Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs

When entrepreneurs seek funding from venture capitalists (VCs), the process often involves traveling to meet potential investors, especially if they are located in different cities or countries. A common question arises: do VCs reimburse travel expenses for out-of-town entrepreneurs? This topic is particularly relevant for early-stage founders who may have limited resources to cover such costs. While some VCs may cover travel expenses as part of their investment process, others expect entrepreneurs to bear the financial burden. Understanding the norms and expectations around travel reimbursement can help founders better prepare for fundraising efforts and manage their budgets effectively.

- Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs?

- What are the expenses of venture capital funds?

- What do venture capitalists get in return?

- What do venture capitalists provide financial resources in return for?

- What do venture capitalists get?

- Frequently Asked Questions (FAQs)

Do Venture Capitalists Reimburse Travel Expenses for Out of Town Entrepreneurs?

When it comes to venture capitalists (VCs) and their policies on reimbursing travel expenses for out-of-town entrepreneurs, the answer is not always straightforward. While some VCs may cover these costs, others expect entrepreneurs to bear the expenses themselves. This largely depends on the stage of the startup, the relationship between the entrepreneur and the VC, and the specific policies of the venture capital firm.

See Also What's the Best Course on Venture Capital?

What's the Best Course on Venture Capital?1. What Factors Influence Whether VCs Reimburse Travel Expenses?

Several factors determine whether a VC will reimburse travel expenses. These include the size of the VC firm, the stage of the startup, and the potential value of the investment. Larger firms with more resources are more likely to cover expenses, especially if they see high potential in the startup. Early-stage startups might not receive the same treatment as more established companies.

2. Are Travel Expenses Typically Covered for Initial Meetings?

For initial meetings, it is less common for VCs to reimburse travel expenses. These meetings are often seen as an opportunity for entrepreneurs to prove their commitment and the viability of their business. However, if the VC is highly interested or if the entrepreneur is traveling a significant distance, some firms may offer to cover costs.

See Also How Does Equity Dilution Work When a Start Up Goes Through Several Rounds of Funding From Seed to Vc Etc

How Does Equity Dilution Work When a Start Up Goes Through Several Rounds of Funding From Seed to Vc Etc3. Do VCs Reimburse Expenses During Due Diligence?

During the due diligence phase, VCs are more likely to reimburse travel expenses. This is because the firm is seriously considering an investment and wants to ensure the entrepreneur can fully participate in the process. Reimbursement during this phase is often seen as a sign of commitment from the VC.

4. How Do Entrepreneurs Negotiate Travel Expense Reimbursement?

Entrepreneurs can negotiate travel expense reimbursement by clearly communicating their needs and the potential benefits of their startup. It’s important to discuss this early in the relationship and to understand the VC’s policies. Some entrepreneurs include travel expenses as part of their funding request.

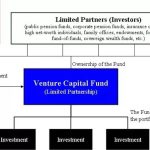

See Also What is the Typical Structure of a Vc Fund?

What is the Typical Structure of a Vc Fund?5. What Are Common Policies Among Top VC Firms?

Top VC firms often have clear policies regarding travel expenses. For example, firms like Sequoia Capital and Andreessen Horowitz may cover expenses for entrepreneurs they are seriously considering. However, these policies are not universal, and entrepreneurs should always clarify expectations before traveling.

| Factor | Likelihood of Reimbursement |

|---|---|

| Stage of Startup | Early-stage: Less likely; Later-stage: More likely |

| VC Firm Size | Larger firms: More likely; Smaller firms: Less likely |

| Type of Meeting | Initial meetings: Less likely; Due diligence: More likely |

| Entrepreneur's Location | Long-distance travel: More likely to be reimbursed |

| VC Interest Level | High interest: More likely; Low interest: Less likely |

What are the expenses of venture capital funds?

