What Are Differences Between Venture Series a B C D and Seed Rounds

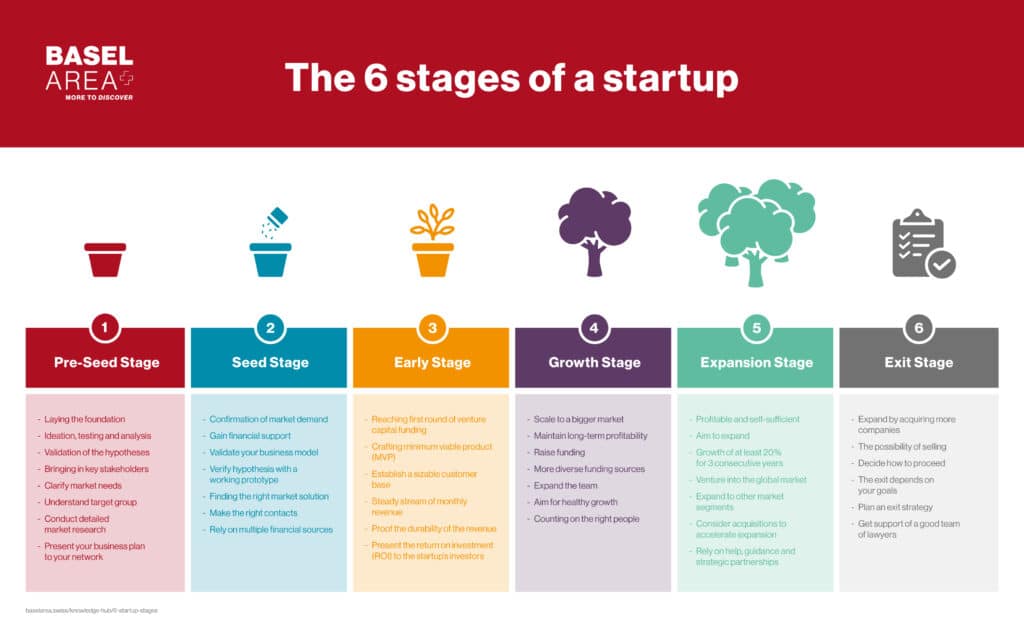

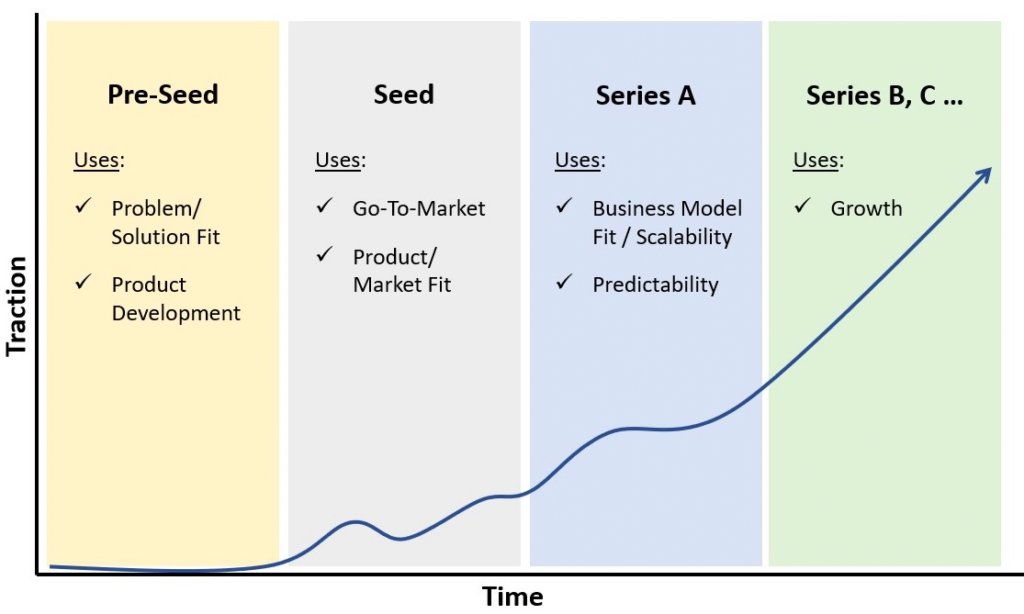

Understanding the various stages of startup funding is crucial for entrepreneurs and investors alike. Venture capital financing typically progresses through several rounds, each with distinct characteristics and purposes. The journey often begins with a seed round, where early-stage funding is secured to develop the initial idea. As the company grows, it may advance to Series A, B, C, and D rounds, each targeting different milestones such as product development, market expansion, or scaling operations. These rounds differ in terms of investment size, valuation, and investor expectations. This article explores the key differences between seed rounds and Series A, B, C, and D funding, providing clarity on their roles in a startup’s growth trajectory.

What Are Differences Between Venture Series A, B, C, D, and Seed Rounds?

1. What is a Seed Round?

The Seed Round is the initial stage of funding for a startup. It typically involves raising capital from angel investors, accelerators, or early-stage venture capitalists. The funds are used to develop a minimum viable product (MVP), conduct market research, and build a team. At this stage, the company is often in its infancy, and the investment is considered high-risk.

See Also How Much in Returns Do Venture Capitalists Generally Expect for Their Investment in a Startup

How Much in Returns Do Venture Capitalists Generally Expect for Their Investment in a Startup2. What is a Series A Round?

The Series A Round is the first significant round of venture capital funding. Companies at this stage have usually demonstrated some level of market traction and have a clear business model. Investors in Series A rounds are typically venture capital firms looking to scale the business. The funds are used to optimize products, expand the team, and increase market reach.

3. What is a Series B Round?

The Series B Round focuses on scaling the business further. By this stage, the company has proven its business model and is generating steady revenue. The funding is used to expand operations, enter new markets, and improve infrastructure. Investors in Series B rounds often include venture capital firms and private equity investors.

See Also What Do Venture Capitalists Look for When Deciding to Invest in an Idea and a Team

What Do Venture Capitalists Look for When Deciding to Invest in an Idea and a Team4. What is a Series C Round?

