLC have an operating agreement?

- What are the pitfalls of an LLC operating agreement?

- Frequently Asked Questions About LLCs (FAQs)

Understanding the Importance of an LLC Operating Agreement in Utah

Essential Components of a Utah LLC Operating Agreement

A Utah LLC Operating Agreement should outline the rights, responsibilities, and relationships between members. Key components include:

- Member roles and voting powers.

- Profit and loss distribution percentages.

- Management structure (member-managed vs. manager-managed).

- Dissolution terms and procedures.

- Dispute resolution mechanisms.

| Component | Purpose |

|---|---|

| Member Roles | Clarifies decision-making authority |

| Profit Distribution | Defines financial allocations |

| Management Structure | Determines daily operational control |

| Dissolution Terms | Outlines steps to close the LLC |

| Dispute Resolution | Provides methods to resolve conflicts |

Why Utah Requires an Operating Agreement for LLCs

While Utah does not legally mandate an Operating Agreement, having one is critical for:

- Protecting limited liability status (avoiding piercing the corporate veil).

- Overriding default state rules under Utah Code § 48-3a-103.

- Establishing custom guidelines for unique business needs.

| Requirement | Benefit |

|---|---|

| Not legally required | Flexibility in creating terms |

| Asset Protection | Shields personal assets |

| Custom Rules | Tailors operations to member preferences |

Drafting a Compliant Utah LLC Operating Agreement

When drafting, ensure alignment with Utah state laws, including:

- Including registered agent details.

- Adhering to Utah Revised Uniform Limited Liability Company Act.

- Addressing taxation choices (e.g., pass-through taxation).

- Specifying capital contributions and ownership percentages.

| Consideration | Legal Reference |

|---|---|

| Registered Agent | Utah Code § 48-3a-114 |

| Taxation | IRS Form 8832 (if applicable) |

| Contributions | Utah Code § 48-3a-402 |

Amending an LLC Operating Agreement in Utah

To amend the agreement:

1. Review the amendment clause in the original document.

2. Obtain unanimous or majority member approval (as specified).

3. File updated Articles of Organization if structural changes occur.

4. Maintain records with the Utah Division of Corporations.

| Step | Key Action |

|---|---|

| Member Approval | Follow voting requirements |

| Documentation | Update internal and state records |

| Compliance | Align with Utah LLC Act |

Utah LLC Operating Agreement and Legal Protection

A well-drafted agreement strengthens legal protection by:

- Reinforcing the LLC’s separate legal entity status.

- Reducing personal liability risks for debts or lawsuits.

- Ensuring compliance with state and federal regulations.

| Protection Aspect | Impact |

|---|---|

| Liability Shield | Prevents personal asset seizure |

| Regulatory Compliance | Avoids legal penalties |

| Dispute Prevention | Minimizes internal conflicts |

Does Utah require an operating agreement for LLC?

Legal Requirements for Utah LLC Operating Agreements

Utah does not legally require an LLC to have an operating agreement. However, state law (Utah Code § 48-3a-101 et seq.) recognizes operating agreements as enforceable documents. While not mandatory, creating one is strongly recommended to establish clear guidelines for business operations and member relationships. Key considerations include:

See AlsoConnecticut LLC Operating Agreement- State law defaults govern LLCs without an operating agreement, which may not align with members’ preferences.

- An agreement helps avoid disputes by clarifying roles, profit distribution, and decision-making processes.

- It adds credibility and structure, especially for multi-member LLCs or those seeking financing.

Benefits of Having an Operating Agreement in Utah

Even though Utah does not mandate an operating agreement, drafting one provides critical advantages. It serves as a legally binding framework to protect members and streamline operations. Benefits include:

- Protection of limited liability status, reducing personal liability risks for members.

- Custom rules for profit-sharing, management, and dissolution override default state laws.

- Enhanced professionalism when dealing with banks, investors, or legal authorities.

Key Clauses to Include in a Utah LLC Operating Agreement

A well-drafted operating agreement should address essential aspects of the LLC’s operations. Critical clauses for Utah LLCs include:

- Ownership structure (member contributions, ownership percentages).

- Procedures for admitting or removing members.

- Guidelines for profit distribution and tax obligations.

- Dispute resolution mechanisms and dissolution processes.

Consequences of Not Having an Operating Agreement in Utah

Operating without an agreement exposes the LLC to potential risks under Utah’s default statutes. Consequences may involve:

- Loss of control over decision-making processes, as state laws dictate governance.

- Increased vulnerability to member disputes due to undefined roles and responsibilities.

- Difficulty proving the LLC’s separation from personal assets, risking piercing the corporate veil.