What Are Typical Finders Fees Vcs Are Ready to Pay for a Unique Lead on a Start Up

What Are Typical Finders Fees Vcs Are Ready to Pay for a Unique Lead on a Start UpManagement Fees

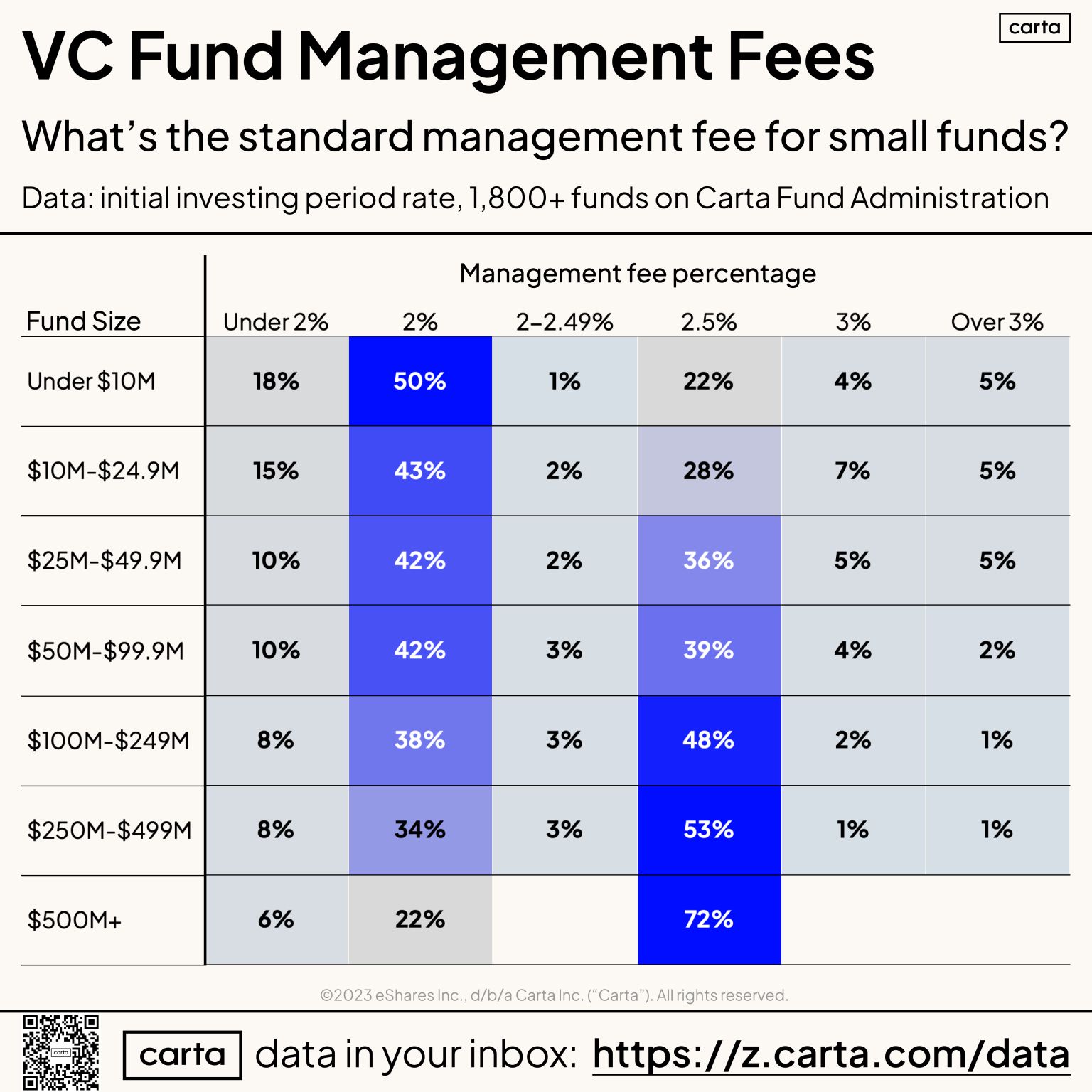

Venture capital funds typically charge management fees to cover the operational costs of running the fund. These fees are usually calculated as a percentage of the total committed capital and are paid annually. The standard range for management fees is between 1.5% to 2.5%.

- Management fees are used to pay salaries, office expenses, and other administrative costs.

- The fee percentage may decrease after the investment period ends, often referred to as the harvest period.

- Some funds may negotiate lower fees for larger commitments from investors.

Carried Interest

Carried interest is the share of the profits that the venture capital firm earns, typically around 20% of the fund's profits. This is only paid after the investors have received their initial capital back and a predetermined rate of return, known as the hurdle rate.

See Also I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make Sense

I Work for a Vc Company That S Not Looking for Unicorns is There Any Chance They Can Succeed How Does This Even Make Sense- Carried interest aligns the interests of the fund managers with those of the investors.

- It is subject to capital gains tax, which is generally lower than ordinary income tax rates.