The Series C Round is aimed at rapid growth and market dominance. Companies at this stage are usually well-established and profitable. The funds are used for acquisitions, international expansion, and product diversification. Investors in Series C rounds include late-stage venture capitalists, hedge funds, and investment banks.

5. What is a Series D Round?

The Series D Round is less common and is typically pursued by companies that need additional funding before an IPO or to address unexpected challenges. This round can also be used for strategic acquisitions or to bridge financial gaps. Investors in Series D rounds are often private equity firms and large institutional investors.

See Also What is the Reputation of the Vc Fund New Enterprise Associates (Nea)

What is the Reputation of the Vc Fund New Enterprise Associates (Nea)| Funding Stage | Purpose | Typical Investors |

|---|---|---|

| Seed Round | Develop MVP, market research, team building | Angel investors, accelerators, early-stage VCs |

| Series A | Optimize products, expand team, increase market reach | Venture capital firms |

| Series B | Expand operations, enter new markets, improve infrastructure | Venture capital firms, private equity investors |

| Series C | Acquisitions, international expansion, product diversification | Late-stage VCs, hedge funds, investment banks |

| Series D | Pre-IPO funding, strategic acquisitions, bridge financial gaps | Private equity firms, large institutional investors |

What is the difference between seed and venture stage?

What is the Seed Stage?

The seed stage is the initial phase of a startup's lifecycle, where the primary focus is on developing the business idea and securing initial funding. At this stage, the company is often in its infancy, with minimal revenue or product development. Key characteristics include:

- Idea validation: Entrepreneurs test the feasibility of their concept and gather feedback.

- Limited funding: Funding is typically sourced from personal savings, friends, family, or angel investors.

- Small team: The team is usually small, often consisting of the founders and a few early employees.

What is the Venture Stage?

The venture stage follows the seed stage and involves scaling the business after achieving initial traction. At this point, the company has a proven product or service and is seeking larger investments to expand operations. Key characteristics include:

- Revenue generation: The company has started generating revenue, though profitability may still be a goal.