How to Create an Operating Agreement for a Utah LLC

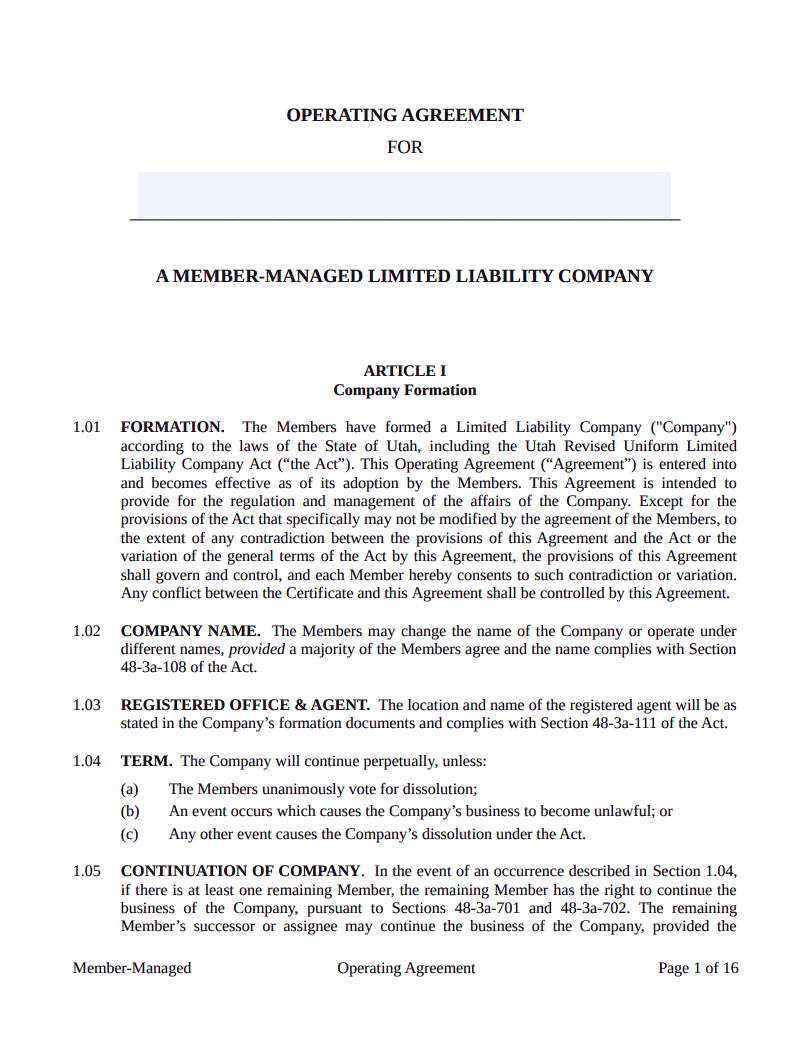

Drafting an operating agreement involves customizing provisions to suit the LLC’s needs. Steps include:

- Consulting a business attorney to ensure compliance with Utah law.

- Using online templates as a starting point but tailoring clauses to specific operations.

- Defining management structure (member-managed vs. manager-managed).

- Formalizing the agreement with signatures from all members.

Can I write my own operating agreement for my LLC?

Legal Requirements for Writing Your Own LLC Operating Agreement

While you can draft your own operating agreement, compliance with state laws is critical. Most states do not require LLCs to file this document, but having one is strongly advised to avoid default rules governing your business.

- Check your state’s LLC statutes to ensure your agreement meets minimum requirements.

- Include mandatory clauses, such as member roles, profit distribution, and dissolution procedures.

- Avoid vague language that could lead to disputes or legal challenges.

