How Much Does Liability Insurance for Assisted Living Facilities Cost?

Liability insurance is a critical safeguard for assisted living facilities, protecting against potential risks such as accidents, injuries, or negligence claims. The cost of this coverage varies widely based on factors like facility size, resident capacity, location, and the scope of services provided. Smaller facilities might pay between $5,000 and $15,000 annually, while larger operations with higher occupancy or specialized care could see premiums exceeding $30,000. Additional variables, including claims history, coverage limits, and optional protections like abuse or professional liability endorsements, further influence pricing. Understanding these elements helps operators budget effectively while ensuring compliance with regulatory standards and maintaining a secure environment for residents and staff.

- Understanding the Cost of Liability Insurance for Assisted Living Facilities

- What insurance pays for assisted living?

-

What is the minimum homeowners liability insurance?

- What Is the Minimum Homeowners Liability Insurance?

- Understanding Minimum Homeowners Liability Insurance Coverage

- Factors Influencing Minimum Liability Coverage Requirements

- Risks of Insufficient Liability Insurance

- How to Determine the Right Liability Coverage for Your Home

- Differences Between Minimum and Recommended Liability Coverage

- How much does it cost to have an assisted living facility?

-

Frequently Asked Questions (FAQs)

- What Factors Influence the Cost of Liability Insurance for Assisted Living Facilities?

- What Is the Average Cost Range for Liability Insurance in Assisted Living Facilities?

- How Can Assisted Living Facilities Reduce Liability Insurance Costs?

- Does Liability Insurance Cover All Risks for Assisted Living Facilities?

Understanding the Cost of Liability Insurance for Assisted Living Facilities

Factors Influencing Liability Insurance Costs

The cost of liability insurance for assisted living facilities depends on factors like location, facility size, number of residents, and coverage limits. Facilities in regions with higher litigation rates often face higher premiums. Additionally, a history of claims or incidents can increase costs. Staff training programs and safety protocols may help reduce risks and lower insurance expenses.

See Also What Are Some Good Questions That a Founder Should Ask a Vc Firm or an Angel Investor

What Are Some Good Questions That a Founder Should Ask a Vc Firm or an Angel Investor| Factor | Impact on Cost |

| Location | Higher premiums in litigious areas |

| Facility Size | Larger facilities = higher costs |

| Claims History | Past claims raise premiums |

| Coverage Limits | Higher limits = higher costs |

| Staff Training | Reduces risk and costs |

On average, assisted living facilities pay between $3,000 and $10,000 annually for liability insurance. Smaller facilities with fewer residents may fall on the lower end, while larger facilities or those with specialized care services often pay more. Premiums can exceed $15,000 for high-risk locations or facilities with inadequate safety measures.

| Facility Type | Average Annual Cost |

| Small Facility (10 residents) | $3,000 - $5,000 |

| Medium Facility (25 residents) | $5,000 - $8,000 |

| Large Facility (50+ residents) | $8,000 - $15,000+ |

Types of Liability Coverage for Assisted Living Facilities

Assisted living facilities typically require general liability, professional liability, and abuse and molestation coverage. General liability covers slip-and-fall accidents, while professional liability addresses claims of negligence in care. Abuse and molestation coverage is critical due to the vulnerable population served.

See AlsoHow Can One Start a Venture With No Money?| Coverage Type | Purpose |

| General Liability | Accidents, injuries on premises |

| Professional Liability | Negligence in care services |

| Abuse/Molestation | Allegations of abuse |

| Property Insurance | Damage to facility assets |

| Umbrella Insurance | Excess coverage beyond limits |

Cost-Saving Strategies for Liability Insurance

To reduce premiums, implement risk management programs, maintain thorough documentation, and invest in staff training. Bundling policies (e.g., liability and property insurance) with one provider may also lower costs. Regularly review coverage to avoid over-insuring or under-insuring the facility.

| Strategy | Effect on Cost |

| Risk Management | Lowers premiums by reducing claims |

| Policy Bundling | Discounts for multiple policies |

| Higher Deductibles | Reduces annual premium costs |

| Staff Training | Minimizes negligence risks |

| Annual Reviews | Ensures cost-efficient coverage |

Comparing Liability Insurance Quotes

Obtain quotes from at least three insurers specializing in senior care. Compare not only prices but also coverage exclusions, claim response times, and insurer reputation. Use a broker familiar with assisted living facilities to navigate complex policy terms.