- Some funds may have a clawback provision to ensure fairness in profit distribution.

Due Diligence Costs

Before making an investment, venture capital funds incur due diligence costs. These expenses cover the thorough investigation of potential investments, including financial, legal, and operational assessments.

- Due diligence costs include fees for external consultants, legal advisors, and industry experts.

- These costs can be significant, especially for complex or high-value deals.

- Some funds may pass these costs on to the investors, while others absorb them as part of their operational expenses.

Legal and Administrative Fees

Venture capital funds also face legal and administrative fees related to the formation and operation of the fund. These include costs for drafting partnership agreements, regulatory compliance, and ongoing legal support.

- Legal fees are incurred during the fund's formation, including the creation of the Limited Partnership Agreement (LPA).

- Ongoing administrative fees cover compliance with regulatory requirements and investor reporting.

- Some funds may use third-party administrators to handle these tasks, adding to the overall cost.

Portfolio Company Support Costs

Venture capital funds often provide portfolio company support, which includes strategic guidance, operational assistance, and networking opportunities. These activities incur additional costs for the fund.

- Portfolio company support can include hiring consultants or industry experts to assist with growth strategies.

- Funds may also incur travel and accommodation expenses when visiting portfolio companies.

- Some funds allocate a budget specifically for these activities to ensure the success of their investments.

What do venture capitalists get in return?

Equity Stake in the Company

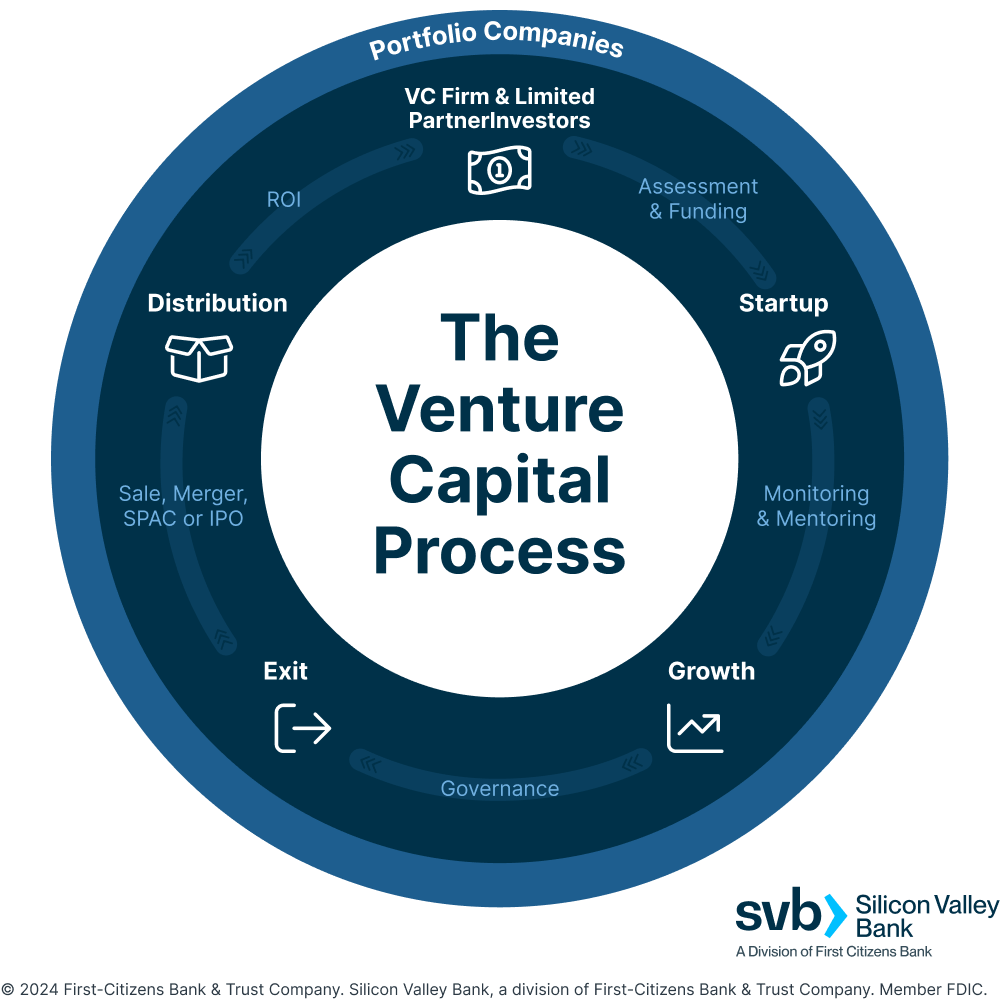

Venture capitalists (VCs) typically receive an equity stake in the companies they invest in. This means they own a portion of the business, which can yield significant returns if the company succeeds. The equity stake is negotiated during the funding round and is proportional to the amount invested. Key points include:

- VCs acquire shares in exchange for their investment.