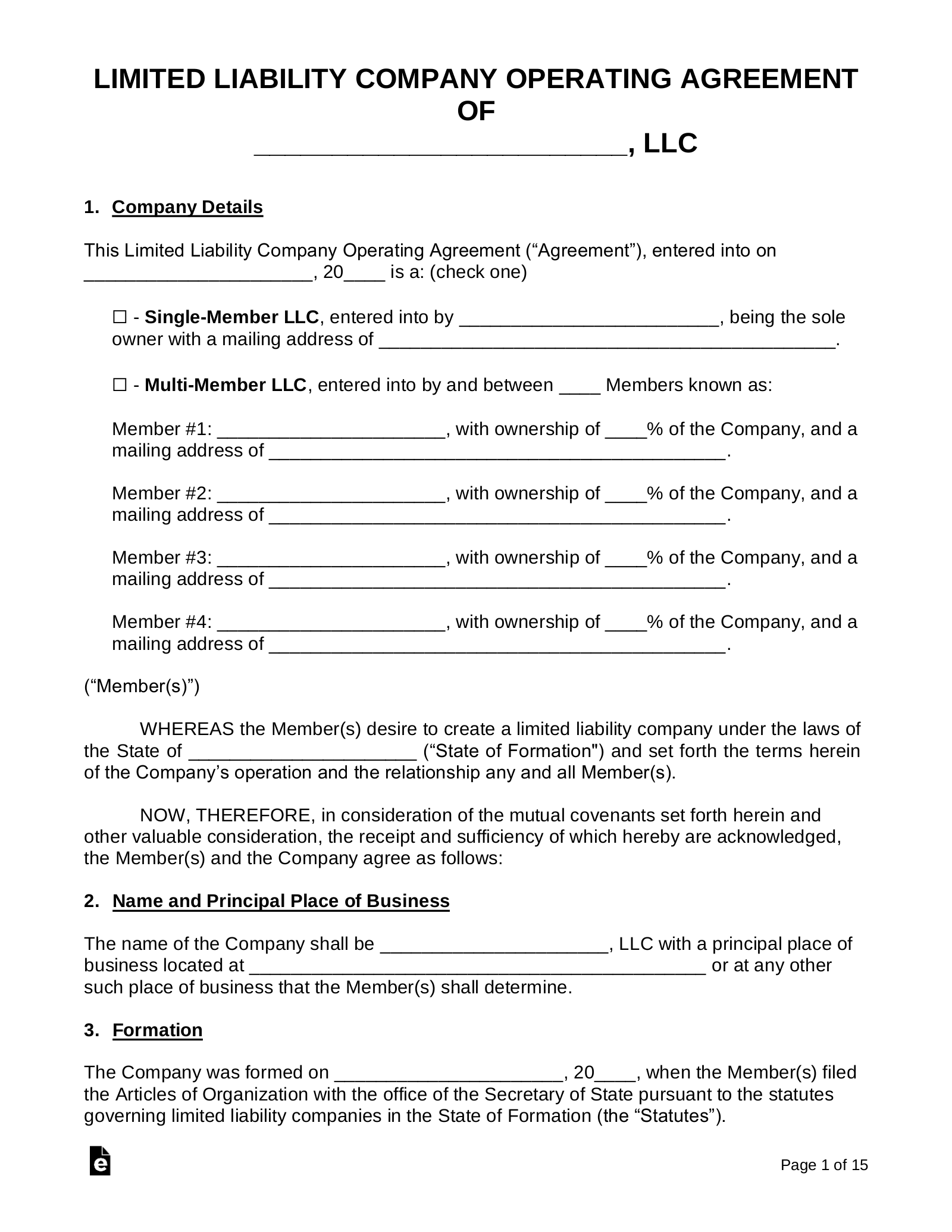

Key Elements to Include in a Self-Drafted Operating Agreement

A well-structured operating agreement clarifies member rights and operational protocols. Focus on customization to reflect your LLC’s unique needs.

- Define membership interests (e.g., ownership percentages, capital contributions).

- Outline management structure (member-managed vs. manager-managed).

- Specify profit/loss allocation methods and voting procedures.

Risks of Not Customizing Your Operating Agreement

Using a generic template or skipping an operating agreement exposes your LLC to unintended consequences.

- Default state rules may override your preferences, such as equal profit splits regardless of contributions.

- Ambiguities can trigger member disputes or litigation.

- Lenders or investors may demand a tailored agreement for credibility.

When to Consult a Legal Professional

While DIY agreements work for simple LLCs, complex situations warrant expert guidance.

- If your LLC has multiple classes of membership or unusual profit-sharing terms.

- When operating in multiple states with conflicting regulations.

- If members have unequal voting power or unique exit clauses.

Tools and Resources for Drafting an Operating Agreement

Several resources simplify the process of creating a legally sound document.

- Use online templates from reputable legal platforms (e.g., Rocket Lawyer, LegalZoom).

- Invest in LLC drafting software with state-specific provisions.

- Pair your draft with an attorney review to fill gaps and ensure enforceability.

Should an LLC have an operating agreement?

Why is an Operating Agreement Important for an LLC?

An operating agreement is a critical document for an LLC, even if not legally required in all states. It establishes the rules, roles, and financial structure of the business, ensuring clarity and preventing disputes. Key benefits include:

- Legal protection: Separates personal and business assets, reducing liability risks.

- Custom governance: Overrides default state laws, allowing tailored management processes.

- Member alignment: Defines ownership percentages, profit distribution, and decision-making authority.

What Legal Protections Does an Operating Agreement Provide?

An operating agreement strengthens an LLC’s legal standing by formalizing its structure. This document:

- Reinforces limited liability status: Courts may treat an LLC without one as a sole proprietorship or partnership, risking personal assets.

- Provides evidence of ownership: Resolves disputes over member contributions or profit shares.