See AlsoIf Money is a Root of Evil, Then What is Poverty?| Step | Details |

| Request Quotes | From specialized insurers |

| Review Coverage | Avoid gaps or overlaps |

| Check Insurer Reputation | Financial stability and reviews |

| Negotiate Terms | Customize deductibles/limits |

| Consult a Broker | Expert policy analysis |

What insurance pays for assisted living?

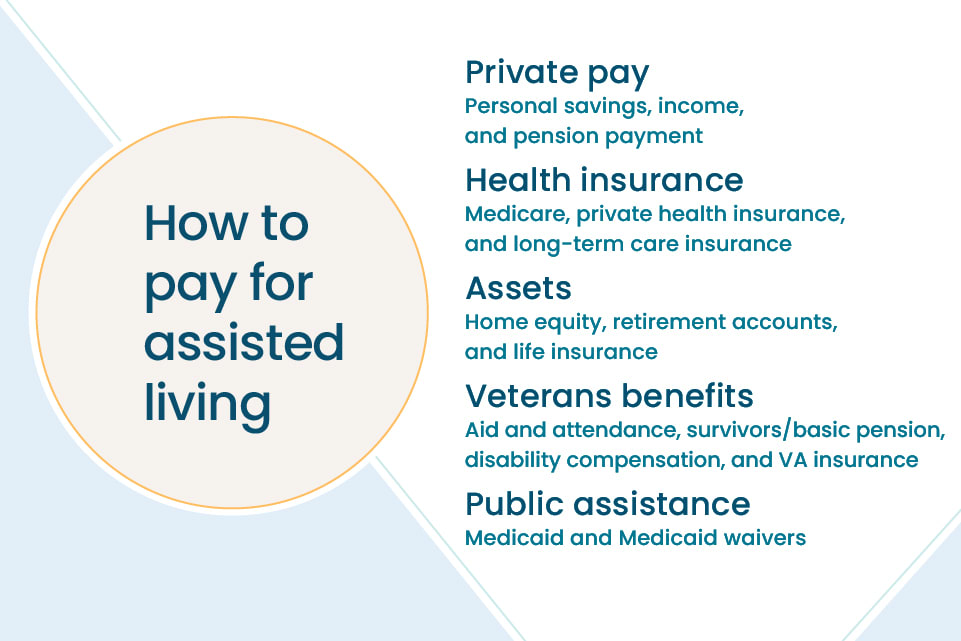

Types of Insurance That Cover Assisted Living

Several insurance options may help cover the costs of assisted living, depending on the policy and eligibility. Long-term care insurance is the most direct option, as it is specifically designed to cover services like assisted living. Medicaid may also provide coverage for eligible low-income individuals, though benefits vary by state. Additionally, some life insurance policies allow policyholders to access funds early through accelerated death benefits or life settlements. Private health insurance and Veterans Affairs (VA) benefits may offer partial assistance under specific conditions.

See Also Which Investors Can I Approach for Funding an Idea Stage Startup

Which Investors Can I Approach for Funding an Idea Stage Startup- Long-term care insurance: Policies often cover assisted living if the resident needs help with daily activities.

- Medicaid: State programs may cover assisted living through waiver programs, but eligibility is income-based.

- Life insurance: Convertible policies or accelerated benefits can provide cash to pay for care.

How Long-Term Care Insurance Works for Assisted Living

Long-term care insurance (LTCI) is tailored to cover services like assisted living when policyholders cannot perform daily activities independently. Policies typically require a waiting period (elimination period) before benefits begin and specify daily or monthly payout limits. Coverage depends on the policy’s terms, such as whether it includes inflation protection or covers memory care.

- Policies require a certification of need from a healthcare provider.

- Benefits may cover room and board, personal care, or medical services.

- Premiums vary based on age, health, and coverage scope.

Medicaid Coverage for Assisted Living Facilities

Medicaid may partially cover assisted living through Home and Community-Based Services (HCBS) waivers, which allow states to fund non-institutional care. Eligibility requires meeting strict income and asset thresholds, and not all states offer the same level of support. Covered services often include personal care, meal preparation, and medication management, but room and board costs are usually excluded.

