What Are the Downsides of Being a Venture Capitalist?

Venture capital is often glamorized as a high-reward career, offering the chance to shape innovative startups and reap substantial financial gains. However, the role of a venture capitalist (VC) comes with significant challenges and downsides that are less frequently discussed. From the immense pressure to deliver returns to the high-stakes nature of investment decisions, the job can be both mentally and emotionally taxing. Additionally, the long hours, constant networking, and unpredictable outcomes can take a toll on personal well-being. This article explores the less glamorous aspects of being a venture capitalist, shedding light on the realities behind the perceived prestige of the profession.

What Are the Downsides of Being a Venture Capitalist?

Being a venture capitalist (VC) is often glamorized for its potential to generate massive returns and influence the future of innovative companies. However, the role comes with significant challenges and downsides that are rarely discussed. Below, we explore the key disadvantages of being a venture capitalist.

See Also What is a Major Drawback of Accepting Venture Capital?

What is a Major Drawback of Accepting Venture Capital?1. High Risk of Investment Losses

Venture capitalists invest in early-stage startups, which are inherently risky. The majority of startups fail, and even those that succeed often take years to generate returns. This means VCs face the constant pressure of losing their investments. Unlike traditional investments, where diversification can mitigate risk, VC portfolios are highly concentrated in a few companies, amplifying potential losses.

2. Long Investment Horizons

VC investments are illiquid and require a long-term commitment. It can take 7-10 years or more for a startup to reach an exit event, such as an IPO or acquisition. During this time, VCs must remain patient and supportive, even if the company faces challenges. This long horizon can strain resources and limit flexibility in reallocating capital.

See Also What is the Worst Part of Being a Vc?

What is the Worst Part of Being a Vc?3. Intense Competition

The venture capital industry is highly competitive, with top-tier firms dominating the best deals. Newer or smaller VC firms often struggle to access high-quality startups, forcing them to take on riskier investments. Additionally, competition drives up valuations, reducing potential returns and increasing the pressure to outperform.

4. Emotional and Mental Strain

The emotional toll of being a VC is significant. VCs must navigate the highs of successful exits and the lows of failed investments. They also bear the responsibility of managing relationships with founders, co-investors, and limited partners (LPs). The constant pressure to deliver returns can lead to burnout and stress.

See Also How to Best Educate Myself About the Venture Capital Industry

How to Best Educate Myself About the Venture Capital Industry5. Limited Control Over Outcomes

Despite providing capital and guidance, VCs have limited control over the success of their portfolio companies. Startups operate in dynamic markets, and external factors like economic downturns or technological shifts can derail even the most promising ventures. This lack of control can be frustrating for VCs who are deeply invested in their companies' success.

| Downside | Description |

|---|---|

| High Risk | Most startups fail, leading to potential investment losses. |

| Long Horizons | Investments can take 7-10 years or more to yield returns. |

| Competition | Intense competition for top deals drives up valuations. |

| Emotional Strain | Managing relationships and pressure can lead to burnout. |

| Limited Control | VCs have little control over external factors affecting startups. |

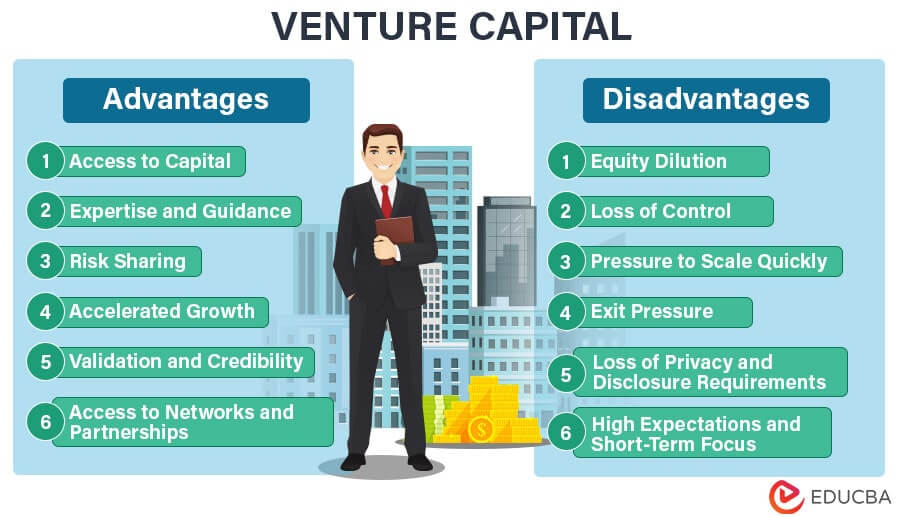

What are the negatives of venture capital?