- Supports compliance: Ensures adherence to state-specific regulations and banking requirements.

How Does an Operating Agreement Clarify Member Roles?

Without clear guidelines, member conflicts can disrupt operations. An operating agreement:

- Assigns responsibilities: Outlines management duties, voting rights, and authority levels.

- Sets expectations: Details procedures for adding/removing members or transferring ownership.

- Prevents deadlocks: Establishes protocols for resolving disagreements, such as mediation or buyout terms.

Can an LLC Operate Without an Operating Agreement?

While possible, operating without this agreement exposes the LLC to risks:

- State default rules apply: Courts may enforce generic laws that don’t align with members’ intentions.

- Unclear financial terms: Profit splits, capital contributions, and tax allocations may become contentious.

- Weakened credibility: Banks or investors may question the LLC’s legitimacy without a formal agreement.

What Key Clauses Should an Operating Agreement Include?

A comprehensive operating agreement should address:

- Membership structure: Names, ownership percentages, and capital contributions.

- Management framework: Roles of managers vs. member-managed operations.

- Dissolution terms: Procedures for closing the business or handling a member’s exit.

What are the pitfalls of an LLC operating agreement?

1. Ambiguity in Roles and Responsibilities

A poorly drafted LLC operating agreement often fails to clearly define roles, duties, and decision-making authority among members. This vagueness can lead to disputes, operational inefficiencies, or even legal conflicts. To avoid this:

- Specify managerial roles (e.g., managing vs. silent members).

- Outline voting rights and thresholds for major decisions.

- Define conflict resolution processes to address disagreements.

2. Inadequate Profit and Loss Allocation Terms

Many agreements overlook detailed profit-sharing structures, leading to misunderstandings about financial distributions. Ambiguous clauses may violate IRS guidelines or create tax liabilities. Key considerations include:

- Aligning allocations with IRS “substantial economic effect” rules.

- Clarifying capital contribution requirements and repayment terms.

- Addressing unequal distributions if members have varying ownership stakes.

3. Lack of Succession Planning

Failing to plan for member exit, death, or disability can destabilize the LLC. Without clear terms, transitions may trigger internal disputes or dissolution. Essential provisions should cover:

- Buyout procedures and valuation methods for departing members.

- Transfer restrictions to prevent unwanted third-party ownership.

- Designating successors or outlining dissolution steps if a member leaves.

4. Non-Compliance with State Laws

Operating agreements must adhere to state-specific LLC regulations. Overlooking statutory requirements can invalidate clauses or expose the LLC to legal risks. Critical steps involve:

- Reviewing mandatory state provisions (e.g., annual reporting, fees).

- Ensuring registered agent details and governance structures comply.

- Updating the agreement to reflect changes in state laws over time.

5. Poorly Defined Dissolution Procedures

Without a clear roadmap for dissolution, closing the LLC can become chaotic and legally fraught. Ambiguities may prolong the process or trigger lawsuits. Mitigate risks by:

- Detailing triggers for dissolution (e.g., member vote, bankruptcy).

- Outlining asset distribution hierarchies to creditors and members.

- Including winding-up obligations, like tax filings and debt settlements.

Frequently Asked Questions About LLCs (FAQs)

Is an LLC Operating Agreement required by law in Utah?

No, Utah does not legally require LLCs to have an Operating Agreement. However, drafting one is highly recommended to establish clear rules for governance, ownership, and operations. Without this document, your LLC will default to Utah’s default state laws, which may not align with your business’s specific needs. An Operating Agreement also strengthens your LLC’s credibility with banks, creditors, and courts.

What key clauses should a Utah LLC Operating Agreement include?

A Utah LLC Operating Agreement should outline member roles, profit distribution, voting rights, management structure, and dissolution procedures. It should also define how to handle membership changes, disputes, and amendments to the agreement. Including clauses about capital contributions, tax treatment, and meeting protocols ensures clarity and legal protection. Tailoring these terms to your LLC’s goals is critical for avoiding future conflicts.

Can a single-member LLC in Utah benefit from an Operating Agreement?

Yes, even single-member LLCs in Utah should have an Operating Agreement. This document reinforces the LLC’s limited liability status by separating personal and business assets, which is crucial in legal disputes. It also establishes formal operating procedures, making the business more credible to lenders or potential investors. Additionally, it prepares the LLC for future membership changes or expansion.

How do I amend a Utah LLC Operating Agreement after formation?

To amend a Utah LLC Operating Agreement, follow the amendment procedures outlined in the original document, which typically require a member vote or unanimous written consent. Once approved, draft an amendment with the updated terms, have all members sign it, and store it with your LLC records. Major changes, like ownership restructuring, may also require updating state filings with the Utah Division of Corporations.

Leave a Reply

Our Recommended Articles