See Also What Do Vcs Look for in a Financial Model?

What Do Vcs Look for in a Financial Model?- State-specific waivers determine coverage scope.

- Applicants must qualify medically and financially.

- Room and board are typically paid out-of-pocket.

Using Life Insurance to Pay for Assisted Living

Policyholders can leverage life insurance to fund assisted living through options like accelerated death benefits, which provide early payouts for chronic or terminal illnesses. Alternatively, a life settlement allows selling the policy to a third party for a lump sum. Surrendering the policy for its cash value is another option, though it terminates coverage.

- Accelerated benefits require meeting specific health criteria.

- Life settlements yield a percentage of the death benefit upfront.

- Surrendered policies forfeit future payouts to beneficiaries.

Veterans Benefits and Assisted Living Support

The U.S. Department of Veterans Affairs (VA) offers the Aid and Attendance benefit to eligible veterans and surviving spouses, which can help cover assisted living costs. Applicants must meet service, income, and disability requirements. Additional state-level VA programs may provide supplementary assistance.

- Aid and Attendance offers monthly payments for qualifying veterans.

- Service-related disabilities may increase eligibility.

- State Veterans Homes provide affordable care options.

What is the minimum homeowners liability insurance?

What Is the Minimum Homeowners Liability Insurance?

The minimum homeowners liability insurance varies by state and insurer but typically starts at $100,000 in coverage. This coverage protects against claims for bodily injury or property damage caused by you, family members, or pets. While some states or mortgage lenders may require higher limits, $100,000–$300,000 is a common baseline. However, experts often recommend higher coverage to safeguard against costly lawsuits.

Understanding Minimum Homeowners Liability Insurance Coverage

Homeowners liability insurance covers legal and medical expenses if someone is injured on your property or you cause damage to others’ property. The minimum coverage is designed to meet basic legal requirements but may not fully protect high-value assets.

- Bodily injury: Covers medical bills if a guest is injured at your home.

- Property damage: Pays for repairs if you damage someone else’s property.

- Legal fees: Helps cover court costs or settlements if you’re sued.

Factors Influencing Minimum Liability Coverage Requirements

The minimum liability limit depends on factors like state laws, mortgage lender policies, and personal risk tolerance.

- State regulations: Some states mandate specific liability limits.

- Property value: High-value homes may require higher coverage.

- Risk factors: Pools, trampolines, or aggressive pets can increase liability risks.

Risks of Insufficient Liability Insurance

Opting for only the minimum liability coverage can leave you financially vulnerable.

- Out-of-pocket expenses: Costs exceeding your policy limit become your responsibility.

- Asset seizure: Savings or property could be targeted in lawsuits.

- Legal penalties: Inadequate coverage may violate mortgage agreements.

How to Determine the Right Liability Coverage for Your Home

Assess your needs by evaluating assets, lifestyle, and potential risks.

- Calculate net worth: Ensure coverage exceeds total assets.

- Consult an agent: Professionals can recommend tailored limits.

- Consider umbrella policies: These add extra liability protection beyond standard limits.

Differences Between Minimum and Recommended Liability Coverage

While minimum coverage meets basic requirements, recommended limits (often $300,000–$500,000) offer stronger protection.

- Lawsuit protection: Higher limits guard against large claims.

- Asset security: Better shields savings, investments, and property.

- Peace of mind: Reduces stress over potential financial ruin.

How much does it cost to have an assisted living facility?