- Institutional funding: Funding is often provided by venture capital firms or other institutional investors.

- Expanded team: The team grows significantly to support scaling efforts, including hiring specialized roles.

Key Differences in Funding

The funding requirements and sources differ significantly between the seed stage and the venture stage:

- Seed stage funding: Typically ranges from $10,000 to $2 million, sourced from angel investors, accelerators, or crowdfunding.

- Venture stage funding: Can range from $2 million to tens of millions, provided by venture capital firms or private equity investors.

- Purpose of funding: Seed funding is used for idea validation and product development, while venture funding is aimed at scaling operations and market expansion.

Risk and Uncertainty Levels

The level of risk and uncertainty varies between the two stages:

- Seed stage: High risk due to unproven business models and lack of market validation.

- Venture stage: Lower risk compared to the seed stage, as the business has demonstrated some level of success and market fit.

- Investor expectations: Seed investors expect high returns but are aware of the high failure rate, while venture investors seek more predictable growth and scalability.

Focus and Objectives

The focus and objectives of a company differ between the seed stage and the venture stage:

- Seed stage: Focuses on product development, market research, and building a minimum viable product (MVP).

- Venture stage: Emphasizes scaling operations, increasing market share, and optimizing business processes.

- Long-term goals: Seed stage aims to achieve product-market fit, while the venture stage aims for sustainable growth and profitability.

What is a seed round of venture capital?

What is a Seed Round of Venture Capital?

A seed round of venture capital is the initial stage of funding for a startup, typically used to develop a product, conduct market research, and build a team. This round is crucial for turning an idea into a viable business. Investors in this stage often include angel investors, early-stage venture capital firms, and sometimes accelerators or incubators. The funding amount is usually smaller compared to later rounds, ranging from $500,000 to $2 million, depending on the startup's potential and industry.

- Purpose: The primary goal is to validate the business idea and achieve key milestones.

- Investors: Typically includes angel investors, accelerators, and early-stage VCs.

- Funding Amount: Generally ranges from $500,000 to $2 million.

Why is a Seed Round Important for Startups?

The seed round is critical because it provides the necessary capital to transform an idea into a tangible product or service. Without this funding, many startups would struggle to move beyond the conceptual stage. It also helps attract talent, build a minimum viable product (MVP), and gather market validation.

- Product Development: Funds are used to create a prototype or MVP.

- Market Research: Helps understand customer needs and market demand.

- Talent Acquisition: Enables hiring key team members to execute the vision.

Who Participates in a Seed Round?

Participants in a seed round typically include angel investors, early-stage venture capital firms, and accelerators. These investors are willing to take higher risks in exchange for equity in the startup. Some startups may also raise funds through crowdfunding platforms or friends and family.

- Angel Investors: High-net-worth individuals investing personal funds.

- Early-Stage VCs: Venture capital firms specializing in high-risk, high-reward investments.

- Accelerators: Programs that provide funding, mentorship, and resources in exchange for equity.

How is Equity Distributed in a Seed Round?

During a seed round, startups exchange equity for capital. The amount of equity given up depends on the valuation of the company and the amount raised. Typically, startups may give away 10-20% of their equity in this round. This dilution is necessary to secure funding and grow the business.

- Valuation: Determines how much equity investors receive for their investment.

- Equity Dilution: Founders give up a portion of ownership to investors.

- Negotiation: Terms are often negotiated to balance founder control and investor returns.

What are the Key Terms in a Seed Round?

Key terms in a seed round include valuation, equity stake, vesting schedules, and liquidation preferences. These terms are outlined in the term sheet, a document that formalizes the agreement between the startup and investors. Understanding these terms is crucial for both parties to ensure a fair and successful partnership.

- Valuation: The estimated worth of the startup before investment.

- Equity Stake: The percentage of ownership offered to investors.

- Liquidation Preferences: Determines payout order in case of a sale or liquidation.

Can you skip seed and go to Series A?

Is It Possible to Skip Seed Funding and Go Directly to Series A?