- The percentage of equity depends on the company's valuation and the investment amount.

- This stake allows VCs to benefit from the company's growth and future profits.

Board Seats and Influence

In addition to equity, venture capitalists often secure board seats as part of their investment terms. This gives them a direct role in the company's decision-making process. Key aspects include:

- VCs gain voting rights on major company decisions.

- They can influence strategic direction, hiring, and operational changes.

- This involvement helps protect their investment and ensures alignment with their goals.

Preferred Stock and Financial Protections

Venture capitalists usually receive preferred stock, which provides them with financial protections and advantages over common shareholders. These protections include:

- Liquidation preference, ensuring they are paid first in the event of a sale or liquidation.

- Dividends or guaranteed returns on their investment.

- Anti-dilution clauses to protect their equity stake in future funding rounds.

High Return on Investment (ROI)

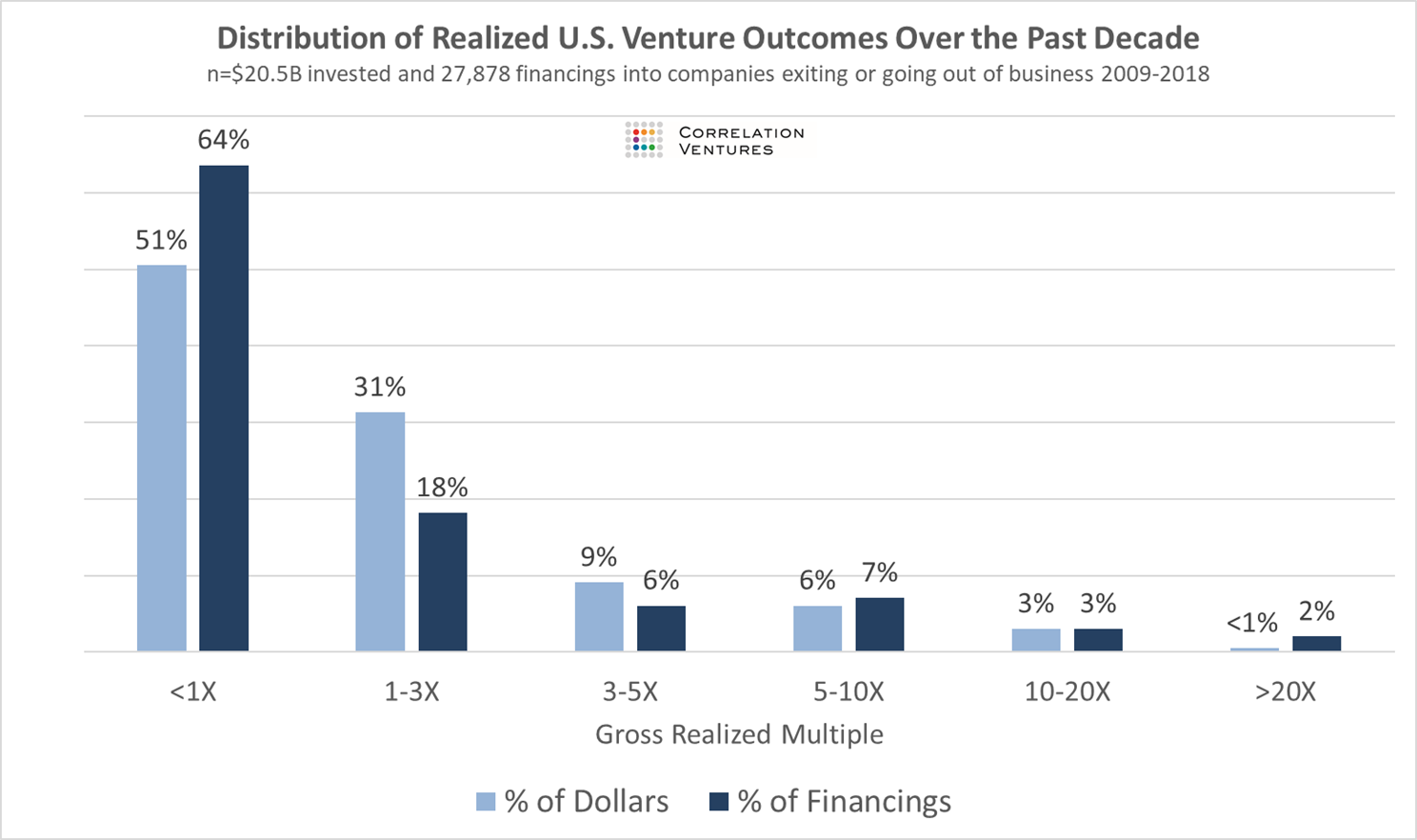

The primary goal of venture capitalists is to achieve a high return on investment. They invest in high-growth startups with the potential for exponential returns. Key factors include:

- VCs target companies with scalable business models and large market opportunities.

- Successful exits, such as IPOs or acquisitions, can generate returns of 10x or more.

- This high-risk, high-reward strategy aligns with their investment thesis.

Networking and Portfolio Synergies

Venture capitalists also benefit from networking opportunities and synergies within their portfolio of companies. These advantages include:

- Access to a network of entrepreneurs, industry experts, and other investors.

- Opportunities to create partnerships or collaborations between portfolio companies.

- Enhanced reputation and credibility in the startup ecosystem, attracting more deal flow.

What do venture capitalists provide financial resources in return for?

Equity Stake in the Company

Venture capitalists provide financial resources in exchange for an equity stake in the company. This means they become partial owners of the business and share in its future profits and growth. The equity stake is typically negotiated based on the company's valuation and the amount of funding provided.

- Ownership Percentage: VCs receive a percentage of ownership, which varies depending on the investment size and company valuation.

- Profit Sharing: As shareholders, they are entitled to a portion of the company's profits, often realized during an exit event like an IPO or acquisition.

- Influence on Decisions: With equity, VCs may gain voting rights or board seats, allowing them to influence key business decisions.

High Potential for Returns