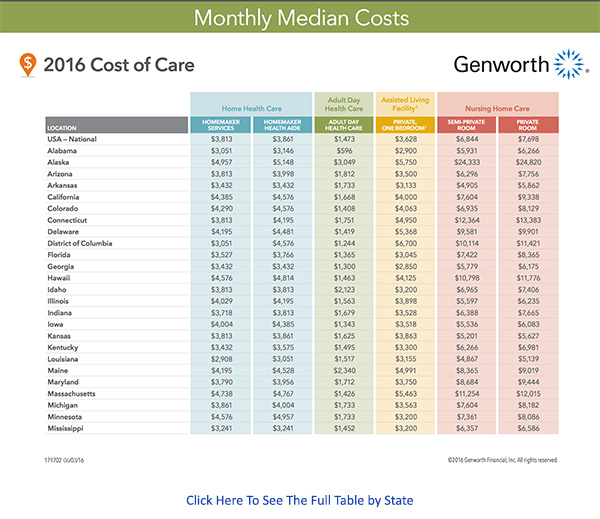

Average Monthly Cost of Assisted Living Facilities

The average monthly cost for an assisted living facility in the U.S. ranges between $4,500 and $6,500, depending on location and services. Urban areas and high-cost states often exceed this range, while rural regions may offer lower rates. Key factors include:

- Geographic location: States like Alaska or New Jersey may cost over $7,000/month.

- Level of care: Advanced medical support increases fees.

- Facility amenities: Luxury options (pools, spas) raise prices.

Factors Influencing Assisted Living Costs

Several variables impact assisted living expenses, including:

- Room type: Private suites cost 20-30% more than shared spaces.

- Specialized care: Dementia or mobility support adds $1,000-$2,000/month.

- Contract terms: All-inclusive vs. à la carte pricing models.

Additional Fees in Assisted Living Facilities

Beyond base rent, additional costs may apply, such as:

- Medication management: $100-$300/month.

- Transportation services: $50-$200/month for medical appointments.

- Personal care supplies: Incontinence products or mobility aids.

Financial Assistance for Assisted Living

Options to reduce costs include:

- Medicaid waivers: Available in some states for eligible seniors.

- Veterans Aid & Attendance: Up to $2,300/month for qualified veterans.

- Long-term care insurance: Covers partial costs based on policy terms.

Comparing Assisted Living to Other Senior Care Options

Cost differences between senior care types:

- Nursing homes: $8,000-$12,000/month for 24/7 medical care.

- In-home care: $25-$35/hour, totaling $4,500+ for full-time support.

- Independent living: $2,500-$4,000/month with minimal assistance.

Frequently Asked Questions (FAQs)

What Factors Influence the Cost of Liability Insurance for Assisted Living Facilities?

The cost of liability insurance for assisted living facilities depends on several key factors. Facility size, including the number of residents and staff, directly impacts premiums, as larger operations face higher risks. Location also plays a role, with states having varying regulations and litigation rates. Coverage limits and policy types, such as general liability vs. professional liability, affect pricing. Additionally, the facility’s claims history and safety protocols—like staff training and emergency preparedness—can lower or increase costs. Facilities with robust risk management practices often qualify for discounts.

What Is the Average Cost Range for Liability Insurance in Assisted Living Facilities?

On average, liability insurance for assisted living facilities ranges from $3,000 to $10,000+ annually. Smaller facilities with fewer residents may pay closer to $3,000–$5,000, while larger facilities or those in high-risk areas could exceed $10,000. Premiums vary based on coverage scope—such as adding abuse or medical malpractice coverage—and deductibles chosen. Facilities offering specialized care, like memory care units, often face higher premiums due to increased liability risks.

How Can Assisted Living Facilities Reduce Liability Insurance Costs?

To lower liability insurance costs, facilities should prioritize risk management strategies. Implementing comprehensive staff training programs reduces accidents and claims, potentially qualifying for insurer discounts. Regular safety audits and updated emergency protocols demonstrate proactive risk mitigation. Choosing higher deductibles can lower premiums, though this increases out-of-pocket costs during claims. Bundling policies, such as combining general liability and property insurance, may also secure multi-policy discounts. Lastly, comparing quotes from specialized insurers familiar with senior care ensures competitive rates.

Does Liability Insurance Cover All Risks for Assisted Living Facilities?

Standard liability insurance typically covers slip-and-fall accidents, property damage, and bodily injury claims. However, it may exclude risks like employee misconduct or cyberattacks, which require separate policies. Professional liability insurance (errors and omissions) addresses claims related to negligent care or administrative errors. Facilities should review policies carefully and consider add-ons like abuse and molestation coverage or directors and officers insurance to fill gaps. Working with an experienced broker ensures tailored coverage for unique operational risks.

Leave a Reply

Our Recommended Articles