Loss of Control and Decision-Making Power

One of the primary negatives of venture capital is the loss of control over your business. When you accept venture capital funding, investors often require a significant say in how the company is run. This can lead to:

- Dilution of ownership: Founders may have to give up a substantial equity stake, reducing their control over the company.

- Pressure to meet investor expectations: Investors may push for rapid growth or specific strategies that may not align with the founder's vision.

- Potential conflicts: Differences in opinion between founders and investors can lead to disputes, slowing down decision-making processes.

High Expectations for Growth and Returns

Venture capitalists typically invest with the expectation of high returns within a relatively short timeframe. This can create several challenges:

- Pressure to scale quickly: Companies may be forced to grow at an unsustainable pace, risking burnout or operational inefficiencies.

- Focus on short-term gains: Long-term strategies may be sacrificed to meet immediate financial targets.

- Risk of failure: If the company fails to meet growth expectations, it may face difficulties securing additional funding or even risk closure.

Equity Dilution and Reduced Ownership

Accepting venture capital often means giving up a portion of your company's equity, which can have long-term implications:

- Reduced ownership stake: Founders may end up owning a smaller percentage of the company, impacting their financial rewards in the event of a sale or IPO.

- Limited control over future funding rounds: Additional funding rounds can further dilute equity, reducing the founder's influence over the company.

- Potential loss of personal wealth: If the company is sold or goes public, founders may receive less financial benefit due to their reduced equity stake.

Stringent Terms and Conditions

Venture capital agreements often come with strict terms and conditions that can be burdensome for founders:

- Liquidation preferences: Investors may have priority in receiving returns, leaving founders with less in the event of a sale or liquidation.

- Board seats: Investors may demand seats on the board, giving them significant influence over company decisions.

- Restrictive covenants: Founders may face limitations on how they can operate the business, such as restrictions on spending or hiring.

Potential for Misaligned Interests

The interests of venture capitalists and founders may not always align, leading to potential conflicts:

- Different timelines: Investors may seek a quick exit, while founders may prefer to build the company over a longer period.

- Divergent goals: Investors may prioritize financial returns, while founders may be more focused on the company's mission or long-term vision.

- Risk of interference: Investors may push for changes that benefit them financially but may not be in the best interest of the company or its employees.

What is the biggest risk in venture capital?

Market Risk

Market risk is one of the most significant challenges in venture capital. It refers to the possibility that the market for a startup's product or service may not develop as expected. This can occur due to changes in consumer preferences, economic downturns, or the emergence of competing technologies. Key factors to consider include:

- Market size: If the target market is too small, the startup may struggle to achieve significant revenue.

- Market timing: Entering the market too early or too late can lead to missed opportunities or saturation.

- Competition: Intense competition can erode profit margins and make it difficult to gain market share.

Execution Risk

Execution risk involves the potential failure of a startup to effectively implement its business plan. This can stem from poor management, operational inefficiencies, or inadequate resources. Critical aspects include:

- Management team: A lack of experienced leadership can hinder decision-making and strategy implementation.

- Operational challenges: Startups often face difficulties in scaling operations, managing supply chains, or maintaining quality control.

- Resource allocation: Misallocation of funds or resources can lead to cash flow problems and hinder growth.

Technology Risk

Technology risk pertains to the possibility that a startup's technology may not perform as expected or may become obsolete. This is particularly relevant in industries with rapid innovation cycles. Key considerations include:

- Technological feasibility: The technology may not work as intended or may require further development.

- Intellectual property: Issues with patents or intellectual property rights can pose significant risks.

- Adoption barriers: Customers may be reluctant to adopt new technologies due to compatibility issues or lack of understanding.

Financial Risk

Financial risk involves the potential for financial loss due to factors such as poor financial management, insufficient funding, or unfavorable economic conditions. Important factors to consider are:

- Burn rate: High cash burn rates can deplete resources quickly, leading to financial instability.

- Revenue streams: Dependence on a single revenue stream can be risky if that stream dries up.

- Economic conditions: Recessions or economic downturns can reduce consumer spending and investment capital.