Yes, it is possible to skip seed funding and go directly to Series A, but it is uncommon and depends on several factors. Startups that can demonstrate significant traction, a proven business model, and strong revenue streams may attract Series A investors without needing seed funding. However, this approach is typically reserved for companies with exceptional circumstances, such as:

- Founders with a proven track record of successful ventures.

- Highly scalable business models with rapid growth potential.

- Existing revenue or profitability that reduces the need for early-stage funding.

What Are the Risks of Skipping Seed Funding?

Skipping seed funding can pose significant risks for startups. Without the initial capital and mentorship provided by seed investors, companies may struggle to validate their ideas or build a minimum viable product (MVP). Key risks include:

- Lack of market validation, which can deter Series A investors.

- Insufficient resources to scale operations effectively.

- Increased pressure to deliver immediate results to Series A investors.

What Do Investors Look for in a Series A Round Without Seed Funding?

Investors considering a Series A round without prior seed funding will scrutinize the startup more rigorously. They typically look for:

- Strong traction, such as significant user growth or revenue.

- A clear competitive advantage or unique value proposition.

- A capable and experienced team with a history of execution.

How Can Startups Prepare for Series A Without Seed Funding?

Startups aiming to skip seed funding must take deliberate steps to position themselves for a successful Series A round. Preparation strategies include:

- Bootstrapping effectively to achieve early milestones.

- Building a strong network of advisors and industry connections.

- Focusing on metrics that demonstrate growth and scalability.

What Are the Advantages of Skipping Seed Funding?

While skipping seed funding is challenging, it can offer certain advantages for startups. These include:

- Retaining more equity by avoiding early-stage dilution.

- Accelerating the funding timeline to reach Series A faster.

- Attracting higher-quality investors who prefer more mature startups.

Frequently Asked Questions (FAQs)

What is the difference between a Seed Round and a Series A funding round?

Seed Round is typically the first official equity funding stage for a startup. It is used to support the initial development of the product, market research, and building a founding team. Investors in this stage are often angel investors, early-stage venture capitalists, or even friends and family. The amounts raised are usually smaller, ranging from tens of thousands to a few million dollars. In contrast, Series A funding is the next stage, where startups have already developed a product and demonstrated some market traction. The focus here is on scaling the business, optimizing the product, and expanding the team. Series A rounds are led by venture capital firms and involve larger investments, often in the range of $2 million to $15 million.

How does Series B funding differ from Series A?

Series B funding is the stage where startups have already achieved significant growth and are looking to expand further. By this point, the company has a proven product, a growing customer base, and consistent revenue streams. The primary goal of Series B is to scale operations, enter new markets, and invest in advanced technologies or infrastructure. Unlike Series A, which focuses on product-market fit and initial scaling, Series B is about taking the business to the next level. Funding amounts in Series B are typically larger, ranging from $10 million to $50 million, and involve more established venture capital firms and sometimes private equity investors.

What distinguishes Series C funding from earlier rounds?

Series C funding is aimed at companies that are already successful and are looking to expand even further, often in preparation for an IPO (Initial Public Offering) or acquisition. At this stage, the company has a strong market presence, significant revenue, and a clear path to profitability. The funds raised in Series C are used for global expansion, acquiring smaller competitors, or developing new product lines. Unlike Series A and Series B, Series C rounds often involve a mix of venture capital, private equity, and even hedge funds. The investment amounts are substantial, often exceeding $50 million, and the valuation of the company is significantly higher.

What is the purpose of Series D funding, and how does it compare to earlier rounds?

Series D funding is less common and is typically pursued by companies that need additional capital before going public or being acquired. This round may also occur if the company did not meet its goals in the Series C round or if it needs to address unforeseen challenges. The focus of Series D is on final growth stages, such as entering new international markets, making strategic acquisitions, or preparing for an IPO. Unlike earlier rounds, Series D often involves more complex financial instruments and may include debt financing alongside equity. The amounts raised can vary widely but are generally in the range of tens to hundreds of millions of dollars, depending on the company's needs and valuation.

Leave a Reply

Our Recommended Articles