Venture capitalists invest in startups with the expectation of achieving high returns on their investment. They target companies with scalable business models and significant growth potential, aiming to multiply their initial investment over time.

- Scalability: VCs look for businesses that can grow rapidly and generate substantial revenue.

- Exit Strategy: They focus on companies with clear exit strategies, such as IPOs or acquisitions, to realize their returns.

- Risk and Reward: While high-risk, the potential for outsized returns makes venture capital an attractive investment model.

Strategic Guidance and Expertise

In addition to financial resources, venture capitalists often provide strategic guidance and industry expertise. They leverage their experience and networks to help startups navigate challenges and accelerate growth.

- Mentorship: VCs offer mentorship to founders, helping them refine their business strategies and operations.

- Networking Opportunities: They connect startups with industry experts, potential partners, and customers.

- Operational Support: Some VCs assist with hiring, marketing, and other operational aspects to strengthen the company.

Access to Additional Funding Rounds

Venture capitalists often support startups through multiple funding rounds, ensuring they have the capital needed to achieve milestones. This ongoing financial support is a key benefit for startups.

- Follow-on Investments: VCs may participate in subsequent funding rounds to maintain or increase their equity stake.

- Bridge Financing: They provide interim funding to help startups reach the next stage of growth.

- Credibility: A VC's involvement can attract other investors, making it easier to secure additional funding.

Alignment of Interests

Venture capitalists align their interests with those of the startup by tying their financial success to the company's performance. This creates a partnership focused on achieving mutual goals.

- Shared Goals: Both VCs and founders work toward increasing the company's value and achieving a successful exit.

- Performance-Based Incentives: VCs often structure deals to incentivize founders to meet specific milestones.

- Long-Term Vision: The partnership is built on a shared vision for the company's future growth and success.

What do venture capitalists get?

Equity Stake in Startups

Venture capitalists (VCs) typically receive an equity stake in the startups they invest in. This means they own a portion of the company, which can yield significant returns if the startup succeeds. The equity stake is negotiated during the funding round and varies based on the startup's valuation and the amount invested.

- Ownership Percentage: VCs often acquire a significant percentage of the company, sometimes ranging from 10% to 50%, depending on the stage of the startup.