Regulatory Risk

Regulatory risk refers to the potential impact of changes in laws or regulations on a startup's operations. This can include new regulations, changes in existing laws, or increased scrutiny from regulatory bodies. Key points include:

- Compliance costs: New regulations can increase operational costs and reduce profitability.

- Legal challenges: Startups may face lawsuits or legal challenges that can drain resources and time.

- Policy changes: Changes in government policy can create uncertainty and affect business planning.

Is a career in VC worth it?

What Does a Career in Venture Capital (VC) Entail?

A career in venture capital (VC) involves investing in early-stage or growth-stage companies with high potential for significant returns. Professionals in this field analyze market trends, evaluate business models, and provide strategic guidance to startups. Key responsibilities include:

- Deal sourcing: Identifying promising startups and entrepreneurs.

- Due diligence: Conducting thorough research on potential investments.

- Portfolio management: Supporting portfolio companies to achieve growth and success.

- Networking: Building relationships with founders, investors, and industry experts.

What Are the Pros of a Career in VC?

A career in venture capital offers several advantages, making it an attractive option for many professionals. These include:

- High earning potential: Successful investments can yield substantial financial rewards.

- Intellectual stimulation: Working with innovative startups and cutting-edge technologies.

- Networking opportunities: Building connections with influential leaders and entrepreneurs.

- Impact: Helping shape the future of industries by supporting groundbreaking ideas.

What Are the Challenges of a Career in VC?

While a career in venture capital can be rewarding, it also comes with its own set of challenges. These include:

- High risk: Many startups fail, leading to potential losses.

- Long hours: Extensive research and networking require significant time investment.

- Pressure to perform: Delivering returns to investors is a constant expectation.

- Competition: Securing top deals in a highly competitive industry can be difficult.

What Skills Are Required for a Career in VC?

To succeed in venture capital, professionals need a combination of technical and interpersonal skills. Key skills include:

- Analytical thinking: Evaluating business models and financial projections.

- Communication: Articulating investment theses and negotiating deals.

- Networking: Building and maintaining relationships with stakeholders.

- Resilience: Handling rejection and learning from failures.

How to Start a Career in VC?

Breaking into venture capital can be challenging but achievable with the right approach. Steps to consider include:

- Gain relevant experience: Work in startups, consulting, or investment banking.

- Build a network: Attend industry events and connect with VC professionals.

- Develop expertise: Focus on a specific industry or technology sector.

- Pursue education: Consider advanced degrees or certifications in finance or business.

Frequently Asked Questions (FAQs)

What are the main challenges of being a venture capitalist?

Being a venture capitalist comes with several challenges. One of the most significant is the high level of risk involved. Venture capitalists invest in early-stage companies, many of which fail to succeed. This means that a large portion of their investments may result in losses. Additionally, the job requires a deep understanding of various industries and the ability to predict market trends, which can be mentally exhausting. The pressure to deliver returns to investors also adds to the stress, making it a high-stakes profession.

How does the workload affect venture capitalists?

The workload for venture capitalists can be overwhelming. They often have to juggle multiple responsibilities, including sourcing deals, conducting due diligence, negotiating terms, and providing ongoing support to portfolio companies. This can lead to long hours and a lack of work-life balance. Furthermore, the need to stay updated on industry trends and network constantly can be time-consuming. The demanding nature of the job can take a toll on personal relationships and overall well-being.

What are the financial risks associated with venture capitalism?

Venture capitalists face significant financial risks. Since they invest in startups, there is a high probability that many of these companies will fail, leading to a loss of capital. Even if a few investments succeed, the returns may not always compensate for the losses incurred from failed ventures. Additionally, the illiquidity of these investments means that capital is tied up for extended periods, sometimes years, before any returns are realized. This lack of liquidity can be a major drawback for those who need more flexible financial arrangements.

How does the emotional toll impact venture capitalists?

The emotional toll on venture capitalists can be substantial. The constant pressure to make the right investment decisions and the fear of losing money can lead to chronic stress and anxiety. Moreover, dealing with the failure of portfolio companies can be emotionally draining. Venture capitalists often form close relationships with the entrepreneurs they invest in, and seeing those businesses fail can be personally disheartening. The need to maintain a positive outlook and continue seeking new opportunities despite setbacks requires a high level of emotional resilience.

Leave a Reply

Our Recommended Articles