- Voting Rights: With equity comes voting rights, allowing VCs to influence major decisions such as mergers, acquisitions, or changes in leadership.

- Potential for High Returns: If the startup grows and is sold or goes public, the equity stake can result in substantial financial gains for the VCs.

Board Seats and Influence

Venture capitalists often secure board seats as part of their investment terms. This allows them to have a direct say in the strategic direction of the company. Board seats are a way for VCs to protect their investment and guide the startup toward success.

- Strategic Oversight: VCs use their board positions to provide guidance on business strategy, product development, and market expansion.

- Risk Mitigation: Being on the board helps VCs monitor the startup's progress and intervene if necessary to prevent potential failures.

- Networking Opportunities: Board seats also enable VCs to leverage their networks to benefit the startup, such as connecting the company with potential partners or customers.

Preferred Stock and Financial Protections

Venture capitalists often receive preferred stock instead of common stock. Preferred stock comes with additional financial protections and privileges that common shareholders do not have. These protections are designed to safeguard the VC's investment.

- Liquidation Preference: In the event of a sale or liquidation, preferred stockholders are paid before common stockholders, ensuring VCs recover their investment first.

- Dividend Rights: Some preferred stocks come with the right to receive dividends before common shareholders, providing an additional income stream.

- Anti-Dilution Provisions: These clauses protect VCs from equity dilution if the company issues more shares at a lower valuation in the future.

Access to High-Growth Opportunities

Venture capitalists gain access to high-growth opportunities by investing in startups with the potential to disrupt industries or create new markets. This access allows VCs to capitalize on emerging trends and technologies.

- Early Entry: VCs often invest in startups during their early stages, giving them a first-mover advantage in high-growth sectors.

- Diversification: By investing in multiple startups, VCs spread their risk across various industries and markets.

- Innovation Exposure: VCs are exposed to cutting-edge innovations, which can provide insights into future trends and investment opportunities.

Management Fees and Carried Interest

Venture capitalists earn management fees and carried interest as part of their compensation structure. These financial incentives align the interests of the VCs with those of their investors (limited partners).

- Management Fees: Typically around 2% of the total fund size, these fees cover operational costs and salaries for the VC firm.

- Carried Interest: Usually 20% of the profits from successful investments, carried interest rewards VCs for generating high returns.

- Performance-Based Earnings: The combination of management fees and carried interest ensures that VCs are motivated to maximize returns for their investors.

Frequently Asked Questions (FAQs)

Do venture capitalists typically cover travel expenses for entrepreneurs?

Venture capitalists (VCs) generally do not have a standard policy to reimburse travel expenses for out-of-town entrepreneurs. However, this can vary depending on the specific VC firm and the stage of the relationship. Some VCs may cover travel costs for promising startups they are seriously considering for investment, especially if the entrepreneur is traveling to meet them for a pitch or due diligence. It is always best to clarify this upfront to avoid misunderstandings.

What factors influence whether a VC will reimburse travel expenses?

Several factors can influence whether a venture capitalist will agree to reimburse travel expenses. These include the stage of the startup, the level of interest from the VC, and the distance traveled. For example, if the startup is in the early stages and the VC is still evaluating the opportunity, they may be less likely to cover costs. However, if the startup is in advanced discussions or the VC has already expressed strong interest, they might be more willing to cover travel expenses as a gesture of goodwill.

Should entrepreneurs ask about travel reimbursement before meeting with VCs?

Yes, it is highly recommended for entrepreneurs to ask about travel reimbursement policies before scheduling a meeting with a VC. This can help set clear expectations and avoid any financial burden on the entrepreneur. When reaching out, it is best to frame the question politely and professionally, such as, Would your firm be able to assist with travel expenses for this meeting? This approach shows that you are considerate of their policies while also advocating for your own financial situation.

Are there alternatives if a VC does not reimburse travel expenses?

If a venture capitalist does not offer to reimburse travel expenses, there are still alternatives to consider. Entrepreneurs can explore virtual meetings as a cost-effective way to pitch their ideas. Many VCs are open to video calls, especially for initial discussions. Additionally, entrepreneurs can look for local investors or attend startup events where they can meet multiple VCs in one location, reducing the need for extensive travel. Planning strategically can help minimize costs while still building valuable connections.

Leave a Reply

Our Recommended Articles